Ethereum (ETH) dropped about 12% over the past week, even after rising to the $3,400 mark as of press time. Analysts see strong liquidity clusters between $3,200 and $3,350, suggesting the coin might revisit that zone before attempting a rally toward $3,500.

ETH is under pressure from weak global economic indicators and increased risk-off sentiment. Consumer-oriented companies reported disappointing quarterly results, and renewed worries about high valuations in artificial intelligence have increased the pressure.

The longest-ever U.S government shutdown, meanwhile, is continuing to weigh on sentiment. A survey by the University of Michigan found consumer-sentiment expectations hit the lowest level since at least 1978.

ETH On-Chain Metrics Cool as DeFi and Trading Slowdown Deepen

On-chain metrics indicate that the ecosystem is cooling. Total value locked (TVL) on the Ethereum network dropped to roughly $74.256 billion, a level not seen since July, with a 24 percent fall in the last 30 days. One high-profile trigger was an attack of Balancer v2, a leading DeFi platform, which lost $120 million on Monday.

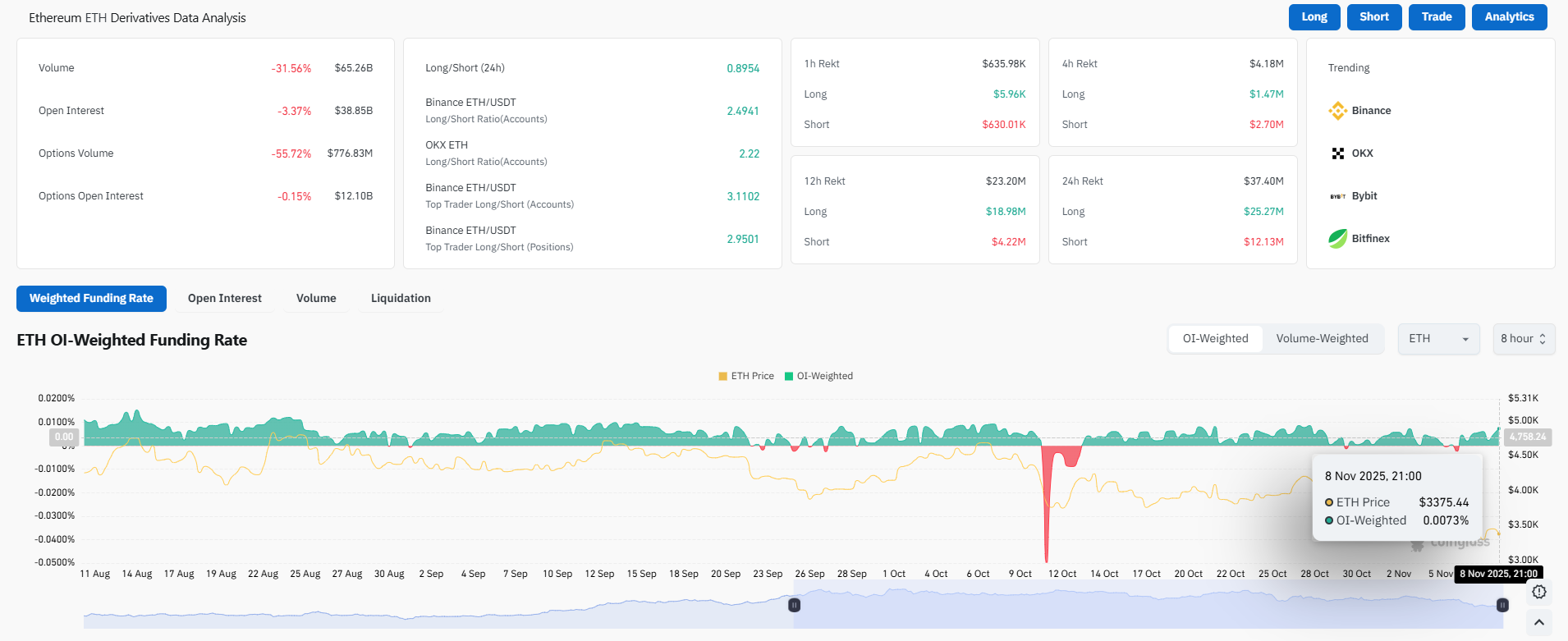

Trading activity reflects caution. Volume, according to CoinGlass data, is lower by 31.6% to around $65.3 billion while open interest dropped 3.4% to approximately $38.85 billion. ETH’s OI-weighted funding rate is hovering around 0.0073%, suggesting a lack of bullish leverage.

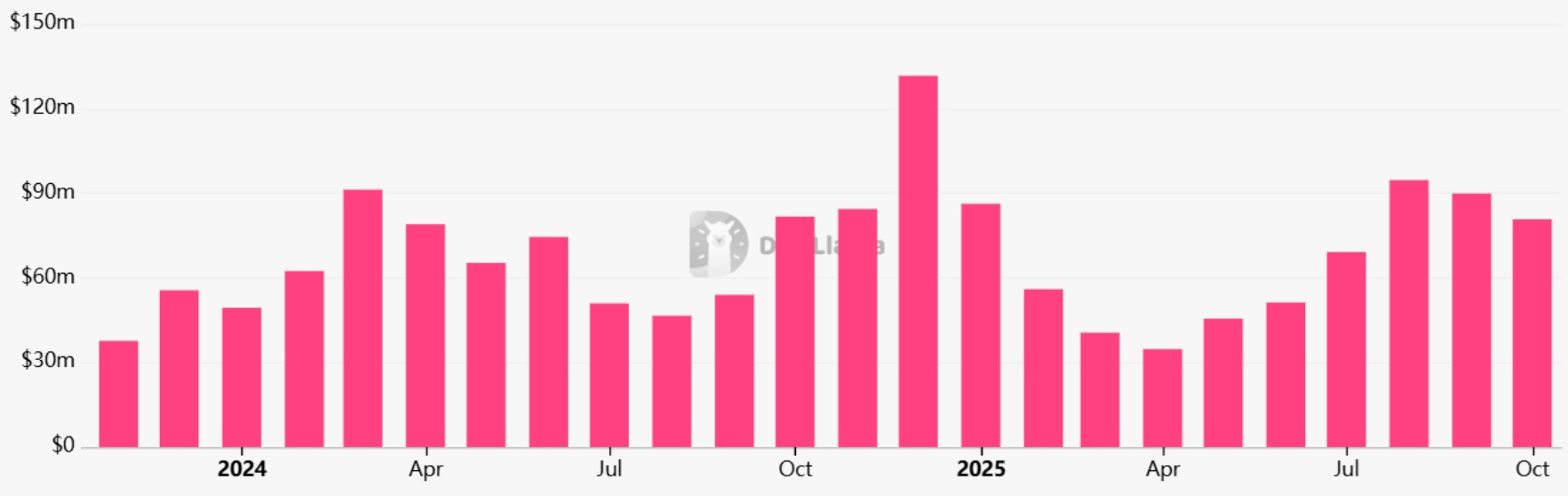

Ethereum DApps on Ethereum dropped to $80.7 million in October. This is 18% lower than September. The drop in activity could mean a decrease in staking rewards and slower performance of the network.

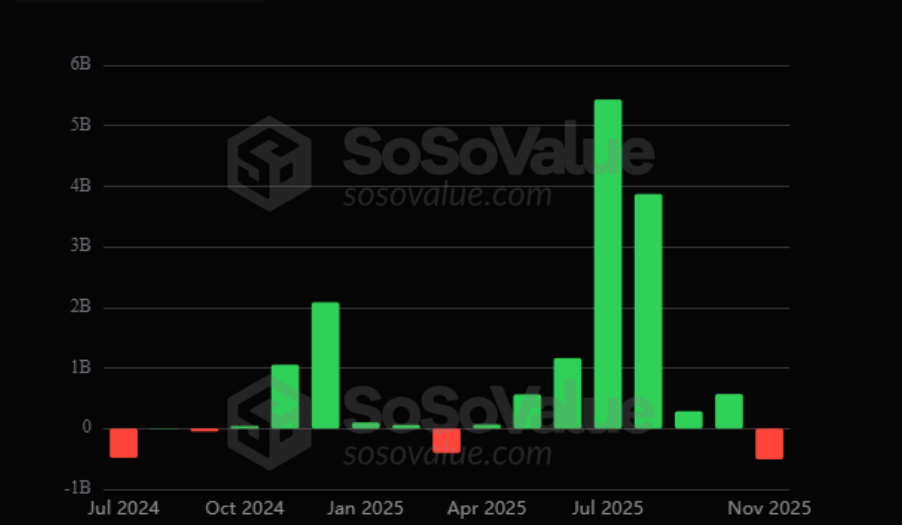

Weak ETF Demand and Macro Pressure Limit Ethereum’s Upside

Investor interest in Ethereum spot ETFs is, however, still tempered. U.S.-listed ETH spot products experienced net outflows of around $507.83 million in November, and none of the major corporate treasuries added to their holdings of ETH.

This suggests institutional appetite is lagging despite structured product availability. Meanwhile, with the derivatives markets pointing to weakness. With macro headwinds accumulating, the prospects of a near-term breakout toward $3,900 seem limited.

Ethereum has a possible positive catalyst. The upcoming Fusaka Upgrade is scheduled for early December. It is expected to deliver crucial scalability and security improvements to the Ethereum network.

For any bullish rally to sustain, a combination of better macro conditions, EFT or treasury buying and stable on-chain growth would also need to take place. Withoutthem, the second largest cryptocurrency by market cap might consolidate, or visit lower supports.

Ethereum’s recent decline is backed by measurable weakness in ecosystem metrics and investor flows, not just market noise. The presence of a defined liquidity cluster around $3,200–$3,350 offers a support base, and the $3,500 level remains a possible upside target.

Ethereum still faces a series of headwinds, including global economic uncertainty and decreased network activity. There is also low institutional appetite supporting broad market participation. This has reduced investor confidence and generally slowed down momentum around the ecosystem.

Source: https://coingape.com/whats-behind-ethereums-drop-macro-tvl-defi-liquidity/