- OpenAI CEO Sam Altman publicly rejects government loan guarantees request.

- Transparency concerns arise within OpenAI leadership decisions.

- Potential market impact on AI and blockchain infrastructure assets.

OpenAI’s request for government funding on October 27, 2025, followed by CEO Sam Altman’s public disavowal of such aid, highlights leadership transparency issues.

This incident signals potential volatility for cryptocurrencies tied to AI policies, impacting market sentiment and financial strategies due to inconsistent executive communications.

Altman’s Rejection Sparks Transparency Concerns

In late October 2025, OpenAI submitted an 11-page request to the White House, seeking loan guarantees and direct funding to support AI infrastructure. Ten days later, CEO Sam Altman publicly dismissed the request, emphasizing that taxpayers should not be liable for any company’s misguided decisions.

Changes arise as Altman’s dismissal contradicts earlier statements from CFO Sarah Friar regarding potential government credit benefits. Immediate implications include renewed scrutiny over OpenAI’s transparency and strategy.

“We believe that governments should not pick winners or losers, and that taxpayers should not bail out companies that make bad business decisions or otherwise lose in the market.” — Sam Altman, CEO, OpenAI

Financial Repercussions and Market Implications

Did you know? OpenAI’s transparency issues echo past controversies involving major tech firms, highlighting the persistent scrutiny on executive decision-making and corporate accountability.

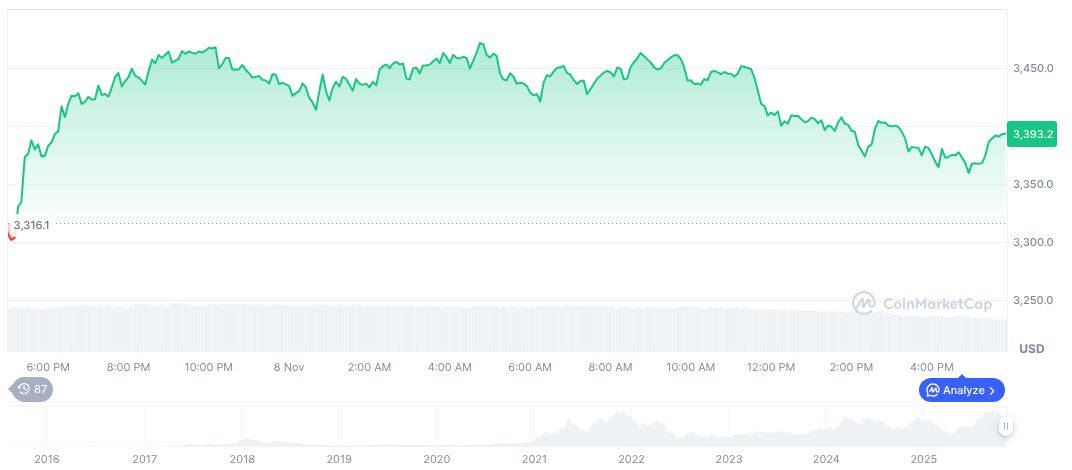

Market reactions followed Altman’s public denouncement, with industry observers concerned about potential effects on AI and blockchain investments. Ethereum (ETH) exhibited volatility with a current price of $3,397.60, down 1.67% over 24 hours. Despite a market cap of $410.08 billion, the 24-hour trading volume sharply decreased by 40.14%. According to CoinMarketCap, ETH’s price fell by 22.21% over 30 days ending November 8, 2025.

The Coincu Research Team noted the potential for regulatory shifts in the AI sector to affect crypto markets, particularly in Layer 1 and Layer 2 blockchains. Historical trends suggest infrastructure funding shifts can indirectly influence sector investments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/openai-ceo-denies-loan-request/