Key Takeaways

What’s driving Worldcoin’s recent price surge and breakout attempt?

Rising on-chain activity, record user growth, and aggressive accumulation in spot and futures markets are fueling the rally.

Could Worldcoin’s uptrend continue in the near term?

Yes, if demand and user growth persist, WLD could break $1 and target resistance near $1.2.

Worldcoin [WLD] is attempting a breakout from a month-long descending channel. In fact, WLD successfully held $0.65 support and surged 16.7% to $0.87 before retracing to $0.82 at press time.

Over the same window, the altcoin’s volume surged 136% to $338 million, reflecting growing on-chain activity and steady capital flow.

But what’s behind these gains?

WorldCoin on-chain activity hits a historical high

Since its launch, Worldcoin has steadily expanded in terms of network usage, adoption, and on-chain activity. A major milestone was recently reached as active addresses hit an all-time high of 1 million.

According to Token Terminal, this represents a 170% increase in active addresses over the past 12 months.

Source: Token Terminal

Inasmuch, the network has made a more than 500k uptick in users between May and November, reflecting sustained network demand.

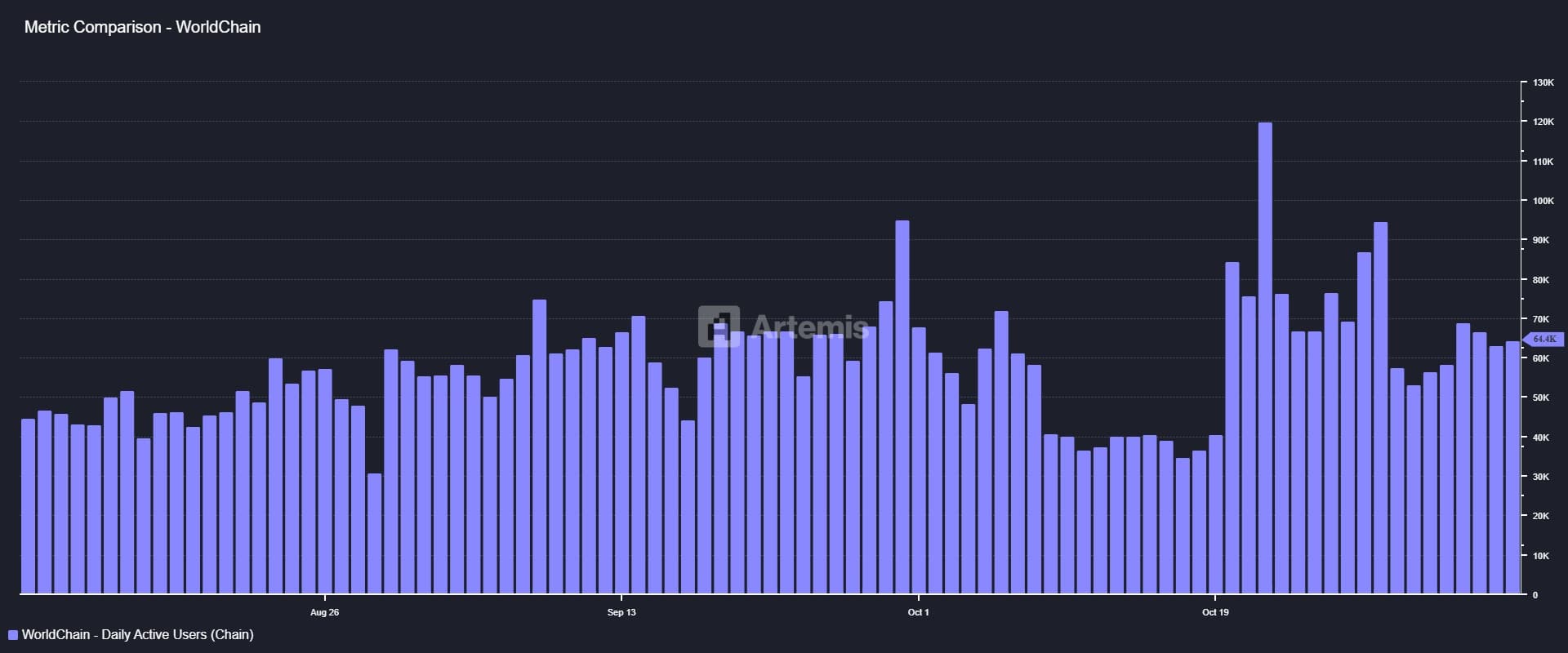

On top of that, the network’s Daily Active Users have stabilized above 60k, ranging between 60k and 90k. At press time, Daily users were 64k, up 44.1% over the last three months, according to Artemis data.

Source: Artemis

Typically, when Addresses and daily users rise in tandem, it reflects strengthening on-chain demand and growing actual engagement.

Often, such a setup is perceived as bullish, as it suggests expanding network adoption, which tends to support price appreciation.

Actual demand follows across the market

Significantly, amid growing network usage, most of these participants are overly bullish across both spot and futures markets.

On the spot side, after the network crossed the 1 million mark, buyers returned to the market to accumulate.

According to CoinGlass, Worldcoin’s Spot Netflow dropped into negative territory. As of this writing, the altcoin’s Netflow dropped to -$2.18 million from $6 million the previous day.

Source: CoinGlass

Usually, a negative netflow indicates increased outflow, a clear sign of aggressive spot accumulation.

Whales lead the Futures market

On the Futures side, whales have dominated the market sustainably throughout the past week.

In fact, Futures Average Order Size data from CryptoQuant showed Big Whale Orders for seven consecutive days.

Typically, when the market records large whale orders, it indicates increased whale participation on either the buy or sell side.

Source: CryptoQuant

Interestingly, in the Perpetuals market on Hyperliquid, buyers have dominated mainly over the past week. According to Nansen data, investors on Hyperliquid have made more buy contracts than sell ones.

Over the past 24 hours, for example, Worldcoin recorded 7.77 million in Buy Contracts compared to 6.4 million in Sell Contracts, as of writing.

Source: Nansen

This suggests that these whales have been mostly buying WLD and taking strategic positions, awaiting the next move.

Is this the start of a sustained uptrend?

According to AMBCrypto, Worldcoin rallied amid growing network adoption backed by actual demand in the spot and futures markets.

As a result, the altcoin’s Sequential Pattern Strength jumped into the positive zone, rising to 2.3, at press time, reflecting strengthening demand side.

Source: TradingView

The positive shift in this indicator reflects changing market dynamics, with buyers gaining control. Under these conditions, WLD is well-positioned for further gains.

If demand continues to rise alongside growing user activity, WLD could break the $1 resistance and aim for the parabolic SAR level near $1.2.

However, if demand weakens, the price may retrace to the $0.68 support zone.

Source: https://ambcrypto.com/worldcoin-rallies-16-hits-1m-users-is-a-1-2-wld-breakout-near/