- Chow Pak-yin’s sentencing marks regulatory enforcement in Hong Kong.

- Regulatory focus on unlicensed financial advice.

- First imprisonment for unlicensed advice in Hong Kong.

Chow Pak-yin, a Hong Kong financial influencer, received a six-week prison sentence on November 8 for providing investment advice without a license through a paid Telegram group.

This marks Hong Kong’s first imprisonment for unlicensed investment advice, prompting increased scrutiny of online financial content and potential risks for investors. No immediate impact on cryptocurrency markets noted.

Hong Kong’s First Imprisonment for Financial Misconduct

Chow Pak-yin, a financial “influencer,” was sentenced on November 8, 2025, by the Eastern Magistrates’ Court in Hong Kong. He was found guilty of operating an illegal paid chat group and offering investment advice without proper licensing. Hong Kong authorities sentenced him to six weeks in prison. The influential group focused mainly on Nasdaq-listed stocks, and Chow generated income amounting to HK$43,680 from subscribers.

The Hong Kong Securities and Futures Commission (SFC) highlighted the enforcement’s aim to ensure regulatory compliance among financial influencers. They warned that engaging in investment advice activities without a license exposes investors to risks.

Michael Duignan, Executive Director, Enforcement at SFC, stated, “The SFC is committed to tackling the unlawful acts of finfluencers.” He emphasized that unlicensed activities fail to meet the required standards of conduct, necessitating investor caution.

Global Ripple Effects and Ethereum Price Insights

Did you know? Chow Pak-yin’s case is a pivotal enforcement action in Hong Kong, being the first imprisonment for unlicensed financial advice. It may set a precedent across comparable jurisdictions to tighten regulations.

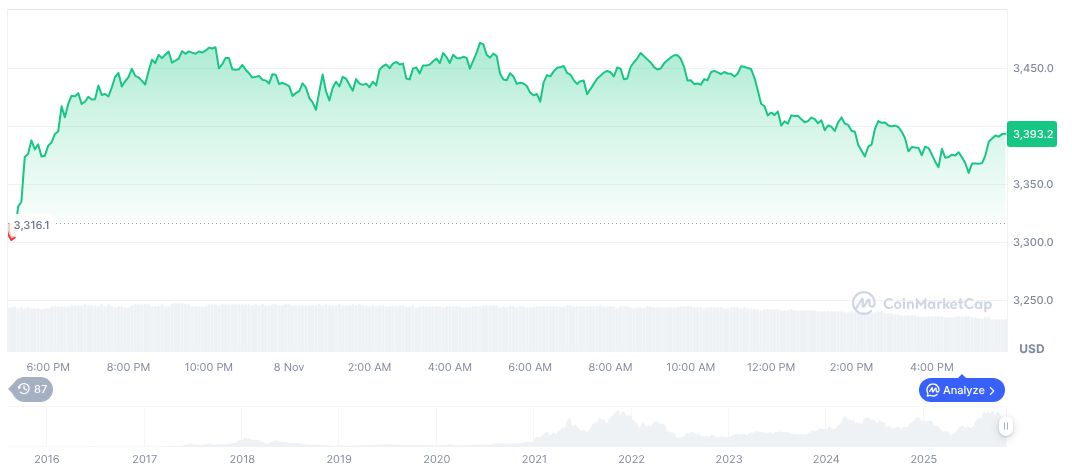

Ethereum (ETH) traded at $3,392.73, with a 24-hour trading volume of $29.50 billion, reflecting a 0.24% daily increase as per CoinMarketCap. Its market cap stood at $409.49 billion, comprising 11.95% of the crypto market dominance. ETH experienced a 12.42% dip over the past week.

Experts from Coincu suggest increased scrutiny may emerge globally on finfluencers, potentially influencing financial activity regulation. This shift might necessitate new compliance measures for crypto and finance-related channels to meet evolving legal frameworks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-influencer-investment-advice/