- Fed Governor Milan suggests stablecoin growth may lower the neutral interest rate.

- Comments may prompt policy rate adjustments to avoid contraction.

- Market and regulatory reactions await further guidance.

Federal Reserve Governor Milan remarked this week that stablecoins could lower the neutral interest rate, necessitating an aligned policy rate cut for economic stability.

Milan’s comments highlight stablecoins’ growing impact on monetary policy, pressing for lower rates to prevent contractionary economic effects amid increased loanable funds. Market shifts remain minimal.

Stablecoin Growth May Lower Neutral Interest Rate

The implication is clear: should the neutral interest rate decrease, failing to adjust policy rates may result in contractionary economic pressures. Stablecoins, by expanding loanable funds, could alter traditional financial calculations significantly.

Presently, the market and financial analysts are observing closely, though no immediate reactions from major crypto figures or communities have been recorded. Industry stakeholders remain cautious, awaiting additional information or policy direction from the Federal Reserve.

Did you know? The use of stablecoins as a factor in neutral interest rate discussions underscores their growing influence in macroeconomic considerations compared to just five years ago, when they were primarily viewed as niche financial instruments.

Stablecoins’ Evolving Role in U.S. Financial System

Did you know? The use of stablecoins as a factor in neutral interest rate discussions underscores their growing influence in macroeconomic considerations compared to just five years ago, when they were primarily viewed as niche financial instruments.

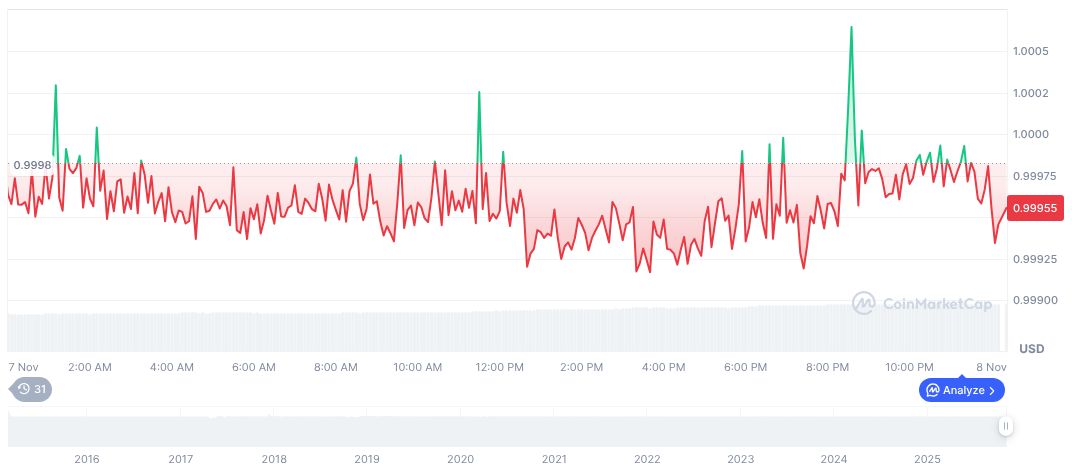

According to CoinMarketCap, Tether USDt (USDT) maintains its $1.00 peg, with a market cap of “183.36 billion,” representing a 5.30% market dominance. While its trading volume reached “161.81 billion” in the past 24 hours—a 14.43% change—the price only showed minimal shifts, underscoring its stability.

The Coincu research team observes that such discussions around stablecoin impacts highlight their potential role in financial ecosystems, offering insight into economic calibrations that may become crucial for regulatory bodies and policymakers. Considerations emphasize the importance of integrating stablecoins responsibly into broader financial systems, guided by robust frameworks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/fed-stablecoin-growth-impact/