- Elixir retires deUSD, launching USDC compensation for holders and derivatives.

- Advice against investing in deUSD through any channels.

- Market sees negative Net Asset Value changes in associated protocols.

Elixir’s deUSD stablecoin has been retired and devalued, prompting a USDC compensation process, announced via Elixir’s official Twitter account.

This reflects broader DeFi instability, impacting collateral providers, AMM LPs, and others, causing liquidity concerns and potential cascading effects across connected ecosystems.

Elixir’s deUSD Retirement: Economic Ripples and Strategic Moves

Elixir’s decision to retire its deUSD stablecoin comes after considerable challenges, including significant economic setbacks impacting its reserves. Official communications indicate that Elixir will compensate holders with USDC. Multiple stakeholders, such as collateral backers and liquidity pools, will see economic adjustments. Affected parties include collateral providers, AMM liquidity pools, and derivatives participants. Elixir emphasizes that investors must refrain from engaging in trades of deUSD through automated market makers or other channels.

Immediate implications involve liquidation and reallocation of capital, with a potential domino effect across users and protocols reliant on deUSD. Economic impacts span various Defi platforms utilizing this stablecoin as collateral, including lending platforms and market makers. Considering economic vulnerability, related tokens and protocols could experience cascading financial shifts. Stakeholders are urged to anticipate liquidity variations and adjust investment strategies to mitigate losses.

“Elixir’s official Twitter account announced that the stablecoin deUSD has officially been retired and no longer holds any value. The platform will initiate a USDC compensation process for all holders of deUSD and its derivatives…”

Market reactions are guarded yet strategic, as stakeholders assess portfolio rebalancing needs. No formal comment has emerged from leading crypto figures or authorities, while users navigate operational impacts. Major protocols connected to deUSD and derivatives could seek strategic restructuring, while detailed Elixir comments on financial or governance adaptations remain forthcoming.

deUSD’s Demise: Comparing Past Stablecoin Failures

Did you know? The collapse of Elixir’s deUSD is reminiscent of Terra’s UST fall in 2022, marking the first instance of a protocol officially retiring a stablecoin while initiating compensation.

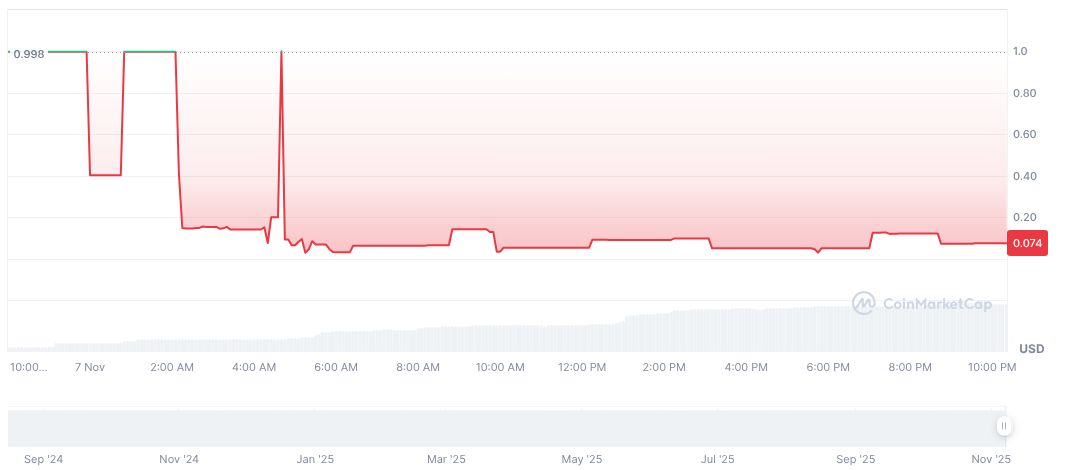

CoinMarketCap reports that Elixir’s deUSD stablecoin, previously integral to DeFi ecosystems, has plummeted to a value of $0.07. Its market cap stands at $6.75 million, reflecting a stark 92.58% drop in price over 24 hours. The 24-hour trading volume surged by 898.51%, highlighting persistent volatility. Supply metrics remain unchanged, with circulating supply noted at 91,242,322 tokens. This data emphasizes the significant economic shakeup following deUSD’s collapse.

Insights from Coincu’s research anticipate long-term alterations across financial, regulatory, and technological spheres due to this event. Elixir’s reactive compensation plan signals an industry precedent for dealing with failing stablecoins. Future regulatory frameworks might evolve to address ecosystem vulnerabilities and strengthen user protection in similar scenarios.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/elixir-deusd-stablecoin-retired-usdc-compensation/