- US inflation estimated at 4.7% for November, affecting rates.

- Federal Reserve urges caution amid missing data.

- Crypto markets and equities experience significant volatility.

The US one-year inflation rate for November was preliminarily estimated at 4.7%, slightly below expectations, according to Jinshi data, amidst a U.S. government shutdown delaying official releases.

This unexpected inflation figure has led to market declines, with major indices falling and heightened volatility in crypto equities, reflecting investor uncertainty over future monetary policy actions.

Inflation Surpasses Projections Amid Data Delays

Inflation figures, reported by Jinshi, suggested a rate of 4.7% for November, slightly exceeding anticipated figures. This release occurred during a period of incomplete fiscal data due to official shutdowns. Industry leaders, such as Austan Goolsbee, President of the Federal Reserve Bank of Chicago, emphasized caution, noting, “When things are still very unclear, we should be more careful and slow down.” Enhanced market uncertainty was evident, particularly within various sectors of the economy.

Equity and Crypto Markets experienced declines as news of higher-than-expected inflation spread. Key indices, including the Dow, S&P 500, and Nasdaq, recorded losses, markedly affecting firms like Tesla, Nvidia, and crypto-adjacent stocks such as Coinbase and MARA Holdings. Coinciding with the inflation report, US stocks saw substantial dips, accompanied by varied treasury actions in USDC, where substantial minting and burning were noted, leading to a $253 million net increase in 12 hours. These movements illustrate traders’ preference for dollar-pegged stablecoins amid economic uncertainty.

“If there’s a problem with inflation, there’s actually no observable data to reflect it, which makes me even more cautious about cutting rates prematurely.” — Austan Goolsbee, President of the Federal Reserve Bank of Chicago.

Stablecoin Activity Reflects Market Concerns Over Inflation

Did you know? In similar periods lacking official fiscal data, traders often gravitate toward stablecoins such as USDC, increasing minting activity to stabilize off-exchange transactions.

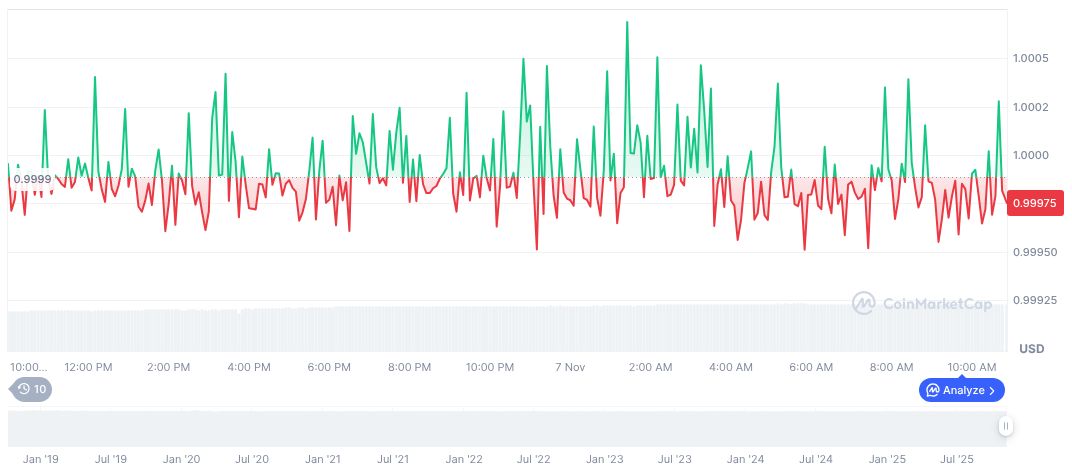

USDC’s market dynamics reflect broader market sentiments, trading at $1.00 with a market cap of $75.35 billion and a 24-hour trading volume of $19.85 billion, according to CoinMarketCap. Despite its stability, USDC witnessed a minor price fluctuation of -0.05% over the past 24 hours, showcasing varied market responses. Such fluctuations engage traders in strategic reallocations, especially amid broader uncertainties influencing crypto assets.

According to Coincu analysts, higher inflation figures may delay any potential interest rate cuts from the Federal Reserve, which could maintain pressure on equity and crypto markets. Previous trends suggest cautious investor behavior during volatile data periods, potentially affecting liquidity and market sentiment in the near-term.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-inflation-impact-crypto-equities/