- Reports claim Richard Clarida endorsed a rate cut, lacking verification from official sources.

- No primary evidence confirms Clarida’s involvement.

- Market reactions to unverified statements remain cautious.

Federal Reserve Vice Chair Richard Clarida reportedly supported an October FOMC rate cut stating modest economic changes and inflation prospects, according to BlockBeats News on November 7th.

However, no primary sources confirm these remarks, raising questions about their authenticity and impact on economic policy discussions and future Federal Reserve decisions.

Unproven Clarida Comments Stir Speculative Market Concerns

Reports allege that former Federal Reserve Vice Chair Richard Clarida backed the October FOMC rate cut; however, no official sources confirm this. Richard Clarida, absent from official statements, is reportedly involved in other roles at Columbia University and PIMCO, rather than the Federal Reserve.

The rumor suggests changes in monetary policy, though without substantiation, the event seems speculative. The alleged statement refers to gradualism in rate adjustments and slower progress due to tariffs. However, no corroborative Federal Reserve records exist.

Industry figures and communities remain skeptical, waiting for reliable news from official channels. The lack of official confirmation has limited any major market or crypto impact. Despite potential concerns, official figures like Jerome Powell have not addressed Clarida’s alleged remarks.

Clarida Departure and Ethereum Market Dynamics

Did you know? Richard Clarida’s departure from the Federal Reserve in 2022 coincided with heightened scrutiny over personal stock trades, influencing subsequent governance reforms in the institution.

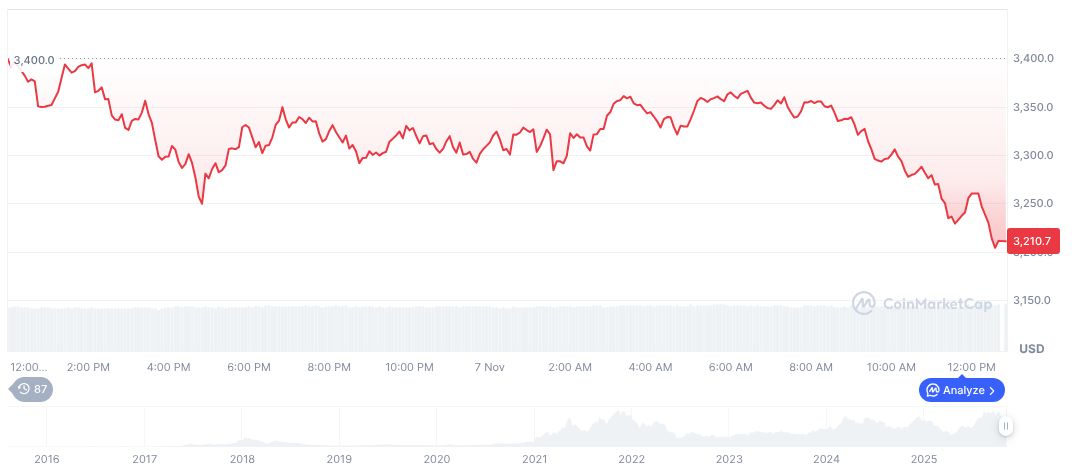

Ethereum (ETH) recently traded at $3,201.68, reflecting a 4.25% decrease in 24 hours, according to CoinMarketCap. The market cap stands at formatNumber(386432341257,2), with a 37.92 billion daily trading volume showing a 4.84% change.

Coincu insights highlight the need for careful analysis of unverified reports, particularly in decisions impacting crypto assets. Potential changes in financial regulation and technology advancements might directly influence market dynamics, but clear substantiation is paramount.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/clarida-fomc-statements-impact-crypto/