- Compound temporarily halts key lending markets after liquidity crisis.

- USDC, USDS markets resume withdrawals November 6.

- Stream Finance reports $93 million loss linked to Elixir.

Compound Finance, under advisement from Gauntlet, initiated an emergency pause on Ethereum lending markets (USDC, USDS, USDT) following a liquidity crisis affecting Elixir’s stablecoins, impacting key stakeholders.

The move addresses substantial risks, including a $93 million loss disclosed by Stream Finance, as markets gradually restore safety and liquidity post-crisis with ongoing governance oversight.

Gauntlet’s Strategic Move Amid $93 Million Loss Impact

Gauntlet advised Compound to temporarily pause key stablecoin markets on Ethereum due to liquidity concerns related to Elixir’s deUSD and sdeUSD. The pause, which was approved, affected USDC, USDS, and USDT lending activities.

Following this pause, withdrawals for USDC and USDS resumed on November 6. Compound aims to gradually restore services, prioritizing system safety as liquidity issues are resolved. Elixir’s stablecoin exposure, notably at the center of this suspension, caused a significant market impact as mentioned in governance updates.

Gauntlet recommends a temporary emergency pause in the following comets: Ethereum USDC, Ethereum USDS, Ethereum USDT. Due to concerns surrounding Elixir, Gauntlet has observed a liquidity crunch in both deUSD and sdeUSD. […] Until this proposal passes, Gauntlet recommends pausing withdraw on the affected comets.

Gauntlet Team, DeFi Risk Management Firm, Gauntlet

DeFi’s Resilience Tested: Challenges and Market Stability

Did you know? Gauntlet’s intervention is not unprecedented; similar actions have historically stabilized DeFi markets during liquidity disruptions, reflecting the ongoing need for agile risk management.

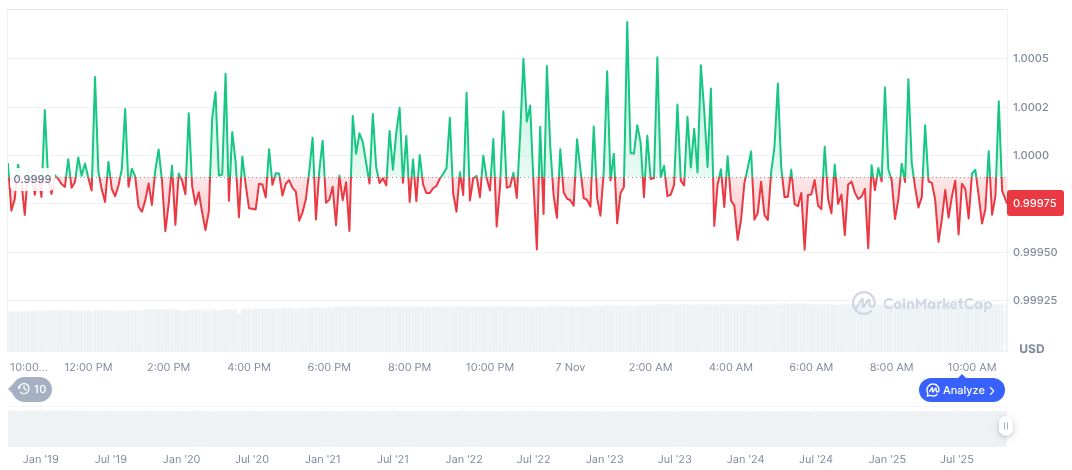

According to CoinMarketCap, USDC remains stable at $1.00, with a market dominance of 2.24%. The market cap holds at approximately formatNumber(75449734212, 2), while recent price fluctuations remain minimal, illustrating a consistent performance despite broader market volatility.

The Coincu research team highlights that liquidity issues in DeFi could prompt regulatory scrutiny and potential technological innovations to fortify financial stability. Bold steps towards systemic resilience are expected as stakeholders adapt to ongoing challenges.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/compound-pauses-ethereum-markets/