- Whale withdrawal raises Aave USDT utilization; market impact significant.

- USDT utilization reaches 92.83% in Aave’s main market.

- Potential for increased interest rates and market volatility.

Whale address 0x540C withdrew 114.9 million USDT from Aave, increasing the protocol’s USDT utilization rate to 92.83%, surpassing its optimal threshold on October 29, 2023.

This surge indicates heightened borrowing demand on Aave, potentially increasing interest rates and affecting liquidity across stablecoin markets, with possible impacts on related assets and governance considerations.

Whale Withdrawal Sparks Interest Rate Surge on Aave

The recent withdrawal of 114.9 million USDT by an anonymous whale, identified by the address 0x540C, has significantly impacted Aave’s main market. This action led to a USDT utilization rate of 92.83%, surpassing the optimal threshold set by the protocol. The identity behind 0x540C remains undisclosed, with Lookonchain being the first to detect the transaction.

The withdrawal has triggered a steep spike in interest rates due to the increased utilization. As a result, the market may experience a combination of incentives for new deposits and deterrents for further borrowing. The move reflects heightened borrowing demand within Aave, potentially affecting other stablecoins such as USDC and DAI, as well as Aave’s governance token.

No official statements have emerged from Aave leadership or regulatory bodies in response to this significant market event. However, Telegram and Reddit discussions indicate significant community engagement regarding the sudden rise in rates. These platforms are buzzing with speculation on possible upcoming responses from other liquidity providers.

Utilization Spike Prompts Concerns of DeFi Volatility

Did you know? In March 2023, a similar event in Aave’s DAI market caused the utilization rate to briefly hit 100%, resulting in rapid interest rate spikes and liquidity inflows.

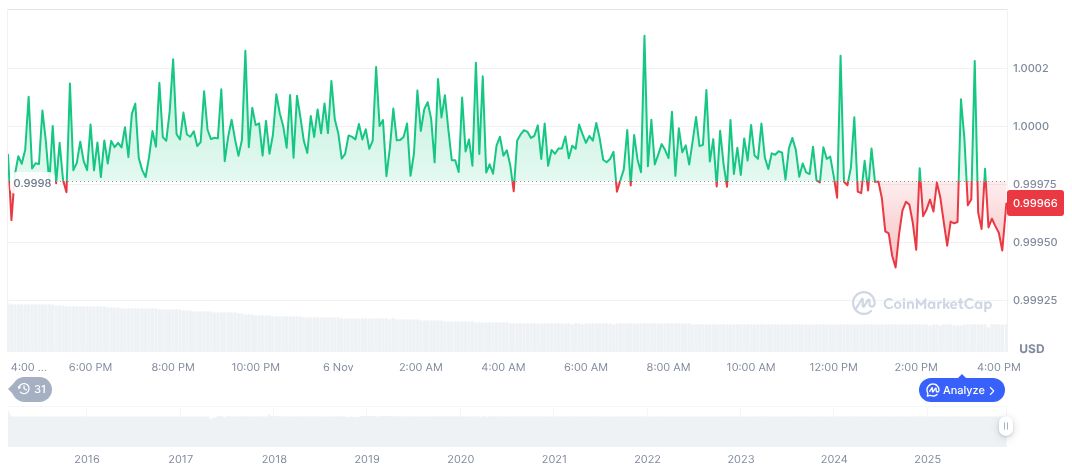

According to CoinMarketCap, Tether (USDT) currently holds a price of $1.00, with a market cap of $183.40 billion. It accounts for a market dominance of 5.42% as of November 6, 2025. Over the past 24 hours, trading volume dropped to $131.49 billion, marking a 42.65% decrease.

Expert insights from the Coincu research team suggest that such utilization spikes could provoke further volatility within the DeFi space. There is growing anticipation of regulatory scrutiny and potential adjustments to interest rate models on platforms similar to Aave’s smart contracts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/aave-whale-usdt-utilization-spike/