Dogecoin price retreated today, Nov. 4, reaching its lowest level since October 11, as the crypto market crash gained steam. It dropped to a low of $0.1600, down 47% from its highest level in September this year. This crash may continue after forming a death cross, and as the DOGE ETF inflows slow.

Dogecoin Price Death Cross Points to a Steeper Crash

Dogecoin price has not been left behind in the ongoing crypto market crash that has affected Bitcoin and most altcoins.

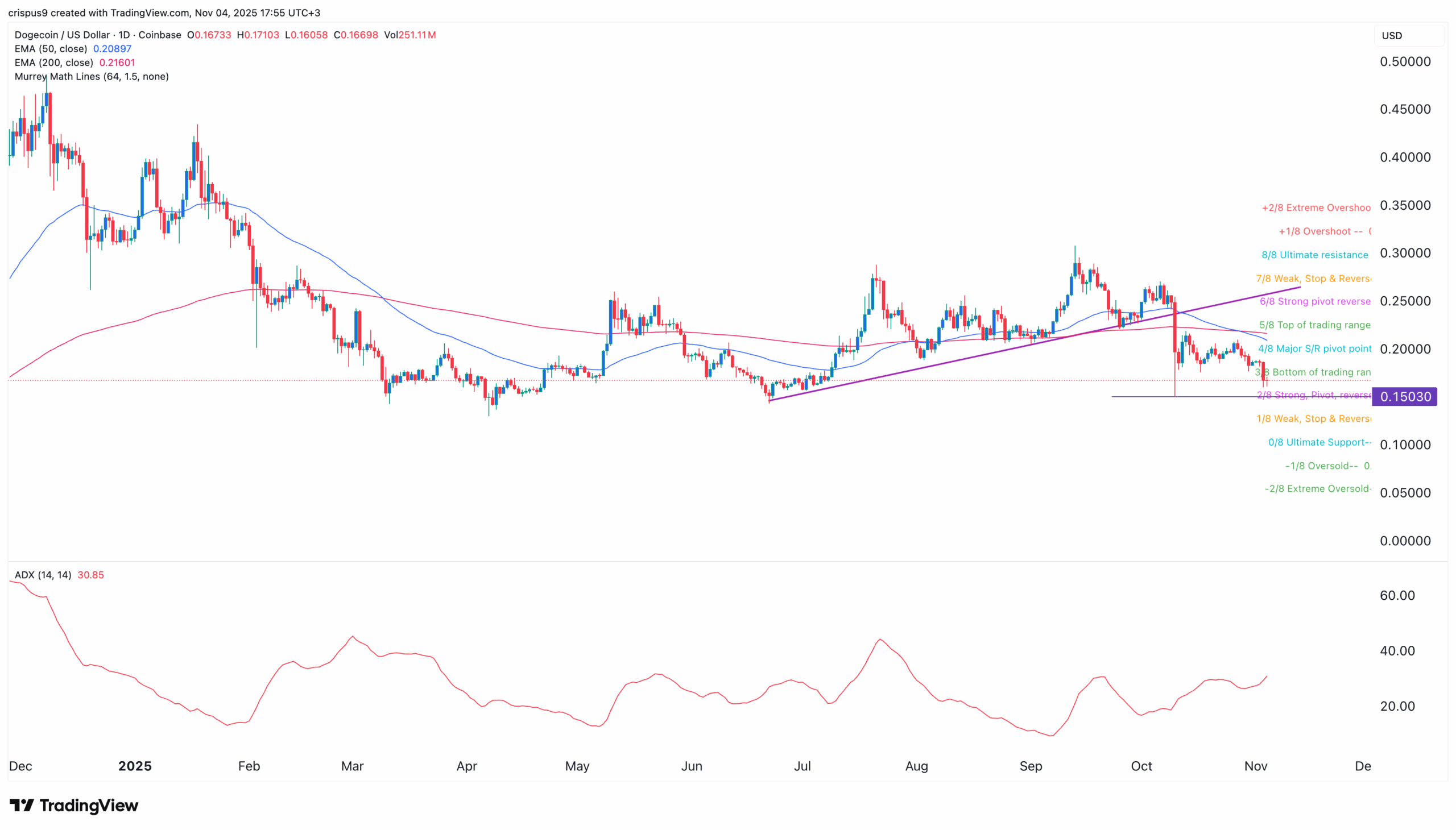

Technical analysis suggests that the coin may drop further in the coming weeks if it loses the key support level at $0.1500.

It has already moved below the ascending trendline that connects the lowest swings in June, August, and September this year.

DOGE price also formed a death cross pattern on October 27 as the 50-day Exponential Moving Average (EMA) moved below the 200-day one. This pattern often leads to a steeper crash as it means that bears have prevailed.

Dogecoin price has also crashed below the Major S/R pivot point of the Murrey Math Lines tool at $0.200, confirming the bearish view.

The strength of the ongoing DOGE price crash has accelerated, with the Average Directional Index (ADX) rising to 30, its highest level since late July. The ADX is a common indicator used to measure the strength of a trend.

Therefore, the most likely DOGE price forecast is that it continues falling in the next few days. More downside will be confirmed if it moves below the important support level at $0.1500 as that will invalidate the forming double-bottom pattern.

A drop below that price will push it to the ultimate support level at $0.10, which is along the ultimate support price. On the other hand, a move above the major S/R pivot point at $0.200 will invalidate the bearish view.

DOGE ETF Inflows Have Slowed

The main reason why the Dogecoin price may continue falling is that sentiment in the industry has waned this month. This explains why Bitcoin and most altcoins have crashed this month.

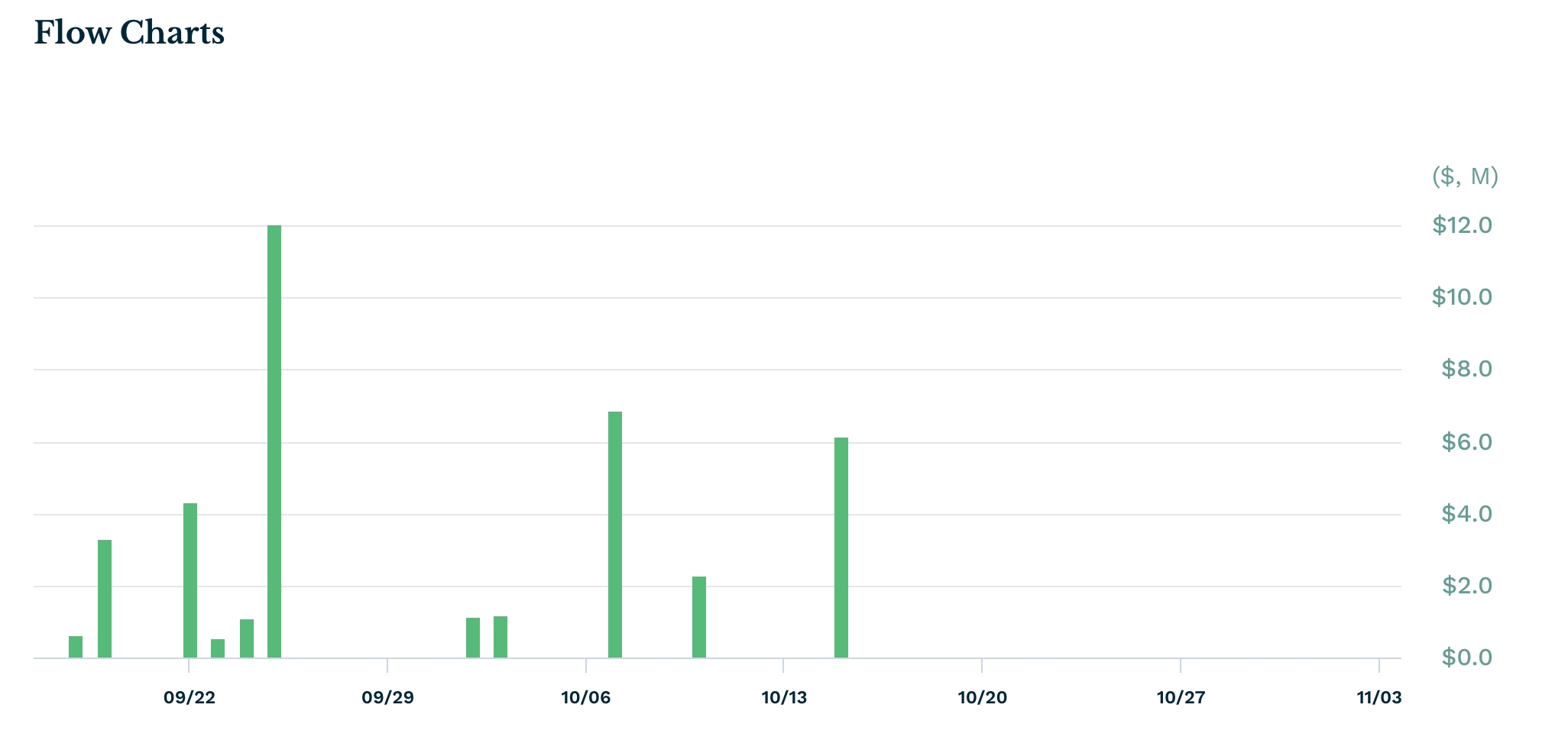

Another reason is that the recently launched DOGE ETF is struggling as investors stay off. Data on its website shows that it has just $30 million in assets, much lower than the XRPR ETF, which has accumulated over $120 million. The two funds were listed on the same day.

More data by ETF.com shows that it has not had any inflows since October 15 this year, when it added $5.2 million in assets. Therefore, this is a sign that the mainstream Act. 40 DOGE ETFs may struggle to gain traction among investors when they become approved, potentially before the year ends.

There are signs that DOGE demand is also waning as the futures open interest has plunged amid the rising liquidations in the market. The OI stood at just $1.5 billion, much lower than the year-to-date high of over $6 billion.