In Brief

- Polygon PoS payment apps hit $1.82B in Q3, growing 49% QoQ, led by Paxos and Revolut.

- Over $1.1B in real-world assets now live on Polygon, covering bonds, credit, and commodities.

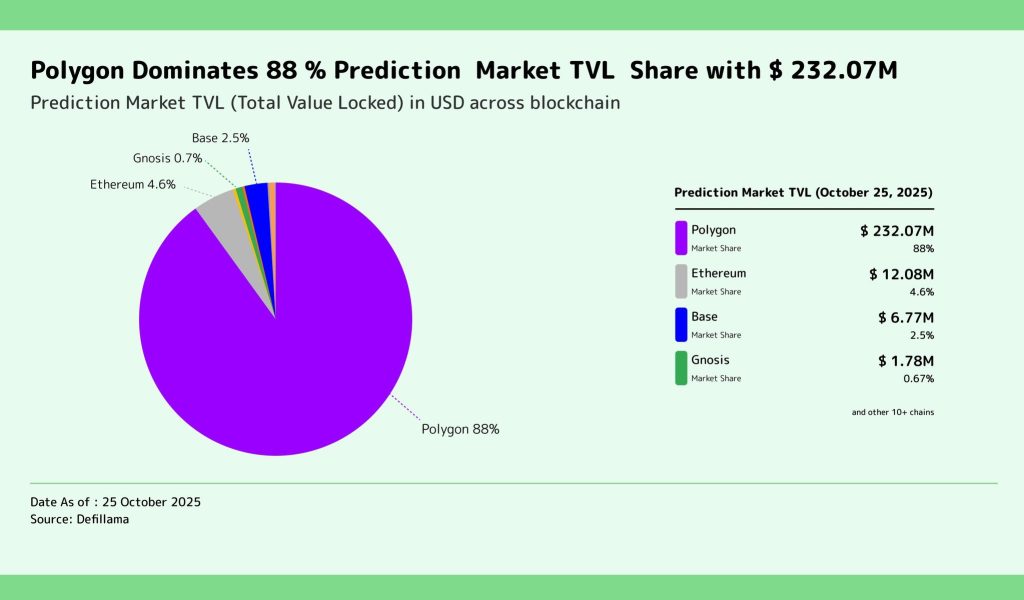

- Polygon holds 88% of prediction market TVL, securing its lead across multiple DeFi sectors.

Polygon has reported a strong performance across key sectors, with PoS payments app transfer volume reaching $1.82 billion in Q3 2025. According to Messari and Dune data, this marks a 49% quarter-over-quarter increase.

The largest contributors were Paxos with $319.4M (up 443.2%), Avenia with $285.5M, and Revolut with $243.4M in transfer volume. BlindPay, Cobo, and other applications added another $1.06 billion combined, showing rising demand for Polygon’s infrastructure.

Real-world asset (RWA) activity on Polygon has also accelerated, with over $1.1 billion now issued on-chain, as per Polygon data. The platform hosts over 273 assets, 3,000 holders, and maintains a 90% market share in tokenised corporate bonds.

According to RR2 Capital, commodities lead RWA categories with $485M, followed by $238M in corporate bonds and $122M in government bonds. Smaller segments include private credit, institutional funds, and tokenized stocks.

Polygon leads in prediction markets and continues to scale new sectors

Polygon also dominates the blockchain-based prediction markets with 88% of total value locked (TVL), totalling $232.07 million. Data from DeFiLlama shows Ethereum, Base, and Gnosis trailing far behind with less than 5% each.

The platform’s aggressive multi-sector expansion is driven by its modular architecture and scaling tools like zkEVM and AggLayer. These technologies secure multiple chains under a unified liquidity framework, strengthening Polygon’s ecosystem network effect.

Polygon now positions itself as a top-tier platform not only for payments but also for tokenised assets and financial services. While Ethereum remains foundational, Polygon is scaling beyond it to support the broader Internet of Value.

At press time, POL, the native token, trades at $0.1866, down 9.02% weekly, based on CoinMarketCap data. Despite short-term price weakness, network fundamentals remain strong and multi-sector activity continues to expand.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/crypto/polygons-ecosystem-surges-with-1b-in/