- Coinbase in advanced talks with BVNK for $2 billion acquisition.

- Deal could close by early next year.

- Stablecoin sector gains institutional interest.

Coinbase Global Inc. is in late-stage talks to acquire BVNK for about $2 billion, with due diligence pending before the deal finalizes by late 2025 or early 2026.

The acquisition could notably impact stablecoin infrastructure, with potential benefits for USDC and ETH, signaling growing institutional interest and possibly affecting the broader crypto market dynamics.

Coinbase’s $2 Billion Initiative for Robust Stablecoin Presence

Coinbase is in late-stage talks to acquire BVNK, focusing on stablecoin payment systems. The acquisition proposal, valued at approximately $2 billion, is anticipated to finalize around late 2025 or early 2026. Coinbase Ventures has been a prior investor in BVNK, suggesting strategic alignment. If completed, this move could bolster Coinbase’s foothold in the stablecoin market, enhancing its infrastructure capabilities. Such integration can offer a competitive edge in the booming stablecoin sector, benefiting major stablecoins like USDC. Industry reactions have been muted with no substantial statements from leaders or regulatory bodies reported yet. Though community discussions are limited, the deal underscores increasing institutional focus on stablecoins.

Did you know? In 2025, Stripe acquired stablecoin startup Bridge for $1.1 billion, indicating a trend among fintech companies toward stablecoin infrastructure investments similar to Coinbase’s current strategy with BVNK.

Chris Harmse, Co-founder of BVNK, stated that “BVNK is the global leader in stablecoin infrastructure, highlighting its broad banking partnerships and licensing.”

Stablecoins in Focus: Analyzing Market and Regulatory Impact

Did you know? In 2025, Stripe acquired stablecoin startup Bridge for $1.1 billion, indicating a trend among fintech companies toward stablecoin infrastructure investments similar to Coinbase’s current strategy with BVNK.

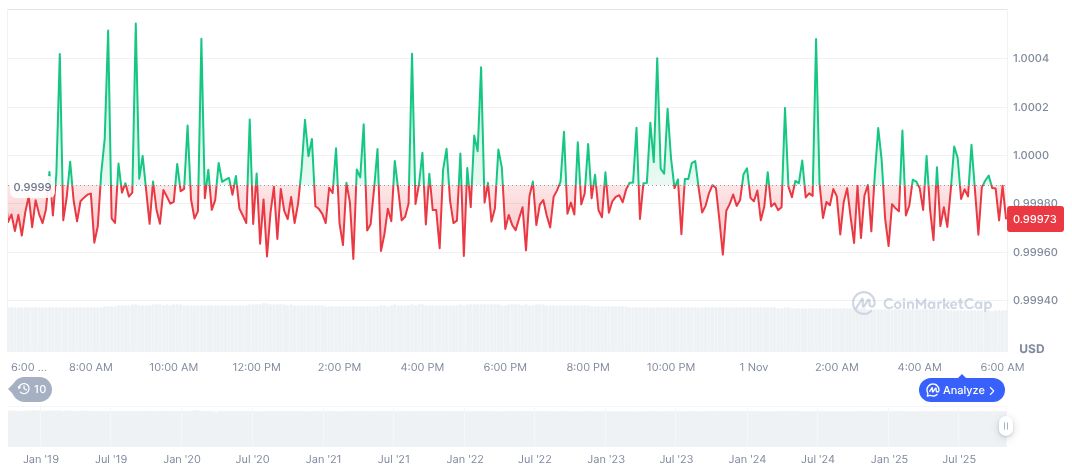

According to CoinMarketCap, USDC maintains stability at $1.00 with a market cap of 75.92 billion and 2.05% dominance. Recent metrics show a 24-hour trading volume drop of 7.28% to 17.03 billion, reflecting a slightly volatile period for the stablecoin with a 2.51% rise over 24 hours and negative movement in the past week.

Coincu research suggests Coinbase’s acquisition of BVNK may further stimulate the stablecoin market, drawing increased regulatory scrutiny and paving the way for more robust stablecoin frameworks, given the historical context of fintech’s ongoing integration with stablecoin technology.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/coinbase-bvnk-acquisition-deal/