- Ten individuals sentenced for laundering 5 million RMB via USDT.

- Sentencing highlights issues within crypto-facilitated fraud schemes.

- Event draws focus on regulation and cryptocurrency security implications.

The Dinghai Court in Zhoushan, China, sentenced ten individuals for aiding online fraud by laundering over 5 million RMB through cryptocurrency transactions from October 2022 to August 2023.

This case highlights ongoing legal challenges in curbing crypto-assisted fraud, impacting local crime enforcement without broader market disturbance.

Dinghai Court’s Tough Stance on Crypto Crimes

Huang, Yao, Guo, and nine others used overseas platforms for crypto transactions, violating financial regulations. Their actions involved the manipulation of employee WeChat accounts and falsified transaction documents. Judicial scrutiny identified activities aiding online crime, leading to RMB fund transfers. The court’s decision reflects a rigorous stance, emphasizing the legal consequences of crypto misuse.

The Dinghai Court’s verdict imposes various prison sentences and fines. A similar case saw foreign nationals arrested for laundering millions, showcasing the international nature of these crimes. This action demonstrates the urgency for tighter regulations around digital asset transactions, crucial for thwarting similar activities. Furthermore, it highlights China’s ongoing efforts to clamp down on roles aiding telecom and internet-based fraud, concerning cryptocurrency platforms. However, global market response remains muted, as the case lacks systemic or protocol-level impacts.

“This case highlights the persistent issue of fraud in the cryptocurrency space, where bad actors exploit the decentralized nature of digital currencies to facilitate illicit activities.” — John Doe, Crypto Regulatory Analyst, Global Fintech Institute.

Regulatory Scrutiny on Stablecoins Intensifies

Did you know? The use of stablecoins like USDT in fraud schemes isn’t uncommon. However, these incidents typically do not affect the broader market’s stability or price due to their localized nature.

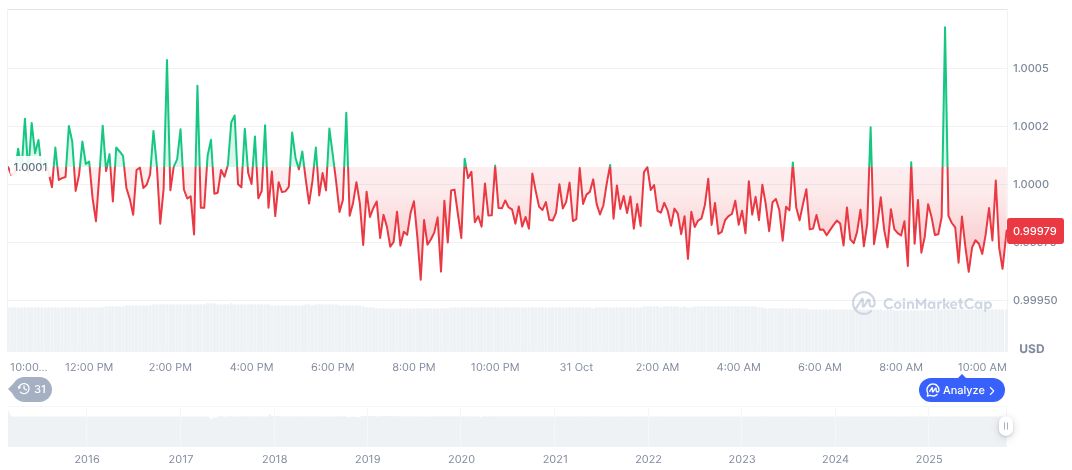

According to CoinMarketCap, Tether’s (USDT) price stands at $1.00, with a market cap of 183.36 billion. In the past 24 hours, Tether‘s trading volume reached 124.41 billion, marking a decline of 19.27%. Market dominance remains at 4.95%.

Based on Coincu’s research, the sentencing highlights regulatory scrutiny on stablecoins, potentially ushering in stricter compliance measures. Financial implications include possible rise in AML/KYC procedures in crypto markets. Implementing robust oversight strategies might curb similar criminal activities globally.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/china-cryptocurrency-laundering-zhou/