- Coinbase in talks to acquire BVNK for $2 billion.

- Potential impact on the stablecoin sector and infrastructure.

- USDC stability amidst crypto market expansions.

Coinbase Global Inc. is reportedly in late-stage negotiations to acquire BVNK, a stablecoin infrastructure startup, for approximately $2 billion, pending due diligence, Bloomberg reported.

This acquisition could enhance Coinbase’s position in the stablecoin sector, potentially influencing market liquidity and institutional investments once finalized.

Potential Impact on Stablecoin Sector and Regulatory Insights

In a strategic move, Coinbase Global Inc. embarks on advanced talks with BVNK, a London-based stablecoin infrastructure firm. The deal is reportedly valued at approximately $2 billion and remains subject to due diligence and regulatory scrutiny. If finalized, completion is expected by early 2026. With the acquisition, Coinbase aims to bolster its influence in the stablecoin sector. Key leadership at BVNK, including prominent fintech and VC investors such as Visa and Citi Ventures, alongside Coinbase Ventures’ involvement. These developments will likely reshape potential institutional flows into the sector.

The implications of this acquisition may be significant for Coinbase, particularly in its stablecoin segment. Notably, BVNK’s compliance-ready tools for cross-border payments could enhance Coinbase’s stablecoin infrastructure. Asset impacts remain speculative, with no direct on-chain effects yet observed.

Brian Armstrong, CEO, Coinbase Global Inc. – While we’re excited about the potential to enhance our stablecoin infrastructure, no details about the acquisition have been finalized yet. (source)

Market Data and Future Implications

Did you know? BVNK’s potential acquisition by Coinbase marks a new addition to a series of major crypto payment infrastructure deals, comparable to Coinbase’s Bison Trails purchase and Circle’s acquisition of Poloniex in recent years.

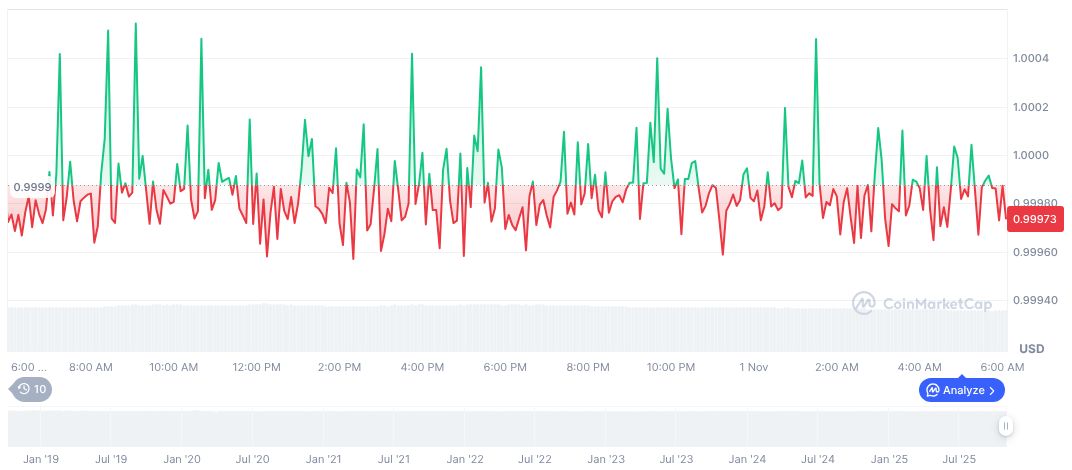

USDC remains a staple in the stablecoin sector, backed by a market cap of $75.95 billion according to CoinMarketCap as of November 1, 2025. Current price stability is observed with a minor 24-hour fluctuation of just 0.09%, highlighting its predominant market position. Continued integration into platforms could potentially affect stablecoin dynamics, particularly for USDC, under Coinbase’s expanded infrastructure.

Research insights suggest regulatory changes and enhanced infrastructure are expected outcomes. As stablecoin oversight frameworks evolve, companies such as Coinbase and BVNK may adapt their services to capture broader market participation. This acquisition may yield significant strategic benefits pending official confirmations and market adaptations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/coinbase-bvnk-acquisition-talks/