- Ether.fi has proposed a $50 million buyback for ETHFI.

- The plan activates below a $3 threshold per token.

- Voting is ongoing with no regulatory obstacles reported.

The Ether.fi community proposes a $50 million ETHFI token buyback, triggered when trading falls below $3, aiming to stabilize prices amid a dramatic drop since its 2024 peak.

This buyback strategy mirrors traditional finance, potentially boosting liquidity and reinforcing market confidence.

Ether.fi Unveils $50M Buyback Plan to Boost ETHFI

The proposal authorises the Foundation to utilise a portion of the treasury to conduct buy-backs of ETHFI tokens while the market price is below US $3, up to a total amount of US $50 million. The goal is to continue to accumulate ETHFI and increase the proportion of protocol revenue directed toward buy-backs while ETHFI trades below this threshold.

The buyback proposal requires approval from the Ether.fi DAO through a vote on the Snapshot platform. A successful outcome would establish liquidity and price stability mechanisms, potentially attracting more investors. The unique price-triggered buyback strategy differentiates Ether.fi’s approach from others that rely on fixed schedules or budget constraints.

Reactions to the buyback proposal are largely positive from the community and experts. Kain Warwick, founder of Synthetix, acknowledged the strategy as beneficial during bear markets, while DeFi analyst Santiago Roel noted it as the year’s largest buyback proposal. The end of the vote is yet to determine further actions.

Historical Context, Price Data, and Expert Analysis

Did you know? In past buybacks, Ether.fi consistently achieved price recoveries of 15-20%, enhancing its reputation as a strategic market stabilizer in DeFi.

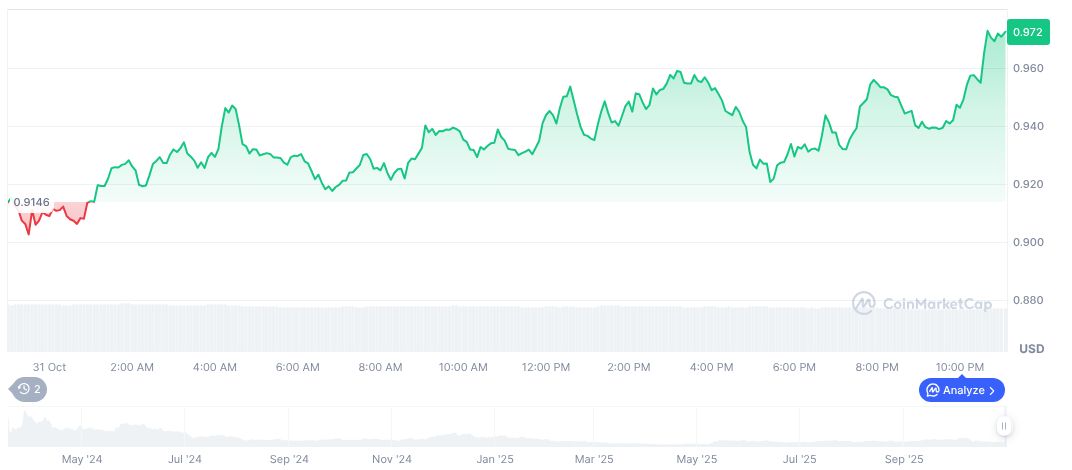

According to CoinMarketCap, Ether.fi (ETHFI) is currently priced at $0.97, with a market cap of approximately $545.91 million. Trading volume hit about $102.35 million over 24 hours, marking a 7.36% decline. In the last 30 days, the price has dipped by 32.06%, but it remains up 3.51% over 90 days.

The research team at Coincu suggests this buyback could significantly impact ETH staking and liquidity flows if approved. Historical trends show similar buyback strategies have led to price recoveries and increased protocol stability. Experts predict that this integration could fortify Ether.fi’s position in the market, setting precedents for future governance decisions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/ethereum/etherfi-50m-ethfi-buyback-proposal/