- Importance of stablecoin regulation highlighted by Federal Reserve leaders.

- Stablecoin use cases need robust validation, say officials.

- Market focuses on regulatory impacts on USD-backed stablecoins.

Federal Reserve Bank of Philadelphia President Patrick T. Harker expressed interest in stablecoins on November 1st, emphasizing the necessity for time to validate their use cases.

The focus on stablecoin validation highlights ongoing regulatory discussions and their implications for the U.S. payments ecosystem, involving key figures like Michael S. Barr and Christopher J. Waller.

Federal Reserve’s Stance on Stablecoin Innovation

Federal Reserve officials are actively discussing the role of stablecoins, emphasizing their potential use cases and the need for regulatory clarity. Federal Reserve Bank of Philadelphia President Patrick T. Harker and Vice Chair Michael S. Barr are prominent voices in these discussions. With ongoing evaluations, stablecoins are recognized for their blockchain technology contributions and engagement in payment systems.

The emphasis on stablecoin regulation arises from prior events, such as the UST/Luna collapse, highlighting the need for a structured framework. Regulatory frameworks will impact USD-backed stablecoins like USDT and USDC, which face interest due to their use in broader financial ecosystems.

“The stablecoin market would benefit from a U.S. regulatory and supervisory framework that addresses stablecoin risks directly, fully, and narrowly. … This framework should allow both non-banks and banks to issue regulated stablecoins and should consider the effects of regulation on the payments landscape, including competing payment instruments.” — Christopher J. Waller, Governor, Federal Reserve

Market reactions are cautious, as stakeholders consider the implications of new Federal Reserve statements. Governor Christopher J. Waller noted the necessity of private innovation besides regulatory oversight, while industry participants await further details. No significant financial market shifts have been observed yet, with many adopting a wait-and-see approach.

Market Insights: Stability and Regulatory Implications

Did you know? U.S. regulatory strategies for stablecoins have been influenced by past market disruptions, demonstrating the importance of clear frameworks to prevent systemic risks similar to the 2022 depegging events.

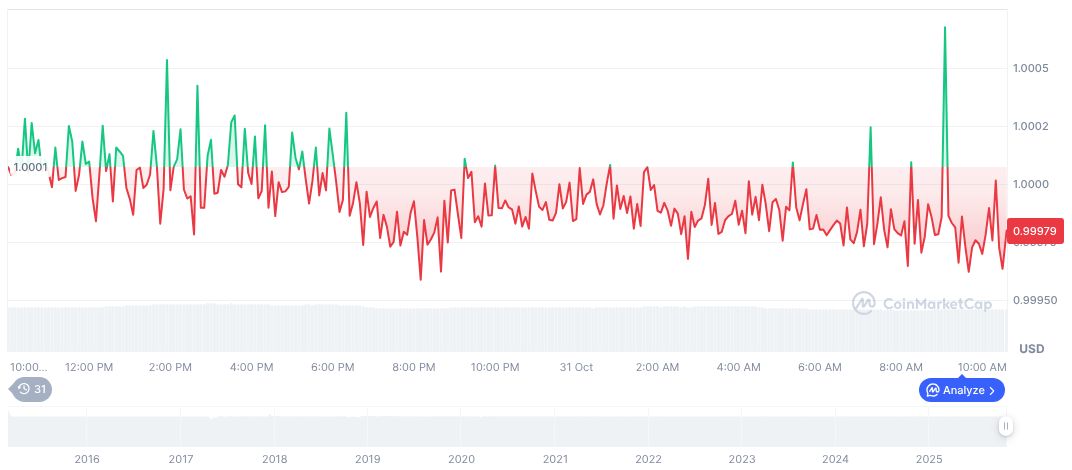

According to CoinMarketCap, Tether USDt’s current price is $1.00, maintaining market dominance of 4.99%. With a market cap of formatNumber(183326292433, 2) and a 24-hour trading volume decrease of -9.60%, Tether’s price stability reflects its role as a pivotal USD-pegged stablecoin. In recent months, a slight fluctuation was noted, with a 0.04% decrease over 24 hours.

Coincu research highlights the importance of adopting a harmonized regulatory framework, crucial for the stablecoin ecosystem’s sustainability. Timely legislative actions could foster innovation while mitigating potential risks, thereby supporting secure and effective financial integrations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/federal-reserve-stablecoin-regulations/