KEY POINTS: ➡️ Bitplanet, backed by Metaplanet’s Simon Gerovich, buys […]

KEY POINTS:

➡️ Bitplanet, backed by Metaplanet’s Simon Gerovich, buys 96 $BTC as it kickstarts its accumulation strategy.

➡️ 351 entities hold 4.04M $BTC today, with Strategy leading the list thanks to its 640,481 Bitcoin-strong treasury valued at over $74B.

➡️ Bitcoin’s global adoption ramps up, as Japan plans to allow banks to offer crypto services, while Europe sees higher adoption rates in 2025.

➡️ Bitcoin’s Layer 2, Bitcoin Hyper ($HYPER) nears $25M in presale, promising faster and cheaper Bitcoin transactions.

Bitplanet just kickstarted its Bitcoin accumulation strategy after making its first purchase of 96 $BTC.

The company first announced its Bitcoin hoarding plan in late August 2025, when it also secured $40M for future crypto investments.

Bitplanet, which is backed by Metaplanet’s Simon Gerovich, plans to reach a 10,000 $BTC treasury across multiple purchases, taking a page out of Strategy’s book. Michael Saylor’s company is currently the largest Bitcoin holder, with 640,418 tokens, valued at over $74B.

This recent purchase, despite being modest, supports the bullish context surrounding Bitcoin, after the coin managed to break $115K for the second time after October 10’s brutal market crash.

Bitcoin Hyper ($HYPER) contributes to the bullish narrative, as Bitcoin’s Layer 2 is nearing $25M in presale and targets a Q4 2025-Q1 2026 release date.

Bitcoin Adoption Ramps Up Globally

While Michael Saylor’s Strategy has been a staple in the crypto sphere for a long time thanks to its unbending Bitcoin support and recurrent buys, it’s not the only one.

According to Bitcoin Treasuries, 351 entities hold 4.04M $BTC, with Strategy, MARA, Twenty One, and Metaplanet occupying the first spots on the list.

Part of the growing interest in crypto and Bitcoin more specifically is the increasingly more lax legislation at global level. Trump’s GENIUS Act kickstarted the trend, after establishing a clear regulatory system that protects investors and supports and regulates issuers.

Now we have South Korea’s recent stablecoin bill, the Digital Asset Basic Act, which aims to allow companies to issue stablecoins so long as they have at least $366,749 in equity capital.

Things are changing in Europe as well. An April 2025 study by Adan highlighted that Europe is taking notice of the growing impact of crypto assets.

The UK currently has the largest rate of crypto asset holders, with 19% of the population holding one or more cryptos. Netherlands and Belgium come at 17%, while Italy and Germany arrive next at 15% and 13% respectively. France sits at 10%.

Despite the October 10 market crash, the interest in Bitcoin seems to have ramped up, which is good news for $BTC as it moves deeper into Q4.

Bitcoin now sells at just over $115K and appears to have entered a consolidation phase over the past 24 hours, which could signal an imminent bull by the year’s end. Analysts at TD Cowen think a price point of $141K by December.

Bitcoin Hyper’s ($HYPER) surging presale may help with that.

How Bitcoin Hyper Promises to Change the Bitcoin Ecosystem Forever

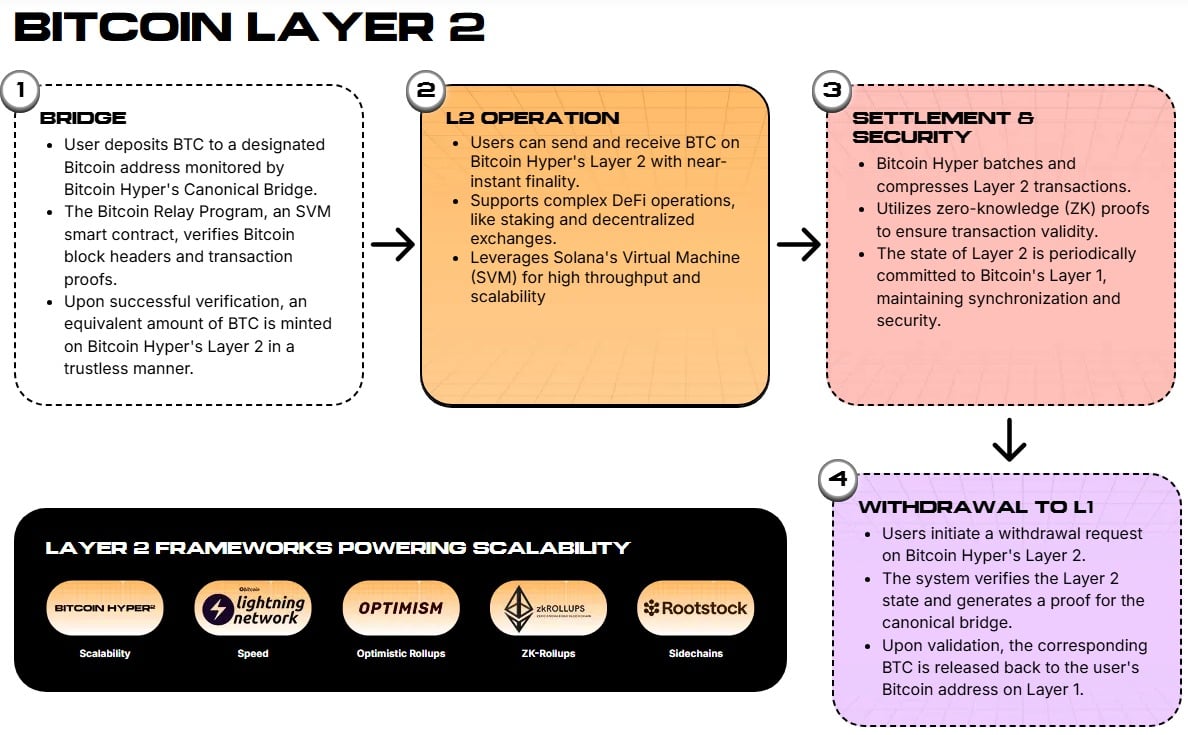

Bitcoin Hyper ($HYPER) is Bitcoin’s coming Layer 2 solution that promises to turn the Bitcoin network faster, cheaper, and more scalable.

Hyper addresses Bitcoin’s most pressing problem: its performance limitation. Bitcoin is natively capped at seven transactions per second (TPS), which puts it on the 23rd spot on the list of the fastest blockchains by TPS.

The side-effects are as expected: high fees, confirmation times that sometimes reach hours, and lack of scalability, which explains why Ethereum and Solana dominate Bitcoin in terms of adoption rates.

Hyper employs tools like the Solana Virtual Machine (SVM) and the Canonical Bridge to correct these problems.

While SVM enables Solana-grade execution of smart contracts and DeFi apps, with near instant finality, the Canonical Bridge addresses the network’s finality problem directly.

Once the Bitcoin Relay Program confirms the transaction details, the Bridge mints your tokens directly into the Hyper layer, giving you near-instant access to the wrapped bitcoins.

The presale is at $24,990,894 at the time of writing, with $HYPER valued at $0.013175, and targets a release date between Q4 2025 and Q1 2026.

Based on Hyper’s utility, a realistic price prediction for $HYPER puts the token at $0.2 shortly after its public listing and $1.2 or higher by 2030.

So, if you want to invest, you may want to do it soon. According to the whitepaper, the official coin listing could happen this year, depending on ‘prevailing market conditions and demand’.

Disclaimer: This content has been supplied by a third party contributor. Brave New Coin does not endorse or promote any products or services mentioned herein. Readers are encouraged to conduct independent research before making any financial decisions. The information provided is for informational and educational purposes only and should not be interpreted as investment advice.

Source: https://bravenewcoin.com/insights/bitplanet-starts-bitcoin-accumulation-bitcoin-hyper-soars