- Coinbase’s Brian Armstrong envisions a blockchain-based startup process.

- Proposal includes seed rounds and tokenized IPOs.

- Major figures and regulatory reactions remain speculative.

Coinbase CEO Brian Armstrong expressed his vision for using blockchain in all startup phases during a TBPN podcast interview in October 2025, potentially transforming business infrastructure.

Armstrong’s plan could revolutionize startup processes, potentially impacting how businesses access funding and go public, leveraging stablecoin USDC and tokenized equity for greater flexibility.

Blockchain Vision for Startups: Formation to Tokenized IPOs

Coinbase’s Brian Armstrong envisions a shift in how startups are built, funded, and taken public through blockchain technology. His plan includes blockchain rails for startup formation, USDC financing, and tokenized equity listings. Though revolutionary, the vision has yet to gain traction among major financial or governmental institutions.

Industries involved might face new opportunities and challenges. The approach suggests a transformation in how startups secure capital and go public, aiming to reduce costs and increase accessibility for founders.

My vision for moving every stage of startup development—founding, financing, and IPO—onto blockchain rails, including founding startups, conducting seed rounds, and eventually tokenized equity listings. – Brian Armstrong, CEO, Coinbase

Market reactions have varied. While some early adopters and entities like ChainCatcher show enthusiasm, significant industry leaders have yet to publicly comment. Regulatory clarity and endorsement are notably absent, with major figures like Arthur Hayes and CZ remaining quiet.

USDC Stability Amid Blockchain Startup Developments

Did you know? Armstrong’s vision echoes earlier attempts to tokenize startup shares, such as Mirror on Ethereum. While the full company lifecycle on-chain is ambitious, historical trends show incremental progress in blockchain-driven investment strategies.

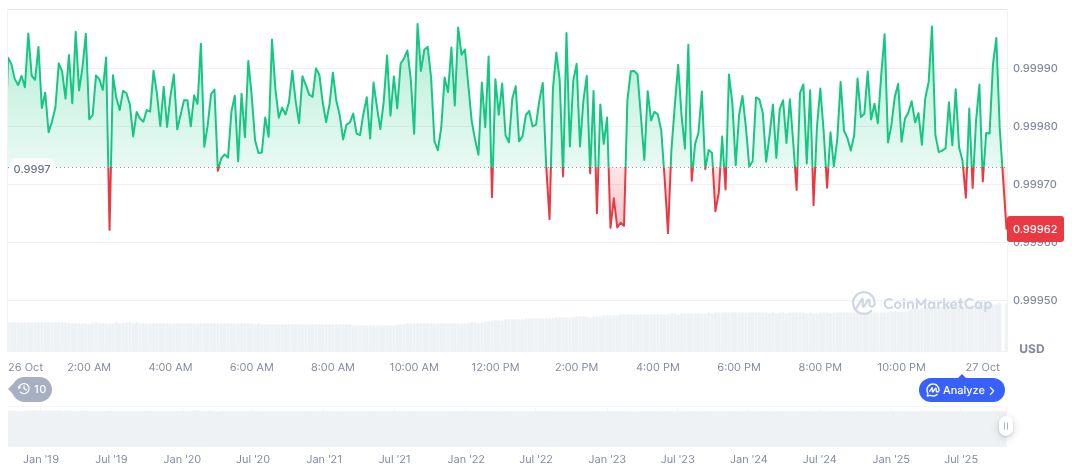

Data from CoinMarketCap shows USDC maintaining steady stability, priced at $1.00 with a market cap of $76.25 billion. Despite a 1.77% drop over the past 24 hours, trading volume surged 81.42%, reaching over $12.75 billion. The stablecoin’s dominance stands at 1.96% in the market.

The Coincu research team foresees potential advantages from blockchain-native startup development, highlighting possible regulatory barriers. They observe ongoing infrastructure support but note that breakthrough adoption requires regulatory and market alignment for substantial impact.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/blockchain/coinbase-startup-blockchain-transformation/