- U.S. inflationary decline attributed to current policy actions.

- Treasury Secretary Bessent credits housing and energy price decreases.

- Uncertainty persists amid government shutdown impacts on the market.

Scott Bessent, the U.S. Treasury Secretary, emphasized improvements in inflation due to current policies during a public statement on October 26.

These remarks underline the administration’s efforts to manage economic conditions, with potential effects on markets and consumer confidence, amid a backdrop of financial uncertainty.

Inflation Drops Linked to U.S. Treasury Policies

Scott Bessent, as the Treasury Secretary, has made remarks highlighting the improvement in U.S. inflation levels, attributing this progress to current administration policies. “After four years of price increases diminishing the U.S. standard of living, inflation is showing substantial improvement due to the policies of this administration,” Bessent stated in a U.S. Treasury Press Release. The statement dismisses any attribution specifically to the Trump era, focusing instead on recent government actions. Inflation improvement has not been clearly tied to specific past administrations, further emphasizing current policy contributions.

The improvement in inflation is linked to falling energy prices, a significant consideration as the U.S. continues leveraging policy changes for economic stability. Bessent affirms expectations of consumer price reductions starting next month, a notable shift aligned with administrative strategies.

Market analysts and industry observers are closely monitoring these statements against the backdrop of a government shutdown. There’s increased market volatility evident from recent stock dips and lower bond yields. Investors are diverting to safe assets like gold amidst prevailing uncertainty, as further clarity on regulatory environments remains pending.

Market Volatility Amid Government Shutdown

Did you know? In times of economic uncertainty, such as government shutdowns, markets have historically shown resilience by quickly rebounding once governmental activities resume, retaining only limited long-term impacts on financial aspects.

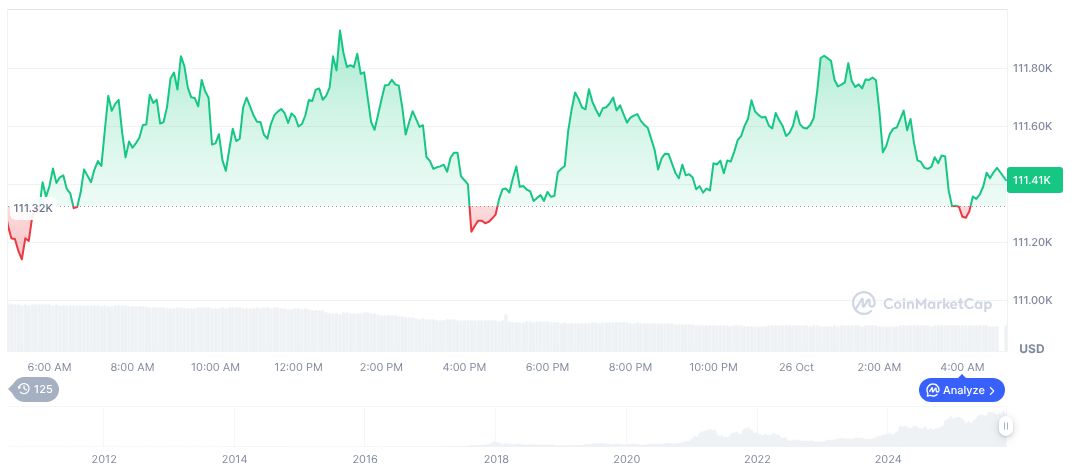

Bitcoin (BTC) currently trades at $112,494.67, representing a 0.86% 24-hour increase, and holds a market cap of 2,243,157,427,275.00 with 59.06% dominance. Its trading volume has decreased by 39.81% over 24 hours. Data sourced from CoinMarketCap.

Research from Coincu suggests that the potential impact of ongoing economic policies could affect market dynamics and regulatory landscapes. These trends, when aligned with historical data, may predict financial resilience and technological adoption shifts in the crypto sphere.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-treasury-inflation-policy-impact/