A new analysis comparing Bitcoin and gold price movements has reignited bullish expectations in the crypto market.

The findings suggest that Bitcoin’s performance tends to follow gold’s trajectory with a delay of roughly 188 days, implying that the world’s largest cryptocurrency could be gearing up for a major rally.

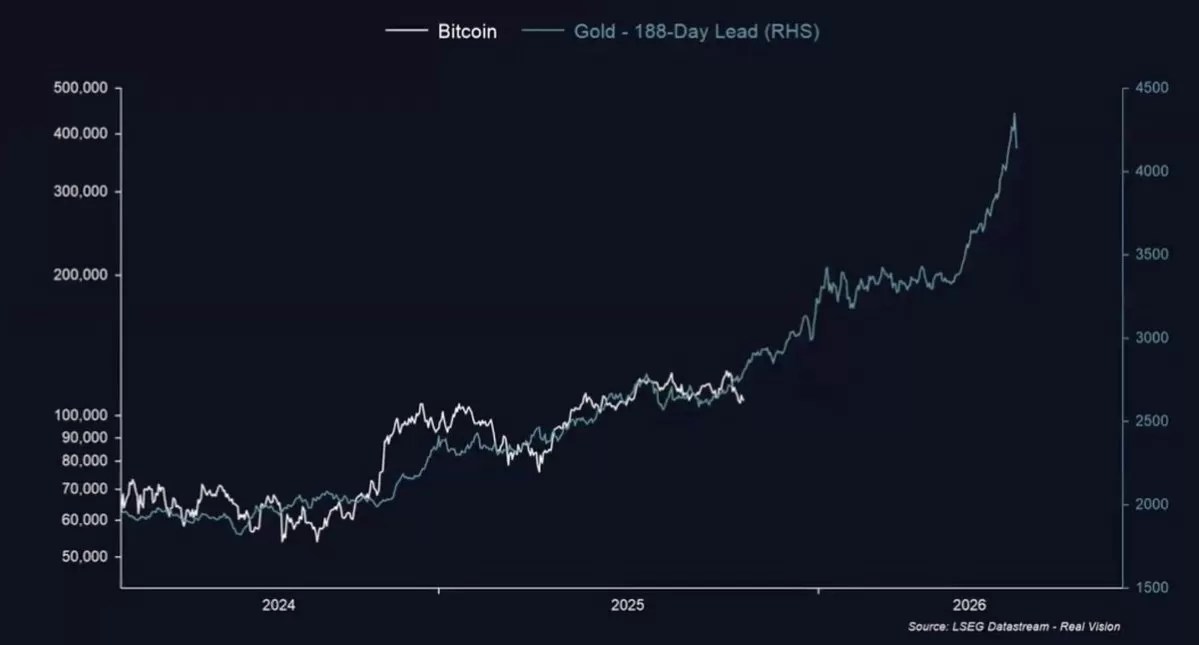

The comparison, based on data from LSEG Datastream and Real Vision, shows that when gold’s price curve is shifted forward by around six months, it closely aligns with Bitcoin’s ongoing trend — and in some cases, Bitcoin even outperforms the precious metal once the catch-up begins.

Six Months Behind — or Six Months Ahead of a Rally?

So far this year, gold has been one of the standout performers among traditional assets, climbing 45% as investors sought safety amid global uncertainty. Bitcoin, by contrast, has added only about 20% during the same period. But analysts say this isn’t a sign of weakness — rather, it’s evidence that the crypto market is simply in a delayed phase of the same bullish cycle.

According to Real Vision’s model, if Bitcoin continues to mirror gold’s pattern with that half-year lag, the cryptocurrency could enter a parabolic phase heading into 2026.

Institutions Quietly Positioning

Market observers have also connected this potential upswing to the growing influence of institutional capital. Since the launch of multiple Bitcoin ETFs, inflows have steadily increased, adding billions of dollars in liquidity to the asset.

Analysts like Raoul Pal have long suggested that these long-term investment flows act as a “delayed amplifier,” meaning that Bitcoin’s reaction to macro trends — such as the gold rally — may appear later but with greater intensity.

A Weak Correlation, but a Powerful Echo

Interestingly, the statistical link between Bitcoin and gold remains weak, with a correlation coefficient of only 0.09. This means Bitcoin still trades more like a risk asset, closely aligned with tech stocks, rather than as a traditional safe haven.

Yet, in visual models comparing their trajectories, Bitcoin’s adjusted curve sits above gold’s — suggesting that when momentum returns, its relative strength could far exceed that of the metal it once aimed to replace.

What the Model Predicts

If the historical rhythm repeats, Real Vision’s projection implies that Bitcoin could exceed $400,000 by 2026, following the same structural climb that gold experienced earlier — only amplified.

Skeptics argue such targets are speculative, but the pattern’s persistence across multiple timeframes is difficult to ignore. With gold already peaking and institutional Bitcoin exposure rising, many traders believe the countdown to the next major leg up has already begun.

Whether the correlation is coincidence or a predictive framework, one thing seems clear: if gold’s rally is the first verse of this song, Bitcoin’s crescendo may still be ahead.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

Source: https://coindoo.com/bitcoin-may-be-six-months-behind-golds-rally-analysts-suggest/