- US CPI maintains stability with a 0.3% MoM increase.

- Market reactions remain muted after expected data release.

- Bitcoin and Ethereum see no significant impact from CPI alignment.

The US core Consumer Price Index rose 0.2% month-over-month in September 2025, matching market expectations and highlighting ongoing price stability in the inflation landscape.

September’s stable CPI data provided no surprises, maintaining equilibrium in financial and crypto markets, with no immediate reactions from major assets like Bitcoin and Ethereum.

September CPI Shows 0.3% Increase, Market Stable

The US CPI increased by 0.3% month-over-month in September, aligning with expectations, according to data confirmed by the Bureau of Labor Statistics. This consistent trend supports market stability, as no unexpected inflationary pressures emerged, paralleling past readings of a 0.2% or 0.3% rise. Core inflation figures also recorded a 3% year-over-year increase, mirroring earlier predictions. According to a statement from the Cleveland Fed, “September Core CPI: 0.26% MoM, 2.95% YoY, in line with previous and expectations.”

With no immediate action needed from financial authorities, the Federal Reserve aims to maintain its current monetary policies. This consistent CPI trend typically results in reduced market volatility, as confirmed historical patterns indicate minimal influence on risk and crypto assets during stable inflationary periods.

Market reactions remained subdued, with notable absence of executive commentary from government officials or influential crypto figures. The data’s in-line results underscored stable investor sentiment. Historical data indicates neutral responses from crypto markets, as anticipated CPI releases lead to restrained market movements.

Implications for Crypto: Expert Insights and Market Reactions

Did you know? Stable CPI readings historically correlate with low market volatility in crypto sectors, suggesting September’s aligned figures continuos a trend minimizing abrupt price fluctuations, underscoring investor assurance in predictable economic indicators.

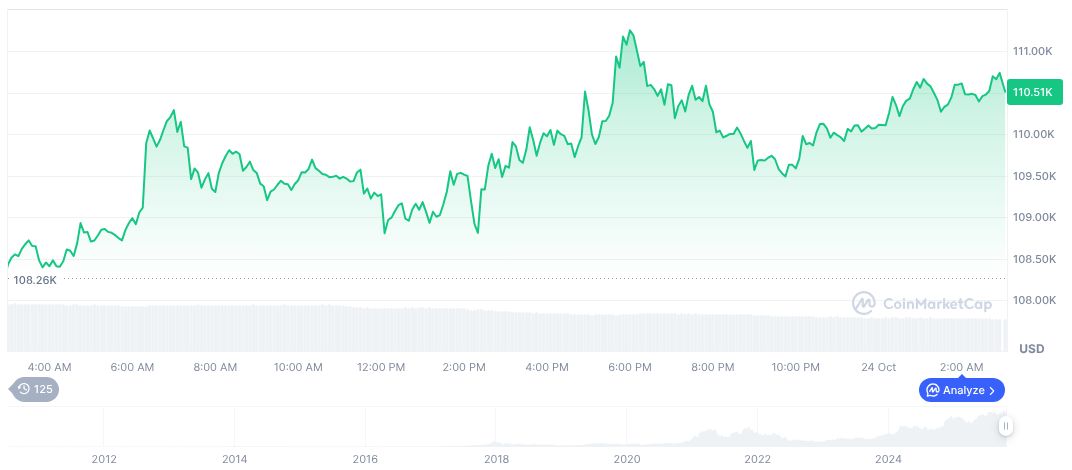

According to CoinMarketCap, Bitcoin (BTC) is valued at $111,842.53, reflecting a 5.96% increase over seven days despite a 1.06% decline over 30 days. The cryptocurrency’s market cap stands at $2.23 trillion, with a market dominance of 59.58% as of October 24, 2025. Recent trading volume reached approximately $50.83 billion.

Experts from the CoinCu research team suggest consistent CPI results are unlikely to cause major shifts in regulatory or technological landscapes. Stable economic indicators often correlate with minor fluctuations in both traditional and crypto markets, highlighting the importance of predictable financial data for long-term strategy alignment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/september-cpi-data-market-impact/