Key Takeaways

Why did Hyperliquid rally after weeks of decline?

The S-1 filing with the U.S. SEC to raise $1 billion boosted investor confidence, signaling institutional-grade growth plans and token buybacks.

What could the $1B raise mean for HYPE’s future?

If executed, it would fund token repurchases and treasury expansion, reinforcing Hyperliquid’s market stability and long-term ecosystem strength.

Since hitting $59 a month ago, Hyperliquid [HYPE] has traded within a descending channel, with a low of $20. However, the altcoin has signaled recovery, rising from a low of $34 to a high of $38.4 on the daily charts.

In fact, as of this writing, Hyperliquid was trading at $38.08, marking a 9.43% rise over the last 24 hours. But what triggered this uptick?

Hyperliquid files public offering to raise $1B

In a significant development, Hyperliquid Strategies Inc. filed an S-1 registration statement with the U.S. Securities and Exchange Commission.

As per the filing, the team aims to offer up to 160 million shares of common stock through a committed equity facility with Chardan Capital Markets.

Source: SEC

This public offering seeks to raise $1 billion to fund general corporate purposes, including the purchase of HYPE tokens.

Thus, the firm will boost its HYPE treasury through token buybacks and open market accumulation.

Currently, Hyperliquid Strategies holds 12.6 million tokens as treasury assets, with 18.43 million tokens held by treasury companies.

This move indicates a growing trend among companies to prioritize crypto treasury assets as part of their strategy.

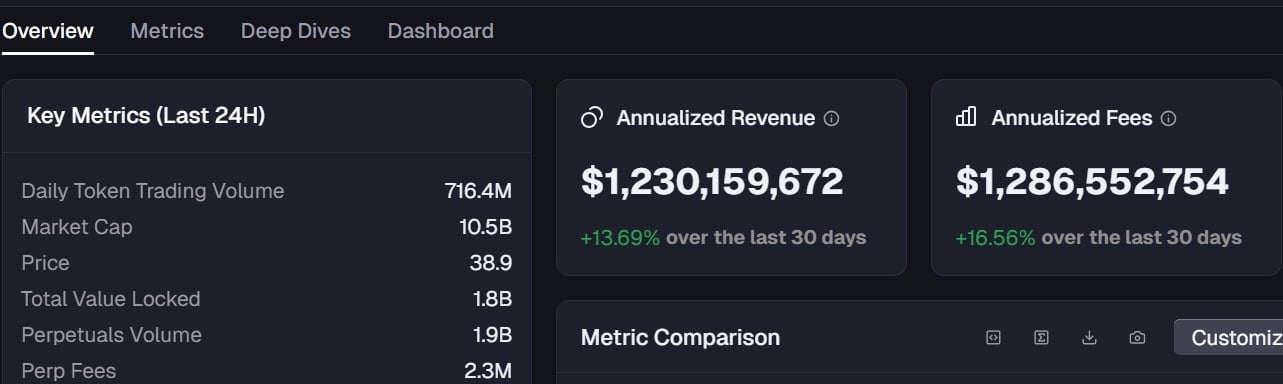

Source: Defillama

With this initiative, Hyperliquid Strategies joins other firms, such as Lion Group and Eyenovia, which have integrated HYPE into their balance sheet.

Even more important, such a massive potential investment in the ecosystem signals the team’s commitment to the network’s health.

In most cases, investors view such commitment positively and often incentivize them to return to the market and invest.

Projects support Behold’s treasury asset

Besides, the rising demand from large entities as a treasury asset, the team has spent significant revenue on HYPE repurchase.

In fact, Hyperliquid’s revenue has surged 13.69% to $1.2 billion, while the chain has jumped 16.5% to $1.28 billion.

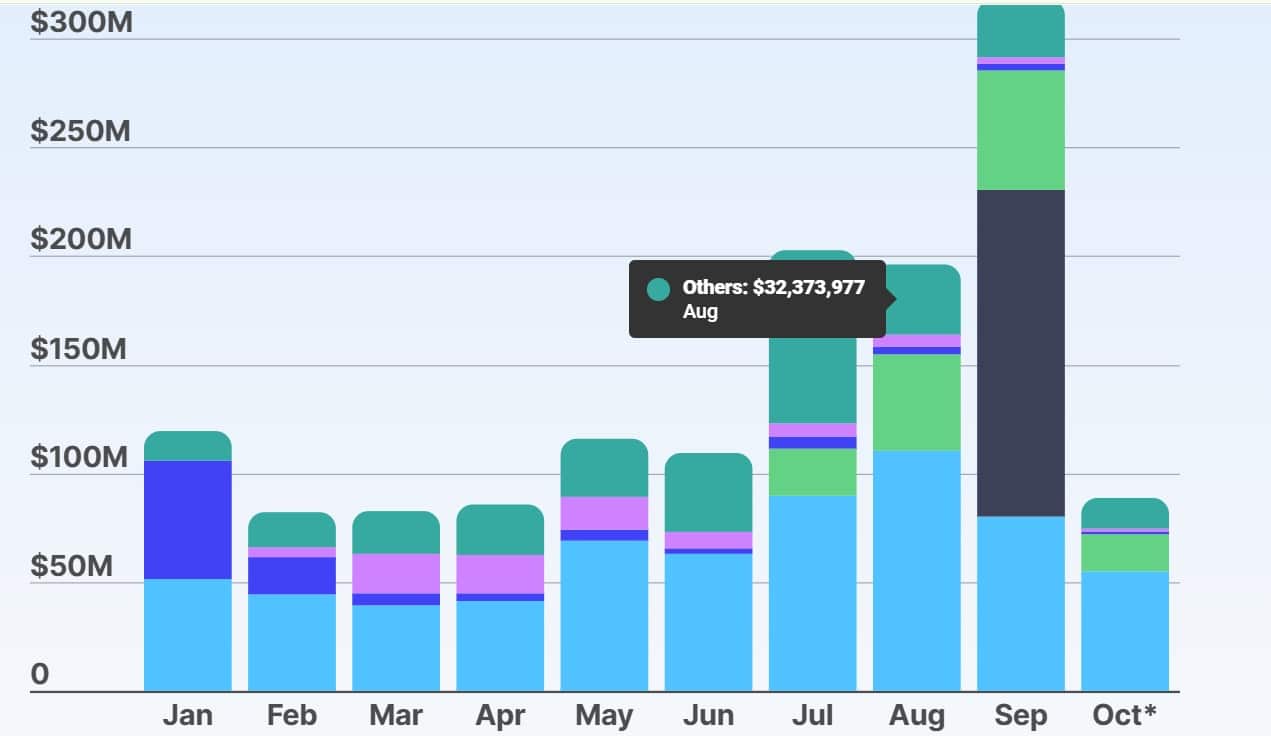

Source: Artemis

Interestingly, the project has spent most of these funds on token buybacks. As such, they have spent more than $644 million to purchase 21.36 million tokens.

Source: Coingecko

These token repurchase initiatives have played a significant role in market stability and indicated the team’s long-term commitment to the project.

Can HYPE ride the wave?

Undoubtedly, the recent announcement has had a significant impact across the market. As such, HYPE’s price rebounded while investors returned to the perpetual market.

In fact, perp volume has rebounded from $5 billion and stabilized around $11.5 billion at press time.

Such a spike indicated increased speculative activity as investors rushed to open new positions, setting HYPE for a significant, explosive move.

Despite investor resurgence and price recovery, the upward momentum remains weak. For that reason, Hyperliquid’s positive index of Directional Movement Index (DMI) has remained below a negative index.

Source: TradingView

At press time, +DI sat around 16, while -DI held above it at 30, signaling strong bearishness. Therefore, if the existing market structure holds, HYPE will retrace to $34.

However, if the sentiment shift witnessed following Hyperliquid Strategies’ filing hold, the uptrend will continue with EMA50 at $43 as significant resistance.

A breach of this level will strengthen the altcoin to target $51, reversing the overall market trend.

Source: https://ambcrypto.com/hyperliquid-strategies-files-for-1b-public-offering-to-bolster-hype-treasury/