- JPMorgan expects a decline in the USD due to Fed actions.

- Predicted DXY index fall to 91.00 by 2026.

- Potential positive impact on BTC and ETH markets.

BlockBeats News reports that JPMorgan Chase predicts the U.S. Dollar Index (DXY) will weaken to 91.00 by mid-2026 amid expectations of Fed rate cuts.

A declining dollar could impact cryptocurrency markets favorably, historically benefiting Bitcoin and Ethereum, as investor interest shifts toward riskier assets with potential reduced real yields.

JPMorgan Foresees Dollar Index Dropping to 91 by 2026

JPMorgan Chase projects a weaker U.S. dollar by mid-2026, linked to anticipated Federal Reserve interest rate cuts. Analysts cite U.S. economic convergence with other markets and a diminished demand for safe-haven investments as contributing factors. The bank’s experts predict that the Dollar Index will fall to 91.00.

The anticipated USD decline could lead to increased volatility in financial markets. JPMorgan’s stance aligns with other industry predictions about the dollar’s trajectory. As the currency weakens, risk assets like cryptocurrencies might see heightened interest from investors.

Market observers and financial analysts are closely watching for further cues from the Federal Reserve on its future moves. No public statements from JPMorgan’s leadership directly confirm the forecasted DXY target of 91.00, though the sentiment exists broadly in market discussions.

Cryptocurrencies Expected to Benefit from Weaker Dollar

Did you know? During the Fed’s lowering of rates between 2017 and 2020, Bitcoin’s value rose significantly as investors turned to riskier assets, diverging from traditional safe havens like the U.S. dollar.

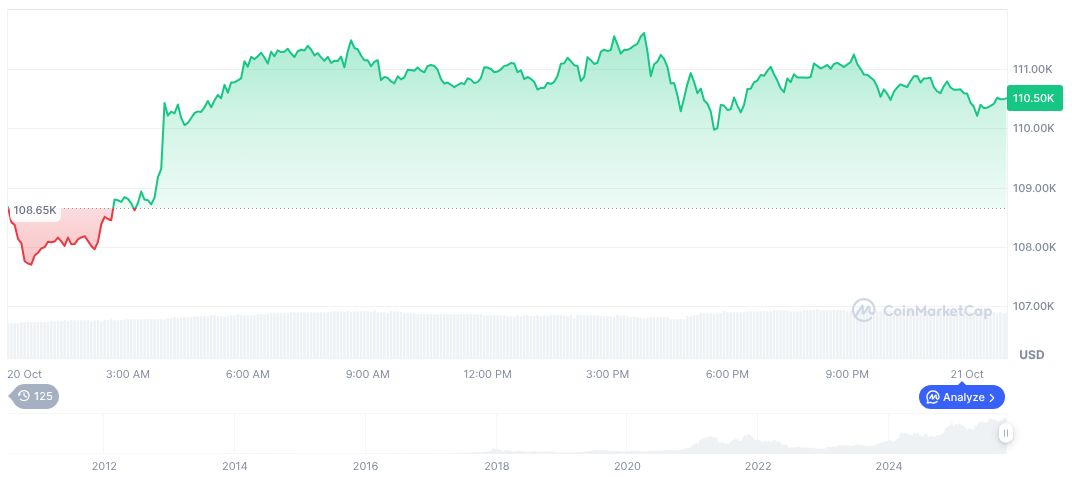

According to CoinMarketCap, Bitcoin (BTC) is valued at $111,961.62, boasting a market capitalization of $2.23 trillion. Its market dominance stands at 59.21%. Recent price shifts show a 1.17% increase in the last 24 hours, despite a 5.29% decline over 90 days.

Insights from the Coincu research team highlight that a weakening USD could catalyze capital inflow into cryptocurrencies. Cryptocurrency markets typically react favorably to such macroeconomic conditions, indicating potential growth opportunities for BTC and ETH amid expected regulatory and financial shifts.

“We look for more USD weakness this year, predicated on the same combination of cyclical factors (including U.S. moderation and tariffs) and structural factors (such as valuations, fiscal, flow dynamics and policy uncertainty) that we have been discussing for several months now.” — Meera Chandan, Co-head of Global FX Strategy, J.P. Morgan.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/jpmorgan-usd-decline-forecast/