- Uncertainty surrounds potential Fed decision; 96.7% rate cut probability questioned.

- CME’s prediction lacks official confirmation.

- Crypto market volatility amid speculation over Fed’s decision.

CME’s “FedWatch” implies a 96.7% probability for a 25 basis point rate cut by the U.S. Fed in October, according to BlockBeats News on October 22.

Despite BlockBeats’ report, there’s no official confirmation. Crypto markets remain volatile, influenced by broader economic factors and investor sentiment rather than potential rate cuts.

Speculation Surrounds Fed’s October Rate Decision

Despite reports of a 96.7% probability of a Fed rate cut, there has been no official confirmation from the Federal Reserve or the Chicago Mercantile Exchange regarding these figures. Speculation continues to drive crypto market volatility.

The absence of official statements from either the Fed or key industry leaders has left the community uncertain about potential economic implications. The perceived likelihood of a rate cut has influenced short-term market strategies among investors.

Brian Armstrong, CEO, Coinbase, commented on recent speculative market sentiment, stating, “The rumors are true, we bought this NFT. The UpOnly show is coming back.”

Key industry figures have remained silent, while broader market discussions focus on other economic drivers, such as ETF flows and on-chain technical events. This continues to affect asset pricing without direct correlation to the Fed’s decision.

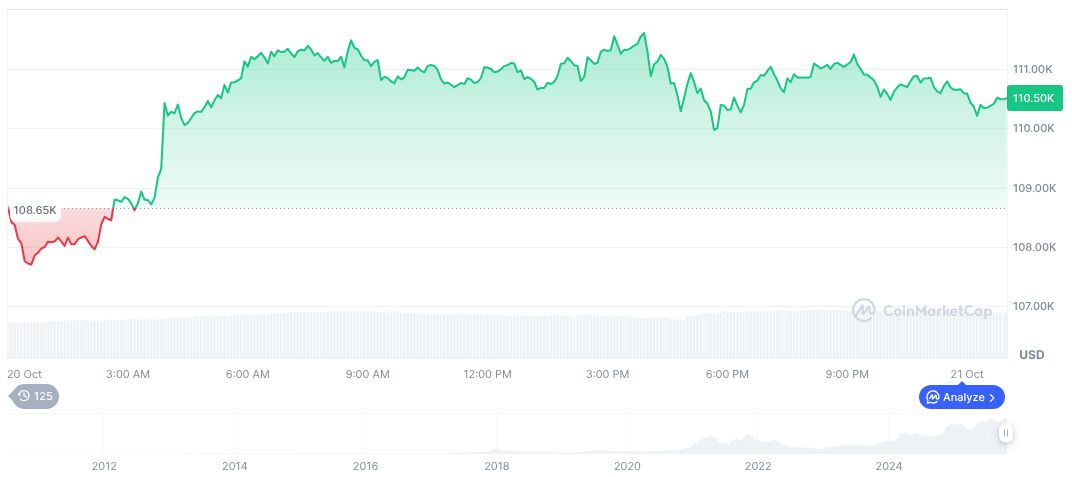

Bitcoin Trades Above $112k Amid Speculation, Volatility Rises

Did you know? Historically, Fed rate cuts have induced short-term crypto rallies, reflecting investors’ optimism about economic easing and liquidity. Such events frequently pave the path for significant market movements.

According to CoinMarketCap, Bitcoin’s current price is $112,841.40, with a market cap of 2.25 trillion and dominating 58.90% of the market. Its 24-hour trading volume soared by 48.88% to reach 78.92 billion, reflecting market volatility. Over 30 days, Bitcoin’s price decreased by 2.20%, showing fluctuating investor sentiment since the last Fed talks.

Insights from the Coincu research team suggest potential economic effects could include realignment of crypto assets and adjustments in institutional investment strategies. While precise outcomes remain uncertain, historical data indicate increased volatility could accompany further announcements or policy shifts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-october-rate-cut-speculation/