- Major US indices saw significant gains

- Cryptocurrency markets showed stability with no major changes

- Lack of official comments linking stock and crypto movements

On October 21, 2025, the US stock market saw gains with the Dow rising 1%, the S&P 500 increasing 1.09%, and the Nasdaq climbing 1.47%, according to market data.

Despite the stock market’s upward trajectory, no official crypto market responses were observed. However, significant on-chain movements and new listings were noted, reflecting potential indirect effects.

U.S. Indices Climb, Crypto Markets Remain Unchanged

The Dow Jones, S&P 500, and Nasdaq indices experienced growth, rising by 1%, 1.09%, and 1.47%, respectively, on October 21. This positive movement in the stock market occurred amidst a stable outlook in cryptocurrency markets, suggesting that major crypto projects did not experience parallel increases.

Despite this stock market performance, crypto leaders have not provided official comments or statements linking these movements to digital currencies. As tracked by exchanges and on-chain data, crypto projects, including notable market movers, maintained regular activity without new volatility signals.

Market observers noted a lack of public comments from major crypto figures regarding any ties between this stock rally and the crypto markets. Discussion forums reflected attention around Coinbase’s new listings and significant ETH transactions, but no consensus arose regarding any consequential impacts.

Regulatory Trends and Historical Context in Focus

Did you know? In earlier instances, significant stock market rallies have at times led to speculation in major cryptocurrencies, though verifiable causal links are rare.

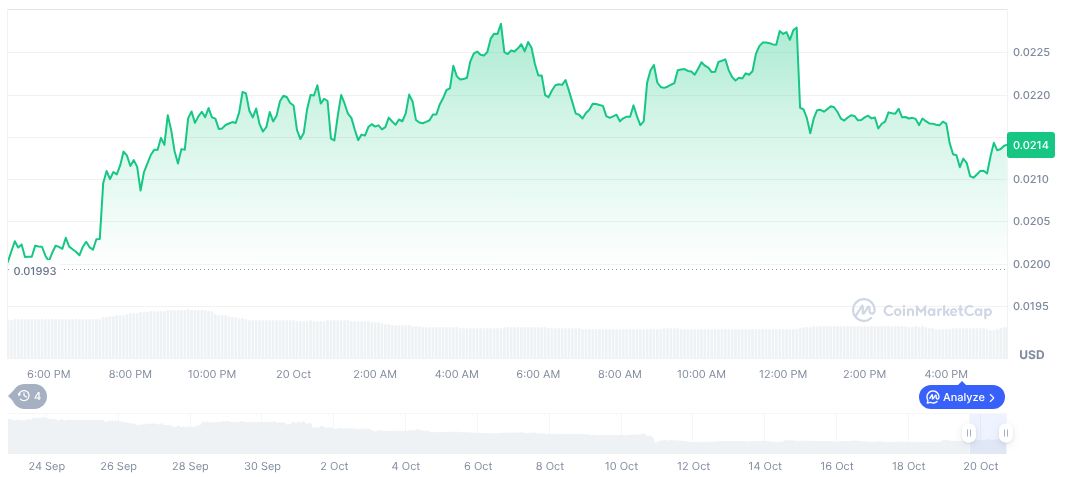

CoinMarketCap data recorded Nomina (NOM) with a current price of $0.02 and a market cap of approximately $62.05 million. The 24-hour trading volume marked a decline of 19.02%, while recent price trends indicate a 6.55% rise over the past day despite a continuing 61.47% decrease over the last three months, illustrating ongoing volatility.

Insights from Coincu suggest that regulatory trends continue to shape the financial landscape. Previous US policy shifts, particularly concerning interest rates, have indirectly influenced speculations in crypto markets. Current economic indicators and technological adoptions remain pivotal for forecasting future dynamics in this shared economic space.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-stock-crypto-market-stability/