Bitcoin’s latest correction has redrawn the battlefield between long-term and short-term investors. While long-term holders (LTH) remain comfortably in profit, short-term holders (STH) are once again struggling to stay afloat.

Recent on-chain data from Alphractal shows that LTHs continue to enjoy strong unrealized gains despite the market cooling near the $110,000 zone. In contrast, many short-term participants who entered late in the rally are sitting on unrealized losses – a classic mid-cycle tension that often defines market sentiment before major breakouts.

Resistance at $113K Could Decide the Next Move

According to analyst Joao Wedson, the $113,200 level is the key threshold to watch. A recovery above it could flip the short-term holder balance back into profit, potentially sparking renewed optimism across the market. However, that same level also serves as a profit-taking zone where LTHs might decide to sell, slowing any sustained move higher.

This delicate balance reflects the ongoing tug-of-war between conviction and caution – between those who have already secured gains and those still chasing them.

Long-Term Holders Stay Calm

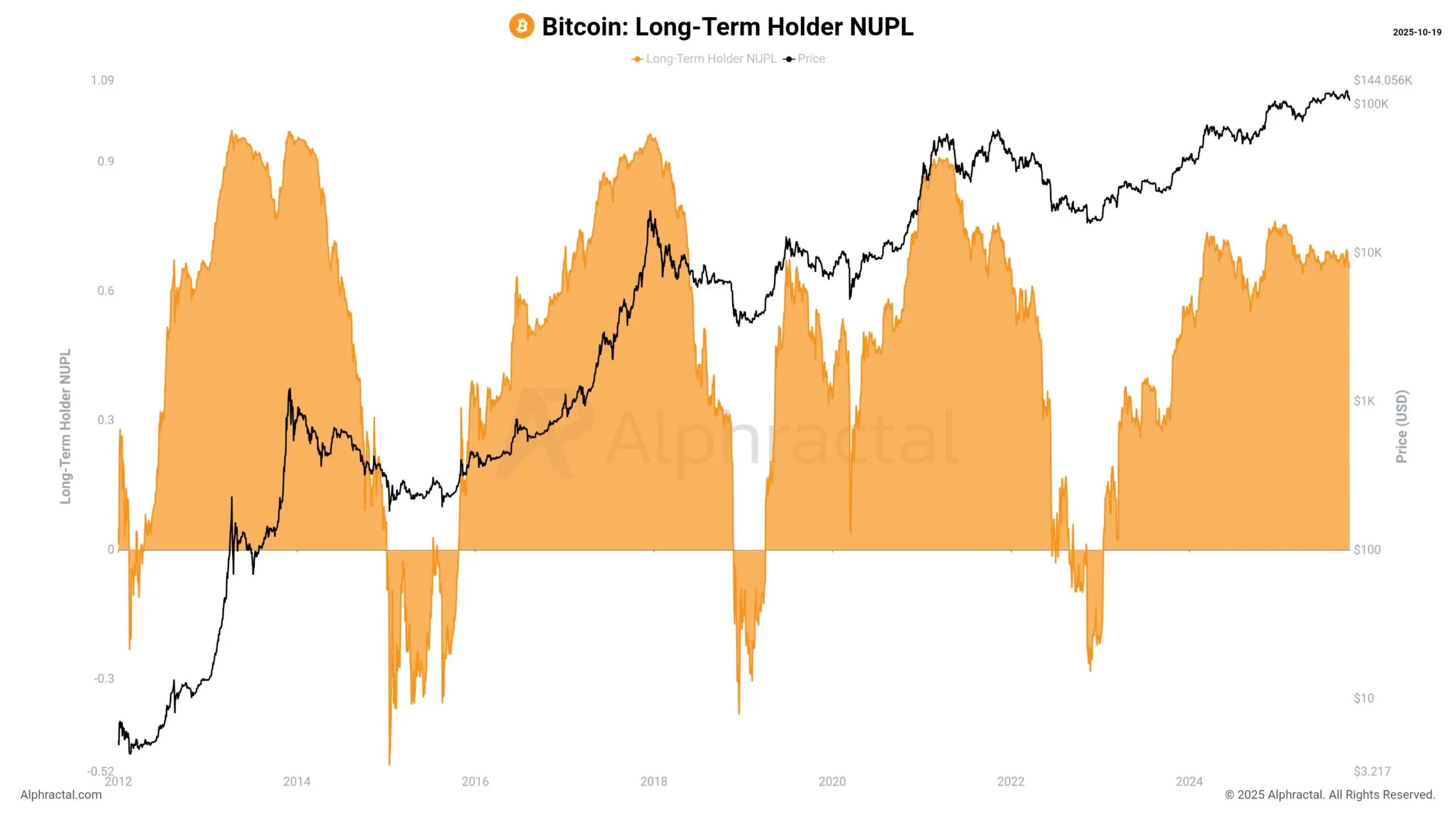

The Net Unrealized Profit/Loss (NUPL) for long-term investors continues to show a healthy margin. Historically, when LTH NUPL remains positive, the market tends to stay structurally bullish. Wedson notes that for these seasoned holders to start feeling real pressure, Bitcoin would need to plunge below $37,000 – a level far from current prices.

Simply put, the old guard is still holding strong, seemingly unmoved by short-term volatility.

For STHs, however, the picture is very different. The Short-Term Holder NUPL remains subdued, showing that many recent buyers are underwater. This aligns with the current Short-Term Holder Realized Price (STH RP), which hovers just above $100,000 – suggesting that until Bitcoin sustains levels above $113K, sentiment among this group will remain fragile.

Profit-Taking Dynamics Reveal Market Maturity

The LTH/STH SOPR Ratio – which compares profit-taking behavior between the two groups – has started to decline. This means long-term investors are reducing their selling activity, while short-term traders continue to exit positions whenever small profits appear.

Wedson describes this as a “late-cycle behavior” often seen before a final push to new highs. A similar setup occurred in late 2021, just before Bitcoin reached its previous all-time high.

A Market Split Between Patience and Hope

In Wedson’s view, long-term holders have already secured substantial profits during earlier peaks in March and December 2024, and again near this year’s all-time high. They’re now content to wait – perhaps even “enjoying time on a yacht,” as he puts it – while short-term participants nervously watch the charts, waiting for Bitcoin to break back above $113K.

The next few weeks could determine whether this patience continues to pay off or whether short-term optimism finally takes control.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

Source: https://coindoo.com/bitcoin-holders-at-crossroads-long-term-confidence-short-term-stress/