Key Takeaways

What is the market sentiment like right now?

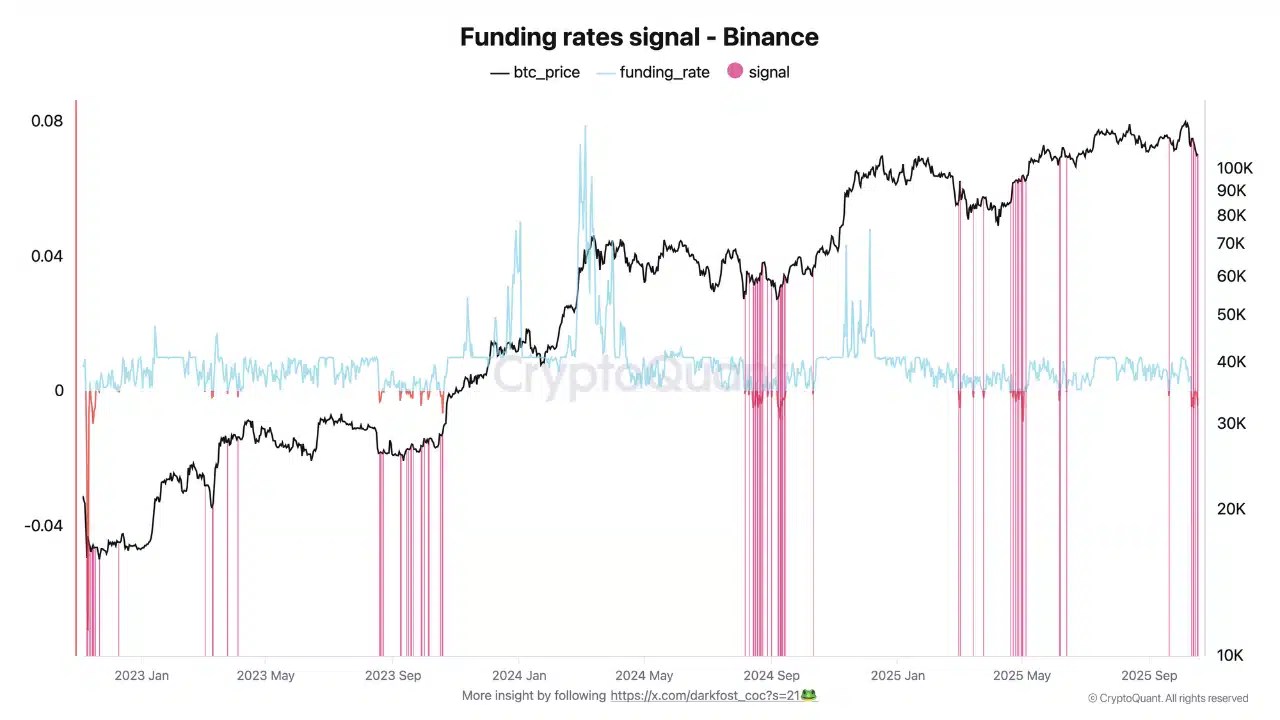

The negative Funding Rates showed that market participants were in disbelief of a potential Bitcoin rally. A short squeeze could drive prices to $116k or even higher.

Is the current price bounce accompanied by high demand?

It was too early to tell, but the trading volume in recent hours has been above average. The weakened selling pressure over the past two days also helped.

Is the Bitcoin [BTC] correction over? Over the past 24 hours, Bitcoin has rallied 3.9%, and at the time of writing, it was exchanging hands at $111,057.

Its climb past the short-term resistance zone at $108k was a good start to the week, if the bulls can keep this form going.

Source: CryptoQuant

The market could be in disbelief of a potential recovery. In a post on CryptoQuant Insights, analyst Darkfost noted that the BTC Funding Rates on Binance were negative.

It was a sign that short sellers were still leading the market.

Usually, after such a swift correction, the market continues to harbor doubt that a recovery is possible. This phase of disbelief is currently visible with the negative Funding Rates.

Ironically, in the derivatives market, this disbelief can fuel recovery.

A price move higher forces short sellers to get liquidated or close their positions at a loss, and these market buys give impetus to a higher price bounce. It would result in a short squeeze.

A rally to $113k, the closest magnetic zone of note, was already in the making. An explosive start to Monday could set a bullish tone for the rest of the week, potentially driving a rally to the next liquidity cluster at $126k.

What’s next for Bitcoin?

In a recent report, AMBCrypto pointed out that there were clues of a bullish reversal over the weekend.

The reduced inflow of BTC to Binance, combined with the price move past $108k, meant that a bounce to the $114k-$116.5k zone is likely in the coming days.

In the long term, the miners’ profitability, though moderate, meant that the overall selling pressure was slightly alleviated, and strengthened market dynamics.

Source: Axel Adler Jr on X

In a post on X, analyst Axel Adler Jr detailed how the market is still in a pullback mode. After the liquidation flush on the 10th of October, short relief bounces are possible.

A sustainable recovery would need steady inflows in the spot market, as well as a commensurate increase in Open Interest.

Source: https://ambcrypto.com/bitcoin-sellers-in-disbelief-heres-why-that-could-drive-a-short-squeeze/