Key Takeaways

What’s driving Mantle’s recent 11.79% surge?

Mantle [MNT] rallied on strong Spot and Futures demand, with whales buying 400K more tokens and retail traders boosting buy volume by $300K.

Can MNT sustain its gains above $1.9?

If buyers maintain momentum, Mantle could target $2.3, but rising profit-taking poses a risk of a pullback toward $1.59.

Since hitting a low of $1.51, Mantle [MNT] has recorded substantial gains for three consecutive days, hitting a high of $1.96.

At press time, Mantle was trading at $1.94, marking an 11.79% increase in 24 hours. Over the same window, the altcoin’s volume jumped 82% to $362 million, indicating growing on-chain activity.

But is this the start of something bigger?

Demand rebounds as sentiment shifts

Interestingly, as Mantle attempted a recovery following the recent dip, whales turned to selling. As such, the altcoin recorded more whale outflows than inflows for two consecutive days, per Nansen.

Source: Nansen

However, the past day saw a significant shift in whale behavior. Top holders increased their holdings by buying 2.7 million tokens, compared to 2.3 million in outflows.

As a result, top holders bought 400k more MNT, a clear sign of aggressive spot accumulation.

On top of that, retail traders took the dip as an opportunity to buy. As a result, the altcoin recorded a positive market delta for three consecutive days.

Source: Coinalyze

Over the past day, for example, Mantle saw $1.3 million in buy volume compared to $1.0 million in sell volume. As a result, the altcoin recorded a positive delta of 300k, indicating increased buying activity.

Buyers dominate Futures

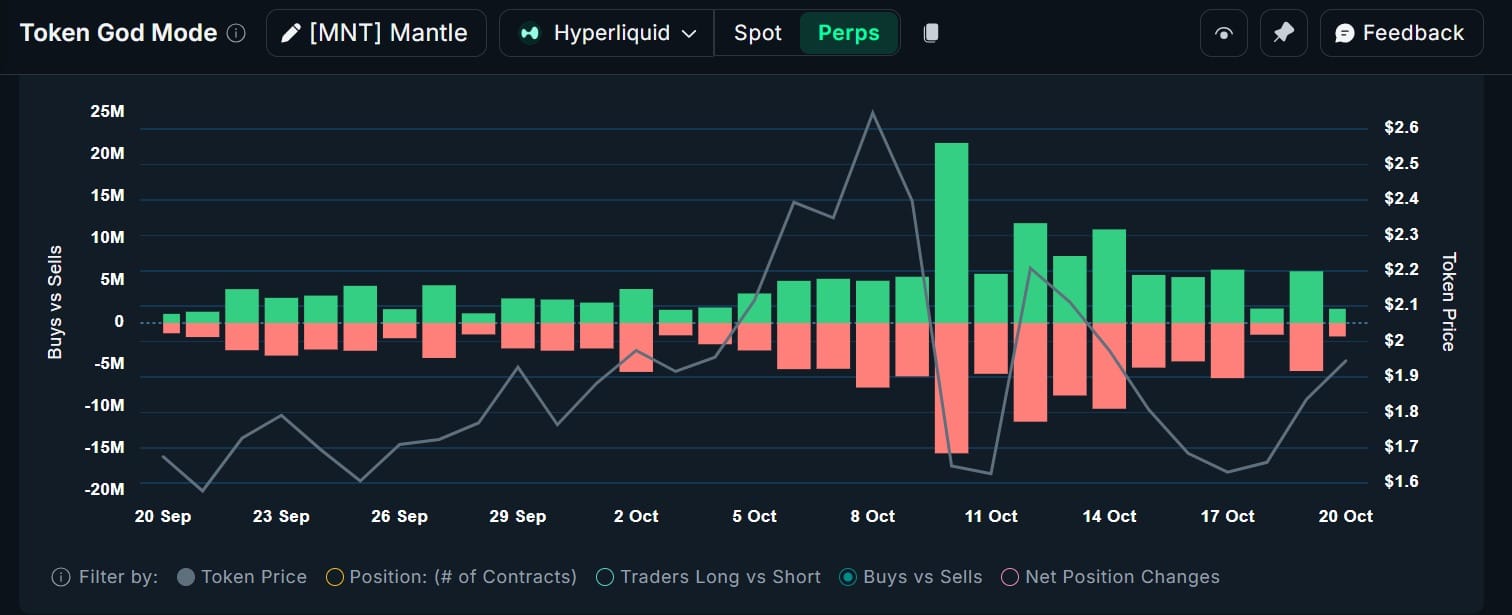

Significantly, with Mantle’s price recovery, more capital flowed into Hyperliquid as demand for Futures soared.

Over the past 24 hours, Mantle saw 6.93 million in contract buys, compared to 5.2 million in contract sells.

Source: Nansen

The altcoin also recorded a Positive Net Position Change of 1.7 million, indicating steady capital inflow into Futures.

Typically, when Futures record more contract buys, it suggests increased participation, with traders opening more positions.

Profit-takers pose a threat

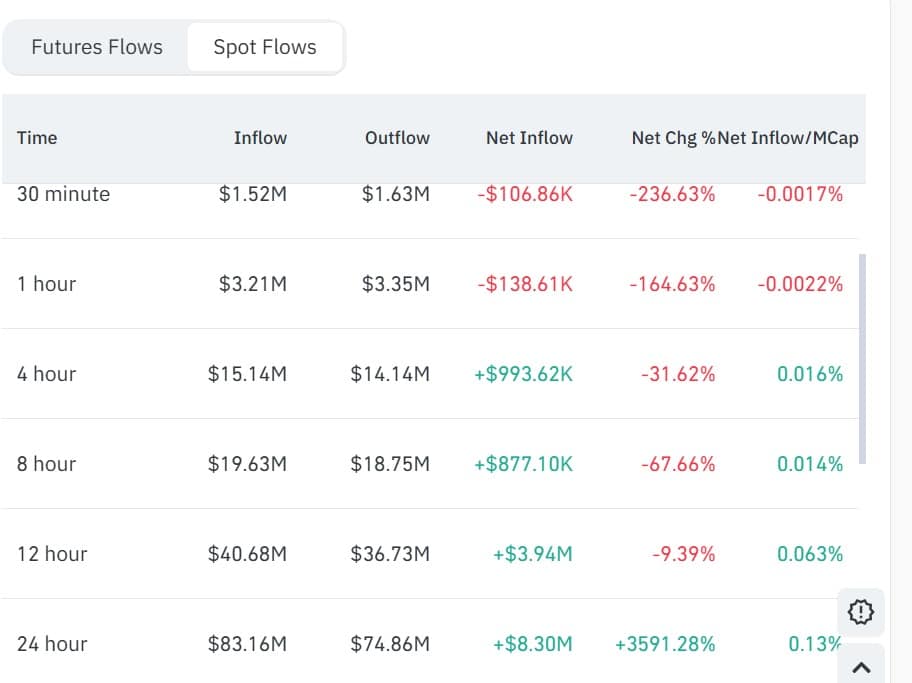

After MNT rebounded from the recent dip, holders rushed to cash out. According to CoinGlass, Mantle recorded a positive Spot Netflow for four consecutive days.

Source: CoinGlass

Over the past day, Mantle recorded $83.16 million in Spot Inflows compared to $74.86 million in outflows.

As a result, Spot Netflow surged 3591.28%, to $8.3 million, reflecting strong inflows, a clear sign of aggressive spot selling.

Historically, increased profit taking has preceded intense downward pressure, a prelude to lower prices.

Can MNT hold recent gains?

According to AMBCrypto, Mantle rebounded significantly as buyers dominated both the Spot and Futures markets.

As a result, the altcoin’s stochastic RSI jumped to 16, making a bullish crossover, indicating strengthening upward momentum. At the same time, its Relative Strength Index (RSI) rose to 51, touching the bullish zone.

Source: TradingView

If the demand holds, RSI will complete the crossover, validating the trend reversal. In doing so, the uptrend will continue, and MNT will target $2.3.

For this bullish outlook to hold, the altcoin must close above $1.9. However, sellers pose a threat to these gains, and if profit-taking intensifies, there could be a retracement to $1.59.

Source: https://ambcrypto.com/profit-takers-threaten-mantles-11-rally-will-mnt-fall/