Global stocks and crypto markets are bracing for the US CPI inflation data release this Friday. The CPI data could significantly raise volatility and uncertainty in the crypto market and impact the upcoming Fed rate cut. Investors are also closely monitoring upcoming trade talks between the United States and China.

The “Unusual” CPI Release During the US Government Shutdown

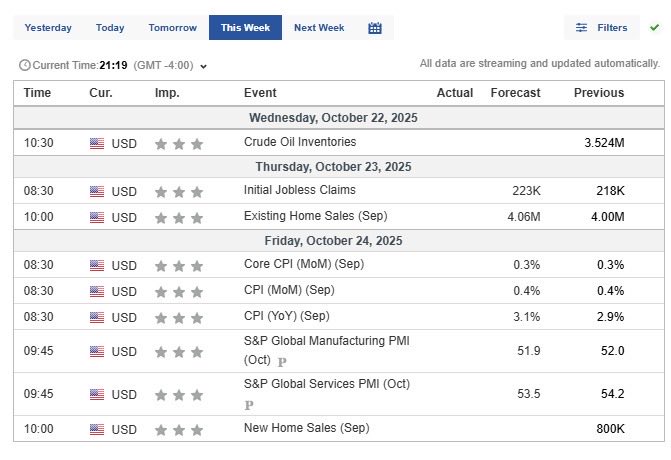

Despite the government shutdown, the U.S. Department of Labor (DOL) earlier confirmed that it’s calling back some staff to release the US CPI inflation data. The release was postponed for another week and scheduled for October 24.

The Kobeissi Letter quoted the release as “unusual” because it comes 5 days before the expected October 29 Fed rate cut. Also, it is the first time CPI data will be reported on a Friday since January 2018.

Notably, the Labor Department said that no other economic data releases will be rescheduled or produced until the government shutdown ends. This comes at a time when the Fed officials remain mixed on further Fed rate cuts amid sticky inflation. However, Fed Chair Jerome Powell signaled another 25 bps rate cut.

Markets are positioned bullish amid a lack of key economic reports. The CME FedWatch Tool also indicates high probabilities for a 50-bps rate cut in total this year, despite rising uncertainty and volatility.

If the headline CPI inflation comes in hot at 3.1% or above, the FOMC could decide to hold current rates. If CPI cools, this could indicate economic weakness. With signs of credit stress renewed after Western Alliance and Zions bad loans, Strike CEO Jack Mallers sees Bitcoin and the crypto market recovery.

Crypto Market Rebounds

The broader crypto market saw a much-anticipated bounce, with gold prices falling after hitting an ATH of $4,375. This happened after Donald Trump’s cooled China tariff fears in the global markets. Data shows Bitcoin short squeeze likely amid speculation of “bullish” CPI, with investors speculating another Fed rate cut.

Meanwhile, Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng are set to meet this week in an effort to further calm tensions ahead of a possible Trump-Xi meeting later this month.

Bitcoin price jumped more than 3%, with the price currently trading at $$111,049. The 24-hour low and high were $107,407 and $111,596, respectively. Furthermore, the trading volume has increased by 75% in the last 24 hours, indicating a massive rise in interest among traders.

Ethereum rebounded above $4,000 level, while BNB and XRP climbed almost 3% and 4.50% in the last 24 hours. Coinglass data indicates massive buying in the derivatives market.

Analyst Ted Pillows pointed out that BTC price is holding, but broader sentiment remains cautious. The next crucial level to reclaim is $112,000, which could push Bitcoin higher. He believes the crypto market could rally more as the US-China trade tensions ease.