In Brief

- DOGE holds $0.18–$0.21 support with upside targets at $0.29, $0.45, and $0.86.

- RSI and price action confirm breakout signals across 4H and daily timeframes.

- 21Shares files for DOGE ETF; DTCC listing completed as approval odds near 99%.

Dogecoin (DOGE) is trading around $0.20056 at press time, after bouncing off ascending channel support. The token has gained 2.71% in the last 24 hours, signaling early bullish momentum following recent consolidation.

Crypto analyst Ali noted that DOGE continues to form higher lows since mid-2023, suggesting a gradual uptrend through late 2025 into 2026. He also identified key resistance targets at $0.29, $0.45, and a long-term extension near $0.86.

On shorter timeframes, Trader Tardigrade highlighted a bullish breakout on the 4-hour chart supported by an inverse head and shoulders pattern on the RSI. This move suggests growing momentum as DOGE approaches the previous high near $0.21.

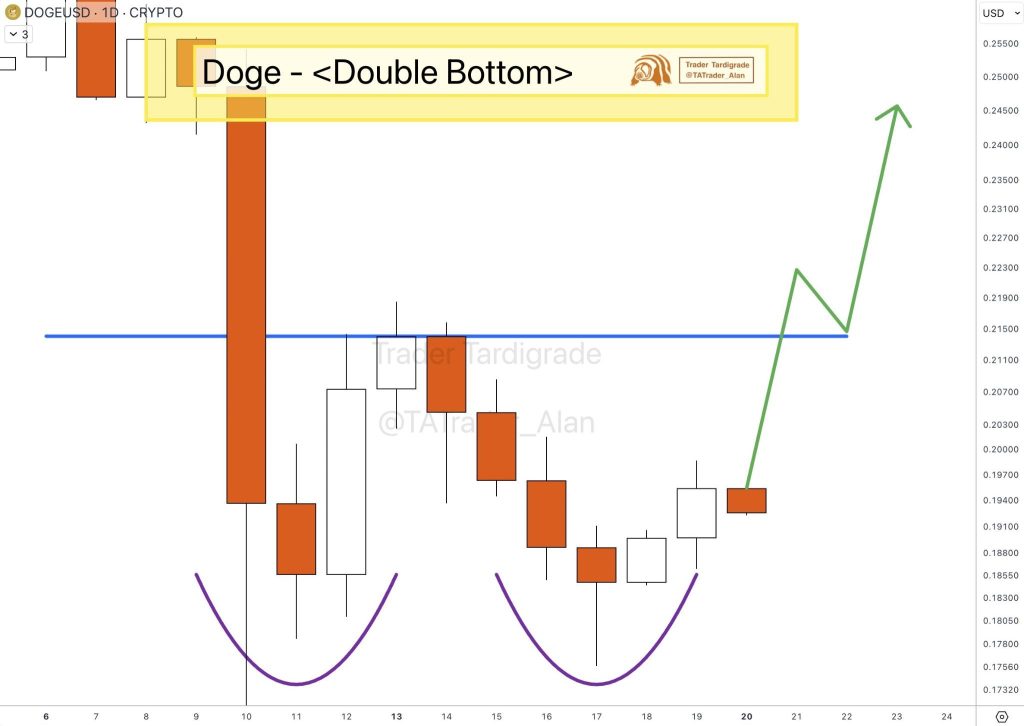

He also observed a double bottom pattern on the daily timeframe, indicating strong support between $0.17 and $0.18. A confirmed breakout above the neckline at $0.215 could drive DOGE toward $0.24 or higher if buying pressure increases.

If DOGE sustains its position above the $0.18–$0.21 zone, analysts expect continued movement toward upper channel resistance in the coming months. Failure to hold this level may trigger a retest of $0.16 before any further upside.

ETF Progress and Market Sentiment Boost Outlook

Dogecoin sentiment is improving further with new institutional interest emerging from 21Shares’ amended S-1 filing to launch the TDOG ETF. The proposed exchange-traded fund will track Dogecoin price performance and trade on Nasdaq.

Coinbase Custody will secure the assets, while 21Shares US LLC will seed the fund with $1.5 million in DOGE at launch. The ETF structure includes Wilmington Trust as trustee, Foreside Global Services as marketing agent, and Cohen & Company as the accounting firm.

The ETF recently secured DTCC listing, while Bloomberg analysts estimate a 99% approval probability amid updated filings. This development increases institutional exposure and reinforces growing confidence in DOGE’s role in the market.

Dogecoin’s technical signals, combined with rising ETF momentum, suggest continued bullish potential if current price levels hold.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/doge/dogecoin-rebounds-from-support-targets/