- Ethereum’s potential surge to $4,500 hinges on bullish patterns.

- ETH forms bullish flag, signals possible continued upward trend.

- Institutional interest critical to Ethereum’s price momentum.

Ethereum could experience a substantial price rally to $4,500 by late October, driven by bullish market patterns and institutional investor interest, reports suggest.

This potential price surge underscores investor confidence in Ethereum’s future, indicating broader market implications for cryptocurrencies amid sustained financial interest and technical advancements.

Ethereum Nears $4,500 Amid Bullish Indicators

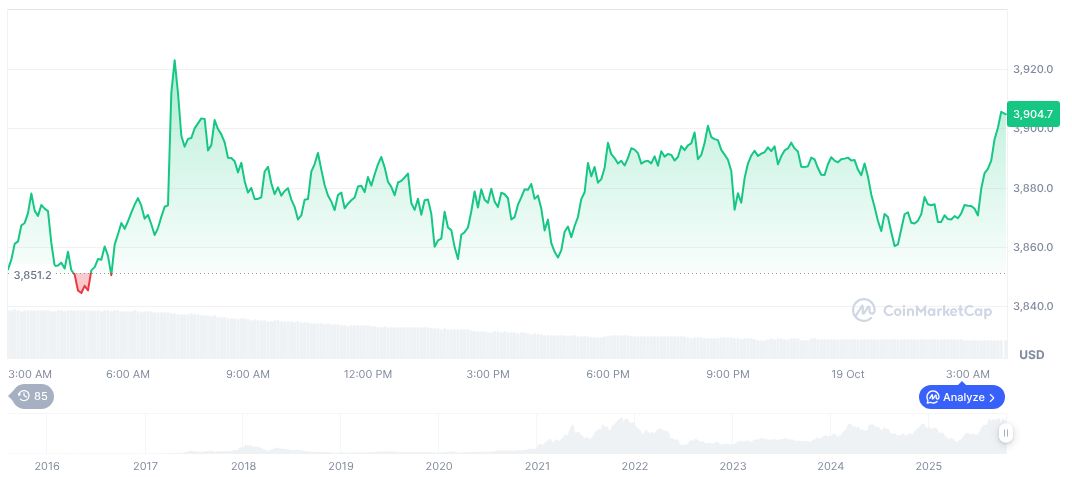

Ethereum appears poised for a potential price rise following a bullish flag pattern, signaling ongoing recovery. ETH maintains its position above the weekly bull market support band, indicating possibilities for achieving $4,500 before possibly peaking at $5,200. If ETH crosses the upper limit of the channel, between $4,450 and $4,500, a significant price rally might occur. Conversely, a breach below $3,550 could imply declines for Ethereum, signaling crucial resistance levels.

Market reactions have been varied, with analysts closely monitoring Ethereum’s price movements. Cointelegraph suggests that speculation around institutional demand and related ETFs plays a significant role in shaping Ethereum’s near-term prospects. However, critical commentary from figures like Vitalik Buterin remains absent in the current analysis. As Vitalik Buterin remarked, “As we continue to upgrade the Ethereum network, it’s crucial to remain focused on our long-term vision while responding to short-term market fluctuations.” This leaves interpretations largely in the hands of the broader investment community.

Historical Trends and Institutional Influence on Ethereum’s Price

Did you know? Ethereum’s 2022 Merge was a pivotal factor in shaping its price dynamics, echoing current trends as technical upgrades often coincide with bullish momentum in the crypto market.

The Coincu research team anticipates that Ethereum’s rally may attract increased regulatory scrutiny, alongside technical developments possibly transforming ETH’s network scalability and security. As Ethereum progresses, institutional demand and regulatory clarity remain pivotal factors impacting its valuation and acceptance.

Ethereum (ETH) currently trades at $3,991.08 with a market cap of $469.98 billion, representing a 12.78% market dominance. Despite a 24-hour trading volume decline of 20.51% to $27.37 billion, ETH gained 3.27% in 24 hours and 4.22% over seven days, though down by 12.14% for the 30-day period.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/ethereum-price-target-bullish-october/