Key Takeaways

What do the addresses depositing BTC signify?

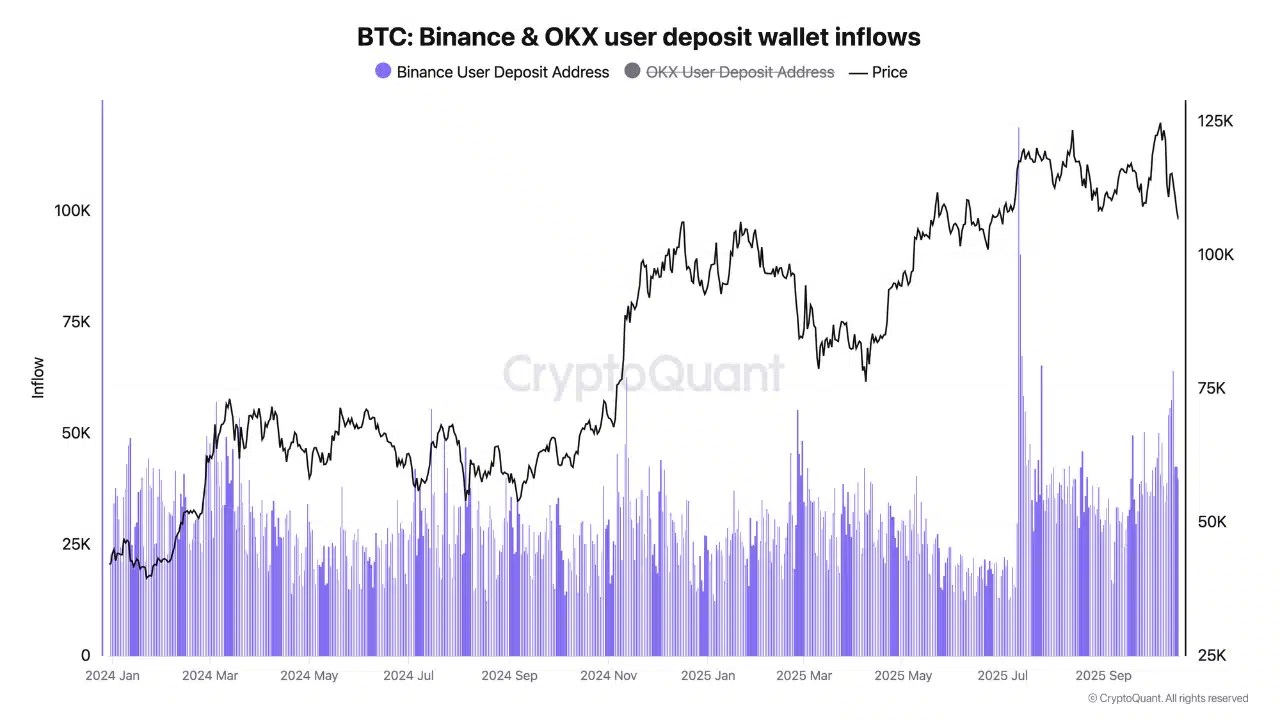

The spike to 64k Active Addresses sending BTC to Binance on the 14th of October signified increased selling, but this number has begun to fall.

Is the short-term outlook bullish or bearish?

Based on the evidence at hand, the outlook remains bearish. There are clues of a bullish reversal, but traders need to wait a while before betting on a price recovery.

The number of Active Addresses sending Bitcoin [BTC] to Binance increased dramatically last week as BTC toppled from $121.5k to $102k within a day on Friday, the 10th of October.

Bitcoin inflows ease as volatility cools

According to CryptoQuant, between 54,300 and 57,780 unique addresses deposited BTC in the following days.

Source: CryptoQuant

In fact, in a post on CryptoQuant Insights, analyst Darkfost noted that the 14th of October saw 64,000 unique addresses deposit Bitcoin.

The last time such heavy inflows were seen was in July, when BTC crossed the $120k mark.

This spike in Exchange Inflows pointed to panic-driven selling and short-term capitulation, deepening volatility as BTC slid under $108K.

However, on the 18th of October, the number of Active Addresses depositing Bitcoin reduced to 30,850. This gradual drop showed reduced selling pressure and suggested that the market could be finding its new equilibrium.

Decoding the short-term BTC expectations

Source: CoinGlass

Traders and investors should be careful of betting on a BTC bullish rebound. They should be doubly careful that they don’t bet on such a move early.

Because the Liquidation Heatmap of the past two weeks showed that the price compression of the past 36 hours saw liquidation levels build up at $108k and $106.2k.

On top of that, higher zones at $114K and $116.5K were filled with leveraged positions, making them potential magnet levels for price rebounds if BTC breaks above $108K.

Hence, traders would want to see a move beyond $108k, as this would increase the chances of further price moves higher to the liquidity clusters overhead.

A recent AMBCrypto report highlighted why a rally to $117k was possible.

Recently, there was a surge in China’s M2 money supply. It has a positive correlation with Bitcoin price movements, and the leading crypto could be a beneficiary once again.

The Spot ETF Flows were negative to close out the previous week, showing bearish sentiment. The ETF capital flow could help signal a potential change in public sentiment if it turns positive.

Source: https://ambcrypto.com/panic-then-pause-bitcoin-inflows-collapse-by-half-what-this-means-for-117k/