Key Takeaways

What caused Astra Nova to crash 65%?

18 wallets linked to hackers dumped 890 million RVV tokens worth $10.66 million following the Binance Alpha listing.

Can RVV recover from this crash?

Recovery depends on security fixes and the team’s token buyback program.

Astra Nova [RVV] surged to a new all-time high of $0.03 after its listing on Binance Alpha, before recording a sharp drop.

In fact, as of this writing, Astra Nova was trading at $0.0105, marking a 65.5% decline in 24 hours. At the same time, its market cap dropped 65%, to $10 million, reflecting massive capital outflow.

But what triggered this drop?

18 Astra Nova wallets dump 890 million RVV

Surprisingly, after getting listed on Binance Alpha, some Astra Nova investors made a coordinated exit from the market.

According to Lookonchain, after listing on Binance, 18 wallets abnormally dumped 890 million RVV worth $10.66 million.

Source: Lookonchain

Some of these tokens are worth $8.4 million to Gate and Kucoin, indicating a coordinated market exit.

While these transfers have resulted in insider trader exit, the Astra Nova Team has accused a malicious attack.

A malicious attack

According to the Astra Nova team, after the launch, the team’s MM account (third party) was hacked, and hackers gained control.

These hackers began selling assets from 18 wallets linked to the account. Despite the hacking, the team remained defiant, positing that the chains, smart contracts and infrastructure remain secure.

However, they promised to use on-chain forensics and also law enforcement to retrieve the lost funds.

Team launches buyback program

Following a widespread community backlash, the team launched a token buyback program to support affected customers.

Through the program, the team will repurchase the same amount of tokens directly from the open market.

At the same time, forensic teams that help to recover the lost funds will walk away with 10% of the lost funds.

According to the team, this initiative reflects the firm’s commitment to protect holders, stabilising liquidity and reinforcing investor confidence.

The team added that,

“We’re here for the community, transparent, accountable, and stronger than ever.”

How did the event effect RVV?

Significantly, after these events, investors panicked and started exiting the market, resulting in a price crash.

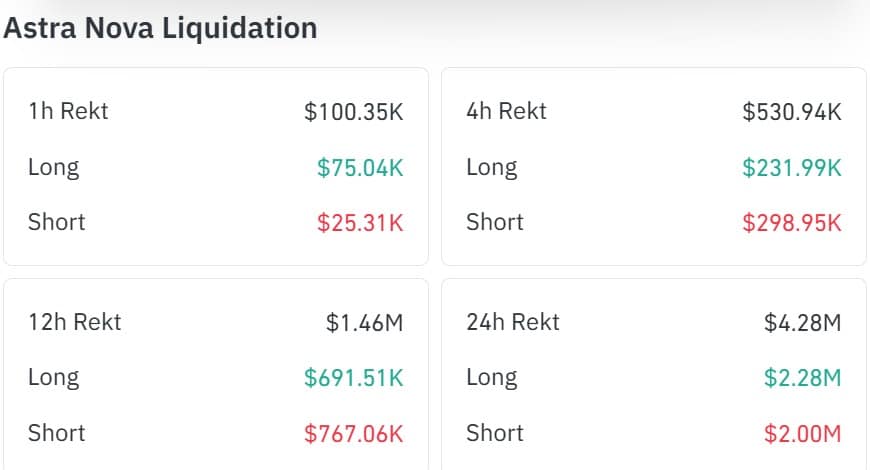

For that reason, positions liquidated in the Futures market skyrocketed. In fact, over the past 24 hours, total liquidations reached $4.28 million.

Source: CoinGlass

Amid these, $2.28 million worth of long positions were liquidated, while $2 million worth of shorts were liquidated.

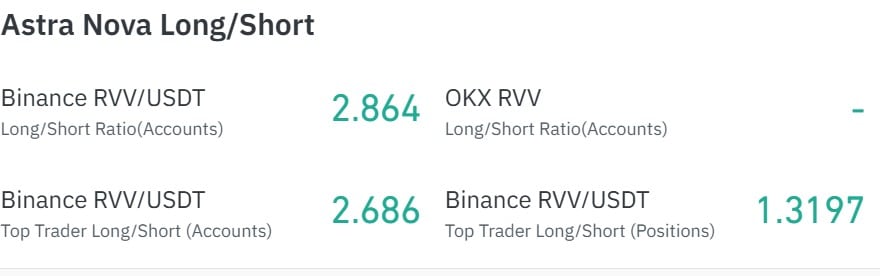

Strangely, despite declining prices and rising liquidations, investors on Binance and OKX are taking long positions.

According to CoinGlass, Long Short Ratio has remained above 2.0, with 2.8 on Binance and 2.6 for top trader accounts.

Typically, when most traders take long positions, it signals bullishness as they anticipate prices to rebound.

Source: CoinGlass

Can RVV recover?

The prevailing market conditions pose a risk for more losses on RVV price charts. If the current trend persists, RVV will breach $0.01 and drop to $0.0093.

However, if the security threat is effectively addressed and the buyback program boosts demand, RVV could recover and target $0.012.

Source: https://ambcrypto.com/18-wallets-dump-astra-nova-are-hackers-behind-rvvs-65-crash/