- Paul Chan highlights the role of digital assets in global finance forums.

- Emphasizes the importance of stablecoins in cross-border settlements.

- Calls for international cooperation to manage digital asset risks.

Paul Chan Mo-po, Hong Kong’s Financial Secretary, highlighted on October 19 the expanding influence of digital assets at international financial meetings, emphasizing extensive uses in regional trade.

Such measures signify a global shift towards digital finance, potentially offering enhanced efficiency in cross-border transactions while ensuring stability amid the rapid evolution of fintech.

Paul Chan Highlights Stablecoin Importance in Global Finance

Paul Chan’s address at the annual meetings of the International Monetary Fund and the World Bank Group drew attention to digital assets’ rapid growth. He noted the significant potential of stablecoins in improving cross-border settlement efficiency and addressing regional trade barriers. Hong Kong as a vibrant digital asset market, financial secretary says.

Financial leaders like Chan are advocating for global cooperation to manage risks associated with digital assets. He emphasized the importance of a cautious approach, reinforcing the need for international standards to protect financial stability.

“Digital assets hold great development potential with significance to fintech. Through the adoption of blockchain technology, more efficient financial transactions at a lower cost can be realised to bring in more inclusive financial services.” — Paul Chan Mo-po, Financial Secretary, Hong Kong SAR

Global Cooperation Urged to Address Digital Asset Risks

Did you know? Increased cross-border settlements via stablecoins could transform Hong Kong’s infrastructure, mirroring initiatives seen in the past decades’ economic booms.

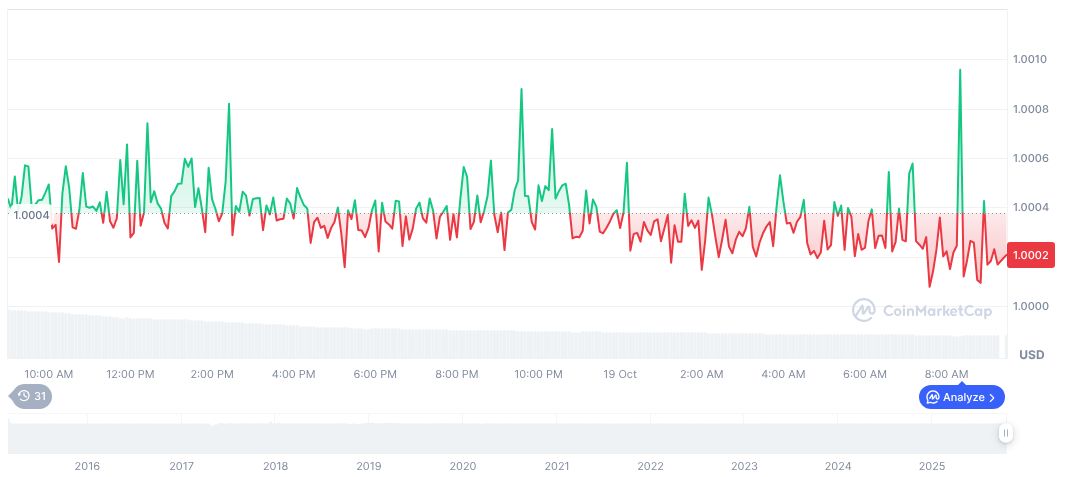

Tether USDt currently holds a strong position with a market cap of $181.91 billion, according to CoinMarketCap. The cryptocurrency maintains a price of $1.00 with a daily trading volume of $81.49 billion—a 50.32% decrease. Despite this, its market presence remains stable with minimal recent fluctuations.

Coincu’s research team notes that Hong Kong’s proactive steps towards integrating digital assets could set a precedent globally. Strengthening international partnerships and regulatory frameworks supports financial innovation while ensuring market integrity.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-digital-assets-global-forum/