Key takeaways

Is Bitcoin headed for a new all-time high?

Possibly. Cycle models show BTC could top out between $143K and $146K if re-accumulation continues.

Why are traders shorting while Bitcoin supply keeps dropping?

Despite heavy shorting in Futures, LTHs are accumulating, draining BTC from exchanges with the chance of a possible squeeze.

Bitcoin [BTC] is giving off mixed signals.

Traders are betting against it, with Open Interest (OI) up 30% and Funding Rates deeply negative. But LTHs aren’t selling.

Since January, BTC supply on exchanges and OTC desks has dropped from 4.5 million to 3.1 million. Despite new highs, people are still buying, and some analysts say Bitcoin could reach $143K to $146K this cycle.

Leverage ramps up as shorts crowd in

Source: CryptoQuant

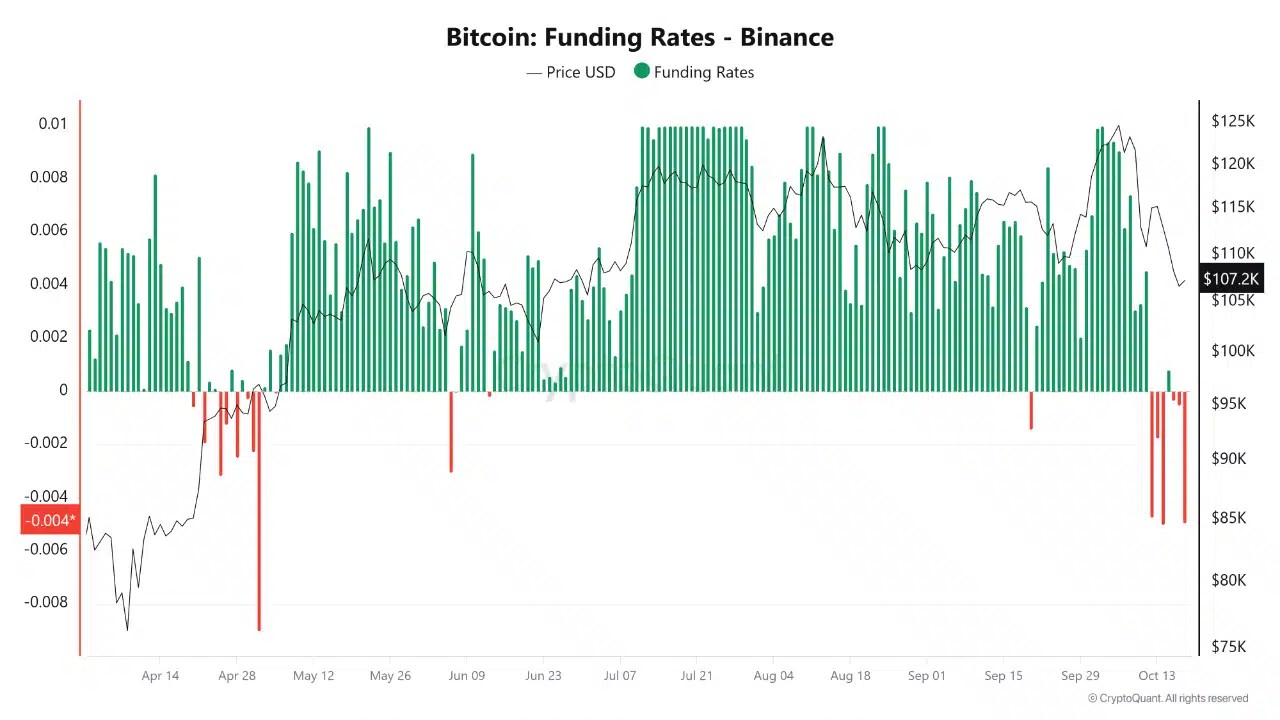

Over the past week, OI on Binance jumped by more than 30%, making it one of the steepest climbs in recent months. At the same time, Funding Rates turned negative, indicating a surge in short positions.

Source: CryptoQuant

In simple terms, traders are heavily betting against the market, expecting prices to fall. But usually, when funding gets this bearish and leverage piles in, it often makes way for a short squeeze.

This would force bearish traders to buy back in.

Supply dries up

BTC is vanishing from exchanges and OTC desks at a rapid pace: supply has dropped from 4.5 million to just 3.1 million coins since January 2024.

Source: CryptoQuant

That’s a big shift.

Miners aren’t selling, and LTHs won’t budge, even as prices break into new highs. Unlike past cycles, there’s no rush to take profits. Instead, BTC is being pulled into cold storage.

Where’s the top?

According to Joao Wedson, CEO of Alphractal, Bitcoin’s current price action still fits within its long-term cycle structure.

If BTC is in a re-accumulation phase, Wedson projects the top of this cycle between $143,700 and $146,300, consistent with historical performance decay across previous cycles.

Source: Alphractal

However, if recent highs around $126K marked a distribution phase, the cycle top may already be in. Still, Wedson notes that,

“The data isn’t acting like we’ve topped…”

Time will soon tell which narrative plays out.

Source: https://ambcrypto.com/is-the-bitcoin-top-in-analyst-says-not-yet-heres-why/