- Trump announces 100% tariff on Chinese goods, potential market impacts.

- Stock futures rise following negotiation news.

- Crypto markets exhibit typical risk-off behavior.

On October 17, 2025, U.S. President Donald Trump announced the potential elimination of recent high tariffs on China, sparking a brief rally in U.S. stock index futures.

The announcement’s impact signaled a potential de-escalation in U.S.-China trade tensions, affecting both stock markets and possibly influencing cryptocurrency markets amid geopolitical uncertainty.

U.S.-China Trade Tensions Escalate with New Tariff Announcement

Donald Trump announced a new 100% tariff on Chinese goods starting November 1, 2025. The move comes as China imposes export restrictions on key materials like rare earths. Trump, speaking in a FOX Business interview, described the tariff decision as unavoidable.

The U.S. stock market reacted positively to Trump’s comments. The Nasdaq futures narrowed their decline to 0.7%, reflecting optimism about potential negotiation progress.

“I think we’re going to do fine with China…But we have to have a fair deal. It’s gotta be fair.” – Donald Trump, President, United States

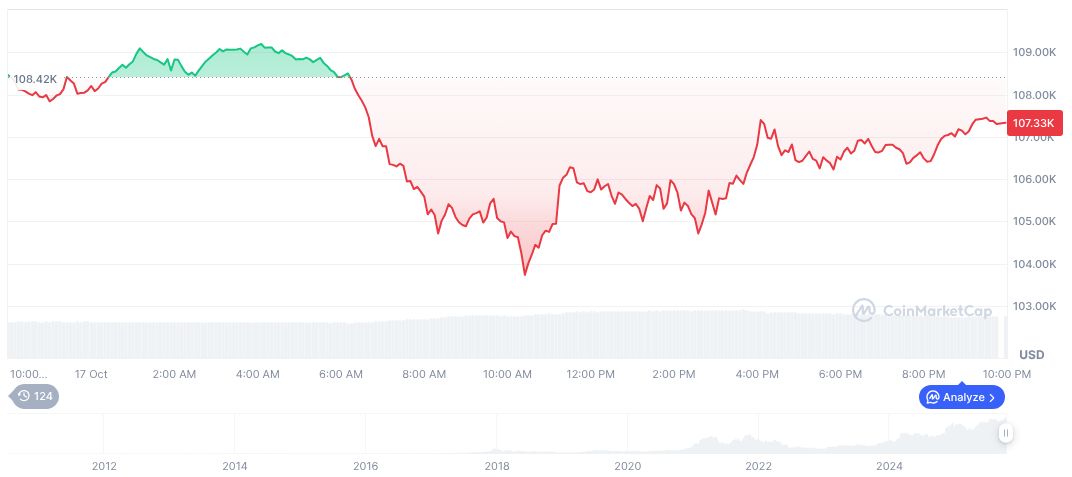

Bitcoin Reaches $107K Amid Volatile Market Conditions

Did you know? Tariffs have been used historically as a tool for economic negotiation between countries.

Bitcoin’s current price stands at $107,423.48 with a market cap of 2.14 trillion dollars, as per CoinMarketCap. It dominates 58.99% of the market with a 24-hour trading volume showing a 17.98% change. In the last 90 days, Bitcoin has suffered price declines, with a 24-hour drop of 0.92%.

For further insights into the potential ramifications of these trade measures, refer to the Yale research on U.S. tariffs.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-tariff-market-impact-2025/