- Tether freezes 13.4 million USDT across Ethereum and TRON due to flagged addresses.

- Immediate market impact is minimal with historical quick recovery patterns.

- Official reactions focus on compliance and illicit use prevention.

Tether Holdings Limited froze 13.4 million USDT across 22 Ethereum and TRON addresses on October 16, 2025, as detected by MistTrack’s blockchain monitoring platform.

This freeze emphasizes ongoing efforts to combat illicit financial activities, impacting USDT liquidity and potentially influencing market perceptions temporarily.

MistTrack’s Alert Triggers Crypto Market Observations

MistTrack’s monitoring identified the addresses, with 10.3 million USDT frozen at Ethereum addresses beginning with 0xecbd and 1.4 million USDT at TRON addresses starting with TYzDe. MistTrack’s public alerts on X (Twitter) and Telegram informed the community about the frozen addresses.

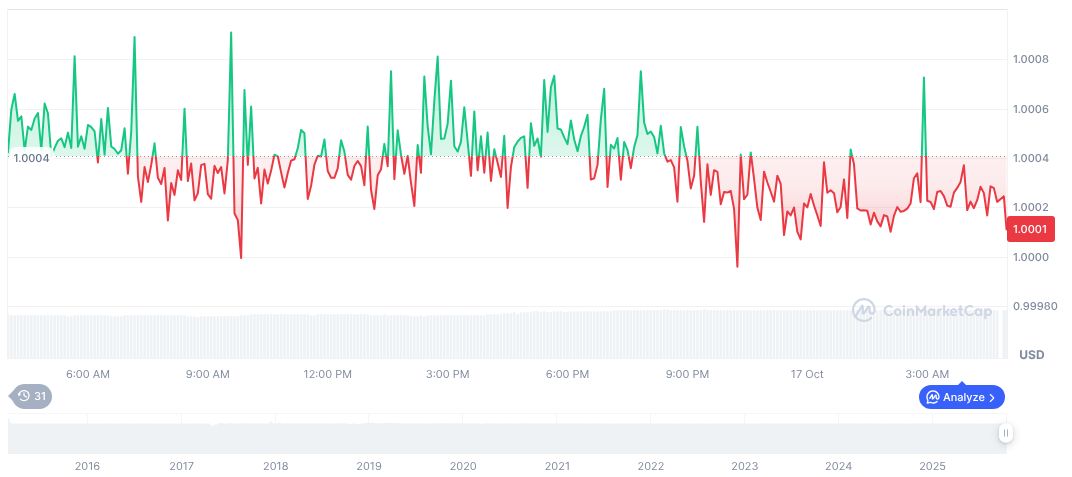

In the cryptocurrency landscape, temporary liquidity constraints and minor disruptions might affect the pairs involving USDT, ETH, and TRX. However, previous freezes show that market sentiment tends to stabilize swiftly. Currently, no immediate significant impacts on the value of USDT are evident.

“On Oct 16, Tether froze 22 addresses across Ethereum and TRON, totaling 13,408,649 USDT” — MistTrack, Blockchain Analytics Platform

Despite the absence of direct comments from Tether executives, historical regulatory compliance emphasis remains a guiding principle for such moves. Statements from cryptocurrency observers highlight aforementioned patterns, with cautionary vigilance for potential traders being recommended based on MistTrack’s alerts.

Historical Context, Price Data, and Expert Insights

Did you know? In Tether’s history of freezing suspected illicit USDT movements, market reactions generally involve brief volatility, followed by quick normalization, highlighting the asset’s resilience under regulatory actions.

Recently updated on October 17, 2025, via CoinMarketCap, Tether USDt (USDT) retains a price point of $1.00, holding a market cap of $181.37 billion, with dominance at 4.92%. Trading volume over the past 24 hours was $180.83 billion, showing a 10.05% shift. Daily volatility remains minimal, with prices showing negligible movements over extended periods.

Coincu Research highlights that technological advancements and regulatory measures will likely guide USDT’s role in financial systems. Historical patterns suggest market steadiness in response to these actions, reinforcing Tether‘s strategic alignment with global regulatory expectations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/tether-freezes-usdt-ethereum-tron/