Arthur Hayes has projected that the Ethereum price could 2.5x before the end of the year. This comes amid massive on-chain accumulation by BitMine, which has just expanded its ETH treasury by over $417 million.

Arthur Hayes Stands by $10,000 Ethereum Prediction

In a recent appearance on the Bankless podcast, Arthur Hayes, co-founder of BitMEX, reiterated his belief that Ethereum is far from reaching its peak this cycle. Hayes said he remains committed to his $10,000 target. This describes the recent price volatility as mere “background noise” within a broader bullish uptrend.

$200–$250k BTC and $10–$12k ETH by year-end?

Tom Lee ( @fundstrat ) and Arthur Hayes ( @CryptoHayes ) share their price predictions, and why they think ETH could do a 2.5x in just 2 months.

2 Legends. Same ballpark. Are we ready for these levels by Dec 31? 👀 pic.twitter.com/DaMuzO2LdE

— Bankless (@BanklessHQ) October 14, 2025

Arthur Hayes went further, likening the token to a decentralized version of Nvidia or AWS. He emphasized that it provides the computational infrastructure for decentralized finance, AI-powered applications, and even institutional financial settlement.

He had made an ETH bullish projection in August, stating the token could go as high as $20,000.

Speaking in the same podcast, BitMine chairman Tom Lee projected that the token could reach between $10,000 and $12,000 by the end of 2025. Lee argued that the recent breakout from the altcoin’s four-year accumulation range signals the start of a new price discovery phase.

He highlighted that a mix of companies adopting the token, clear regulations, and government interest will help the token grow. Lee described ETH as a protocol that is neutral and resistant to censorship, which he believes will attract institutional investors looking for long-term investments.

Analyst Michaël van de Poppe also noted that the ETH/BTC pair movements resemble the early stages of previous upcycles. He said, “It’s just beginning, there’s much more upside ahead.”

BitMine Expands ETH Holdings by $417 Million

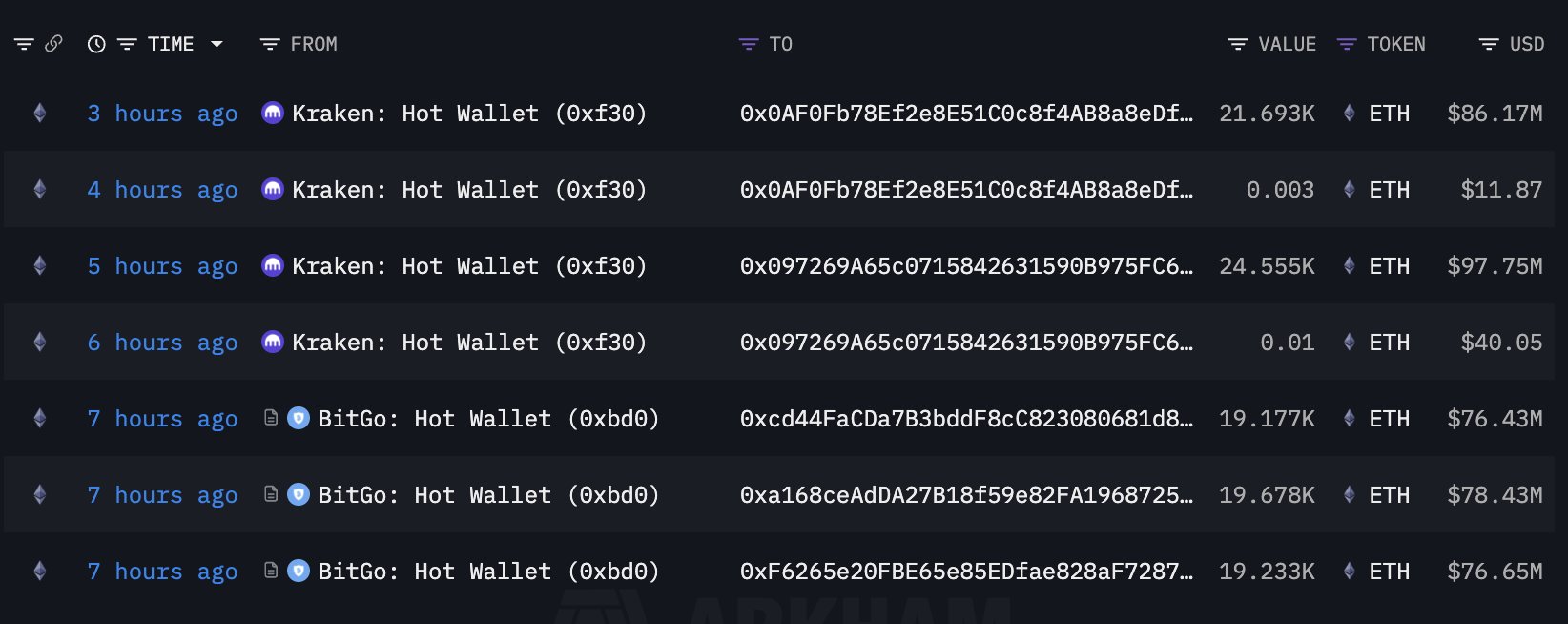

Meanwhile, BitMine continues to strengthen its position in the token’s ecosystem. According to on-chain data from Lookonchain, the company added 104,336 tokens worth roughly $417 million to its corporate treasury in a single day. The tokens were moved from Kraken and BitGo into three new wallets as part of an accumulation strategy.

With this purchase, BitMine’s total holdings now exceed 3.03 million tokens, equivalent to more than 2.5% of the entire supply. Just a week earlier, BitMine bought Ethereum worth $103 million. This showed consistent confidence even as the token’s prices faced short-term pressure from broader macroeconomic uncertainty.

This comes as institutional adoption of the token has reached an all-time high. Treasuries and exchange-traded funds (ETFs) now collectively hold 12.5 million ETH, representing 10.3% of the total supply.

The bullish sentiment comes as Ethereum ETFs continue to attract massive investor interest. The product bounced back after days of outflows. It saw about $169 million in inflows yesterday.