Key Takeaways

What’s driving ChainOpera AI [COAI]’s recovery?

Open Interest climbed 161% to $194M, fueled by rising long positions and BNB Chain traction.

How strong is the current buying momentum?

RSI at 72 and positive CMF confirmed heavy inflows, hinting COAI could target $17.7–$21 next.

As previously reported by AMBCrypto, ChainOpera AI [COAI] rallied to an all-time high of $48 three days ago, driven by an exchange listing frenzy.

The token rallied 132% in the past 24 hours, reaching a high of $16.00 before slightly retracing to $15.37 at press time.

Over the same period, COAI’s market cap rose 130% to $2.7 billion, indicating sustained capital inflows and growing market interest. But what’s behind ChainOpera AI’s resilience?

Why is ChainOpera AI surging?

AMBCrypto observed that COAI rallied, driven by three significant factors: demand in Futures, a rebounding AI crypto narrative, and support from the BSC ecosystem.

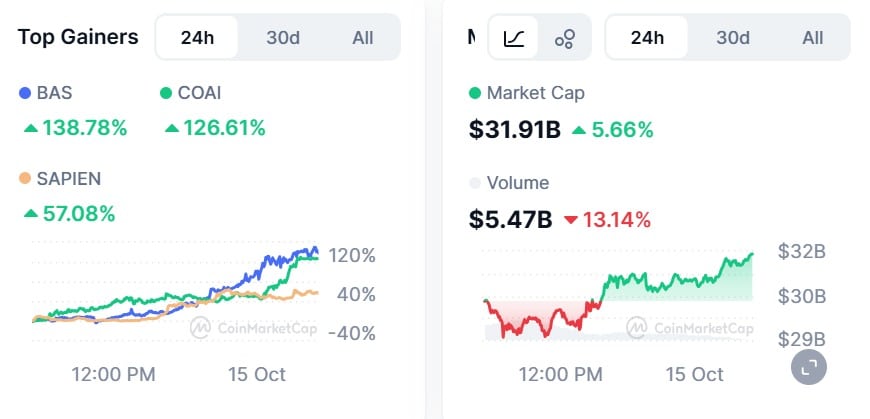

The broader AI crypto market cap rose 5.66% to $31.9 billion on the 15th of October, showing renewed demand across the category.

Among the top gainers, BNB Attestation Service [BAS] surged 138.78%, COAI gained 126.61%, and Sapien [SAPIEN] advanced 57.08%.

Source: CoinGlass

Additionally, Bittensor [TAO] rose 11.6% to $455 after Synergies announced an $11 million investment into its ecosystem. Also, DeXe [DEXE] rebounded 11.6%, following a 46% dip the previous week.

Unlike earlier hype-driven AI projects, ChainOpera AI emphasizes utility and technical development, giving it a stronger market footing as sentiment returns to AI-linked assets.

COAI thrives on BSC

This aligned with its role as a BNB Chain-based AI infrastructure project, thus attracting attention during a risk-off market.

With Binance Coin [BNB] surging past $1.3k, the BSC ecosystem traffic is unmatched, which has greatly benefited COAI through exposure to a ready market.

Source: Artemis

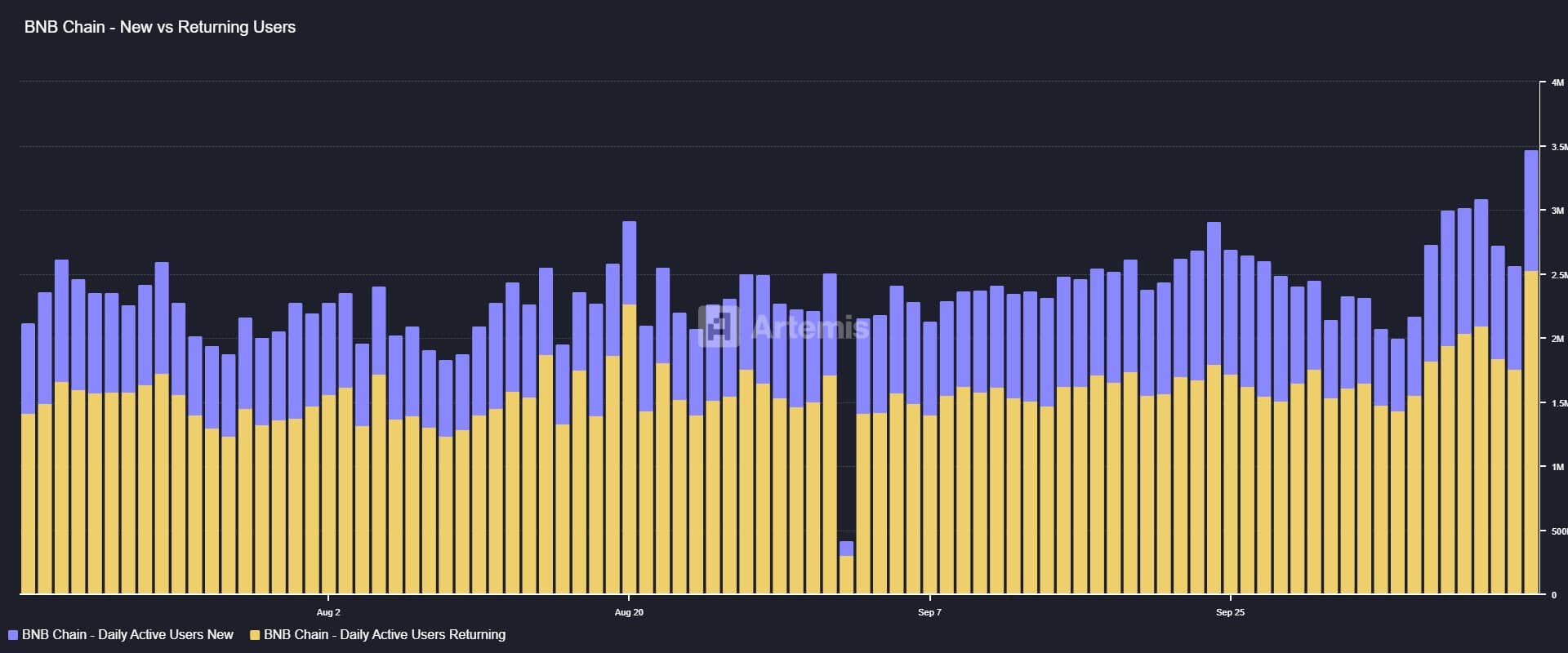

Daily Active Users on BNB Chain recently crossed 3.5 million, with both new and returning users showing a steady rise, according to Artemis data.

The network’s sustained traffic has offered COAI a deep liquidity environment and a receptive retail base.

Futures market heats up

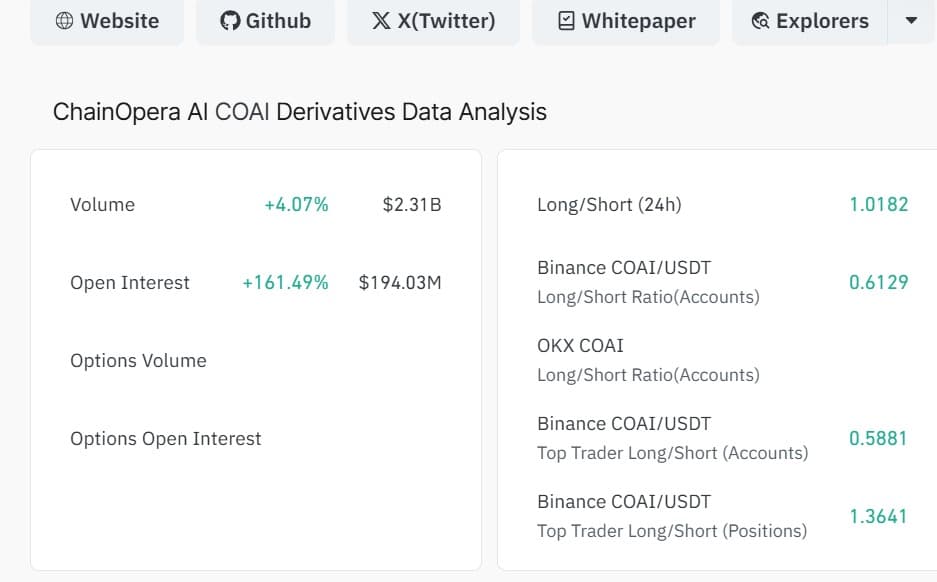

According to CoinGlass, COAI’s Open Interest rose 161.49% to $194.03 million, while Derivatives Volume climbed 4.07% to $2.31 billion over the past day.

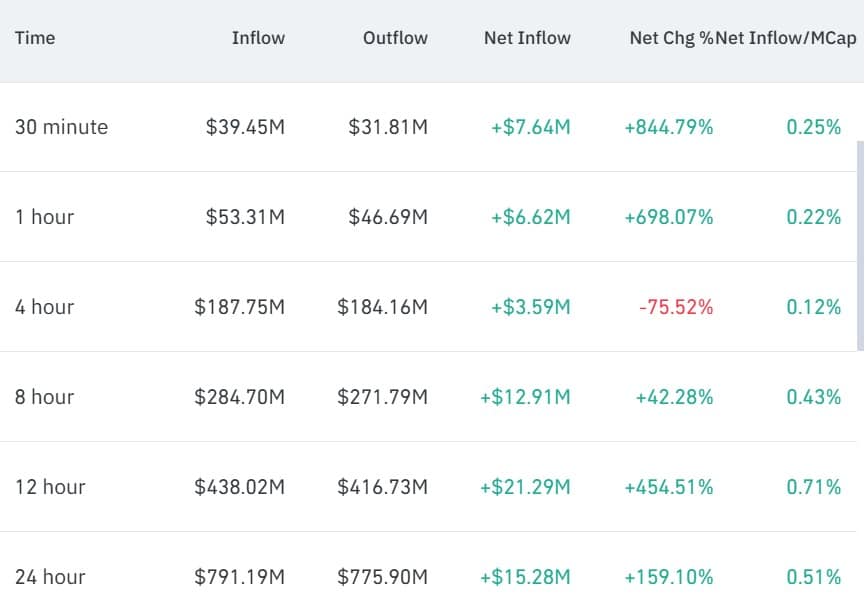

Futures inflows stood at $791.19 million, outpacing outflows of $775.90 million, resulting in a Net Inflow of $15.28 million—a 159% increase relative to market cap.

Source: CoinGlass

Having said that, the Long/Short Ratio settled near 1.01, signaling balanced but long-leaning positioning.

Source: CoinGlass

Momentum metrics stay strong

ChainOpera AI rallied amid broader AI crypto recovery and rising demand for the Futures positions.

As a result, its Relative Strength Index (RSI) surged to 70, indicating bullish dominance. Likewise, its Chaikin Money Flow rose to positive at 0.01, further validating the buyer’s presence.

Source: TradingView

If this buying pressure holds, COAI could retest $17.70 and aim for $21.00 in the short term. However, a drop below $9.80 would invalidate the setup and may signal exhaustion.

Source: https://ambcrypto.com/chainopera-ais-132-rally-signals-ai-sector-revival-coai-to-17-7/