Bitcoin’s sharp downturn last week has triggered one of the steepest drops in social sentiment in recent years, according to data shared by on-chain analyst Ali Martinez.

Following Friday’s flash crash, the weighted sentiment around BTC turned deeply negative, reflecting shaken confidence among retail investors and traders after a sudden wave of liquidations swept through the market.

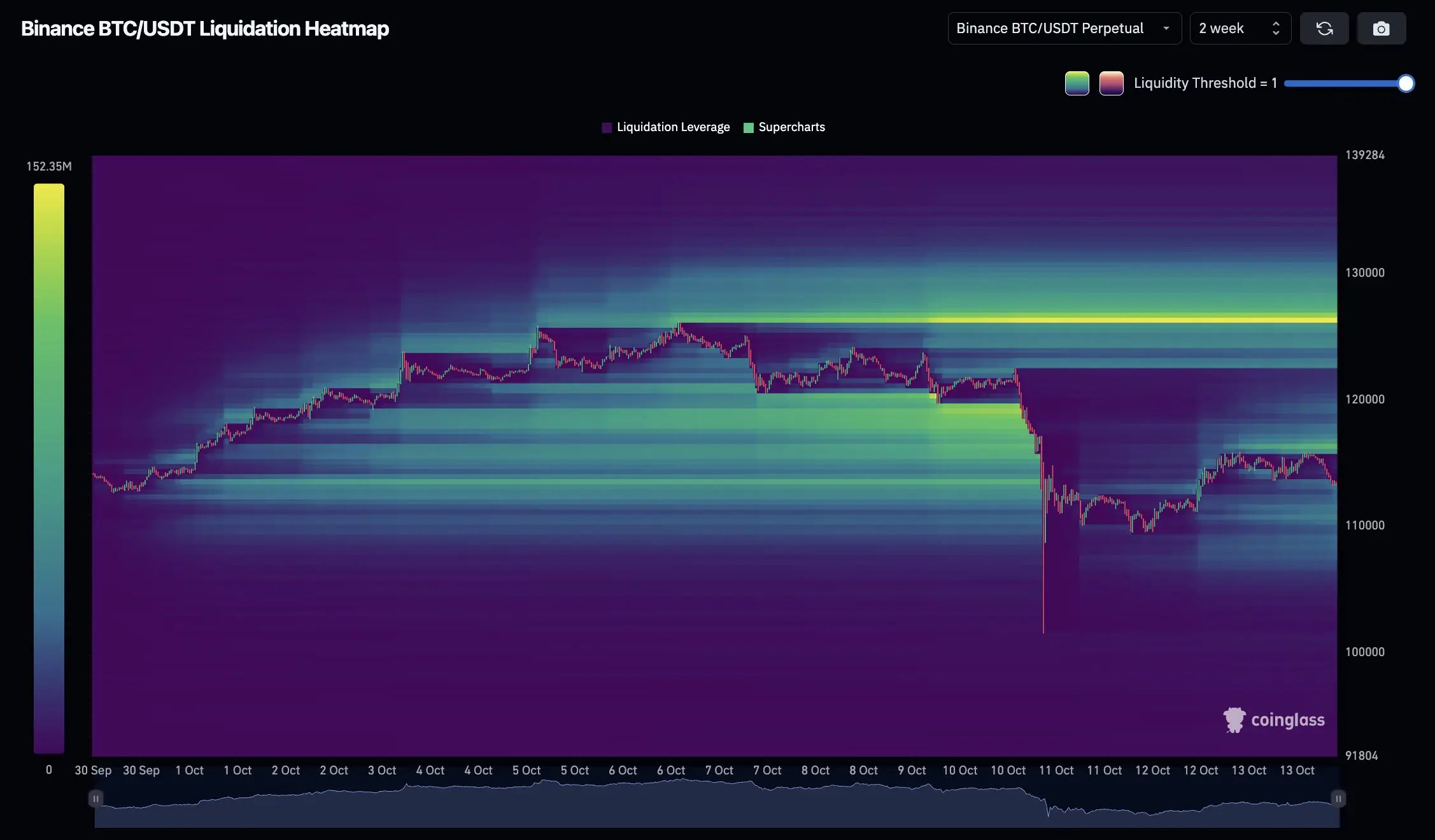

Data from Santiment shows that Bitcoin’s social volume has also declined significantly since early October, marking a clear shift in market psychology. The crash coincided with a massive selloff seen on Binance futures, where liquidation heatmaps from Coinglass reveal hundreds of millions in leveraged long positions were wiped out as Bitcoin briefly plunged below $110,000 before stabilizing near $111,000.

Market Liquidity and “Max Pain” Levels

Analyst Crypto Rover noted that the “max pain” zone for Bitcoin may now be positioned higher, suggesting that a move upward could inflict the most losses on remaining short positions. His heatmap analysis indicates concentrated liquidity between $125,000 and $130,000 – levels where potential short squeezes could accelerate a recovery if demand returns.

Apparent Demand Mirrors Historical Cycles

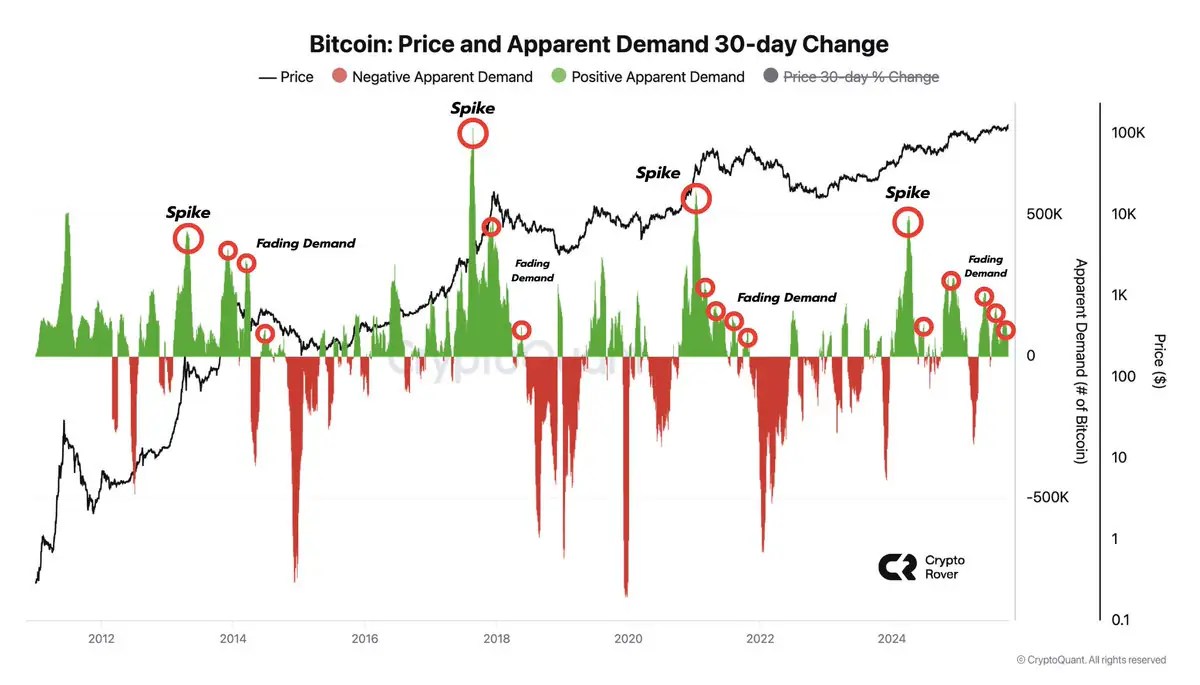

Further analysis by CryptoQuant highlights that Bitcoin’s apparent demand has entered a “fading phase,” similar to patterns observed after previous cycle peaks.

Historical data shows that every bull market top since 2013 was followed by a significant decline in apparent demand, often preceding prolonged consolidation periods. Rover emphasized that only a major resurgence in buying pressure could disrupt this recurring four-year rhythm.

Technical Outlook: Momentum Weakens but Not Broken

From a technical perspective, Bitcoin’s daily chart on TradingView shows a loss of upward momentum, with the RSI hovering near 41 and MACD trending negatively. Despite the recent pullback, the broader structure remains intact, as long as BTC holds above the $105,000-$108,000 range, which serves as key support from June and July consolidation zones.

If bulls manage to regain control above $115,000, analysts believe a relief rally toward $120,000 remains possible – especially if short liquidations accelerate. However, sustained recovery will depend on whether market sentiment improves and on-chain demand stabilizes in the coming weeks.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

Source: https://coindoo.com/market/bitcoin-sentiment-hits-multi-year-low-as-analysts-warn-of-fading-demand/