Key Takeaways

Why did Mantle rally 30%?

Retail buying drove Spot Volume up 118%, pushing MNT to $2.3 before cooling near $2.22.

Can MNT sustain its gains?

Futures longs dominate with +1.5M contracts, but $2.8 Parabolic SAR resistance could decide the next breakout move.

After hitting a low of $1.1, Mantle [MNT] staged a strong comeback and successfully flipped $2 resistance. The altcoin jumped 30.89% to a local high of $2.3 before retracing to $2.2 as of this writing.

During this recovery, MNT’s Spot Volume surged 118% to $1.18 billion, while market cap rose 29% to $7.1 billion. The combined rise confirmed steady capital inflow and growing on-chain activity.

Retail buying frenzy takes over

Interestingly, after the market slip, retail investors jumped into the Spot and Futures market to buy the dip.

In fact, data from CryptoQuant’s Spot Volume Bubble Map showed overheating activity during the bounce, signaling intense retail participation.

When Spot Volume overheats as prices climb, it often reflects short-term euphoria — traders rushing in to buy the dip.

Source: CryptoQuant

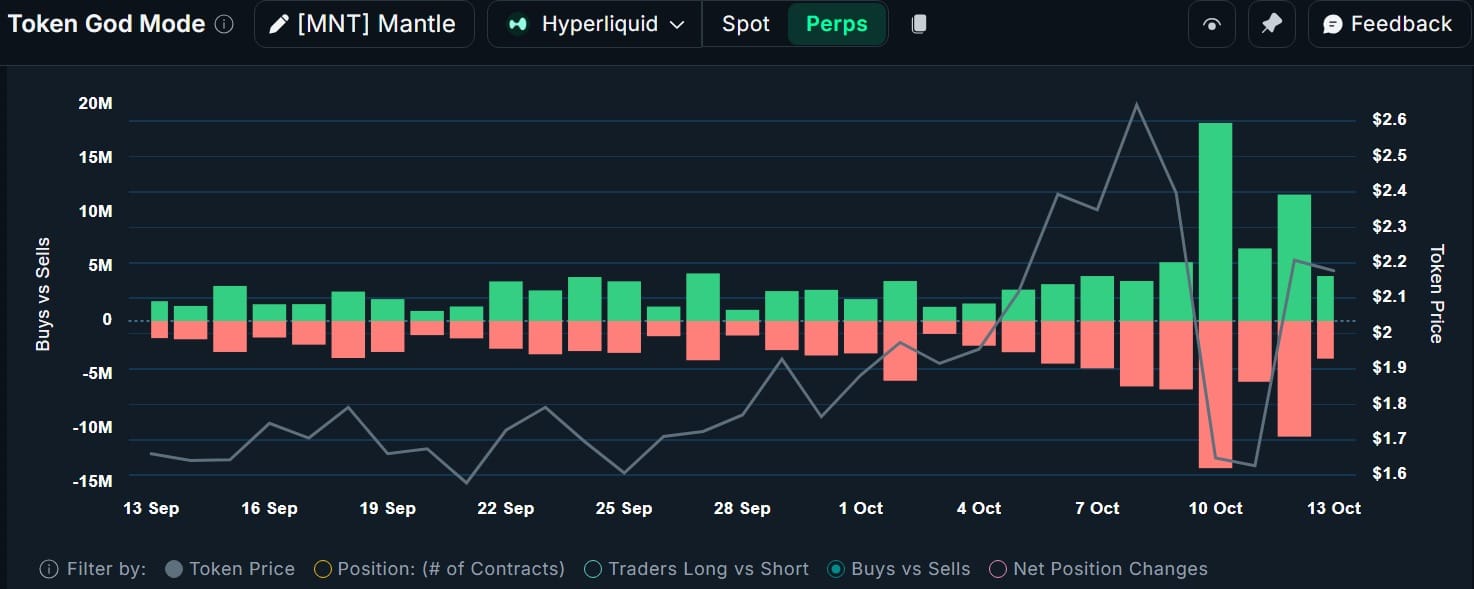

Supporting this, Coinalyze data recorded 5.5 million in Buy Volume against 4.6 million in Sell Volume over the past 24 hours, yielding a positive delta of 0.9 million MNT — evidence of stronger spot accumulation.

Source: Coinalyze

Futures market mirrors spot aggression

On the futures side, retail activity was even more prevalent. CryptoQuant’s Futures Retail Activity chart revealed “too many retail orders,” indicating widespread positioning in the futures market.

Source: CryptoQuant

Significantly, when we examine these trading activities, AMBCrypto observed that retailers were mostly buying.

According to Nansen, buyers’ orders mostly dominated positions opened over the past day. As such, the altcoin recorded 15.8 million in Buy Contracts versus 14.1 million Sell Contracts.

Source: Nansen

As a result, the altcoin recorded a Futures Position Change of +1.5 million. The build-up of long exposure reflected growing bullish conviction.

When buyers dominate futures positioning, it typically signals optimism, but also raises the risk of long squeezes if momentum fades. That left traders watching whether the rally could sustain.

MNT bulls eye $2.8 resistance

According to AMBCrypto, Mantle rebounded largely, driven by retail demand in both the retail and futures markets.

Mantle’s Stochastic Momentum Index (SMI) rebounded to 4.1, hinting at a potential bullish crossover. The Parabolic SAR placed resistance near $2.8, the next target for continuation.

Source: TradingView

If MNT breaks above that level, it could confirm renewed upside momentum. Failure, however, might drag prices back toward $1.9 before any next leg up.

At press time, Mantle traded at $2.22, holding key gains despite overheated retail participation — a signal that enthusiasm remains high, but caution is warranted.

Source: https://ambcrypto.com/mantle-traders-dont-let-mnts-30-surge-fool-you-because/