- Dogecoin trades near $0.211, recovering from a steep crash that briefly sent price under $0.18.

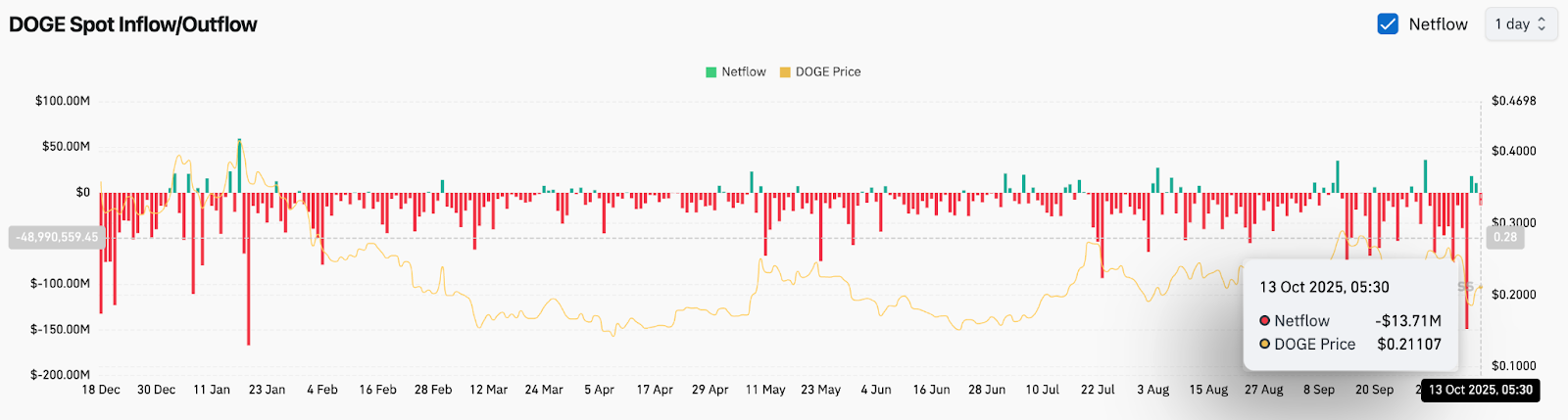

- On-chain flows show $13.7M outflows, but easing magnitudes signal panic selling may be fading.

- Trump’s softer stance on China lifts risk sentiment, fueling hopes of a DOGE rebound toward $0.245.

Dogecoin price today trades near $0.211, recovering slightly after last week’s deep selloff that pushed the token below its 200-day EMA and rising trendline support. The bounce comes as global risk sentiment stabilizes following U.S. President Trump’s conciliatory comments on China, which have helped ease fears of a prolonged trade war.

Dogecoin Price Attempts To Reclaim Lost Ground

DOGE is showing signs of stabilization after a heavy capitulation phase that sent price briefly under $0.18 before buyers stepped in. The rebound toward $0.21 has brought the token back above short-term demand, though it remains well below its former trendline that extended from June.

On the daily chart, resistance is now stacked between $0.222 and $0.233, overlapping with the 100-day and 200-day EMAs. These levels represent the first major test for buyers attempting to re-establish momentum. A clear close above this band could invite renewed participation, potentially opening the way toward $0.245 and $0.26.

Related: Chainlink Price Prediction: LINK Recovery Faces Key Resistance

For now, support sits at $0.20, with deeper protection at $0.18, where last week’s sharp wick found liquidity. If this zone breaks, DOGE could revisit the lower boundary near $0.15, marking a complete retrace of its summer rally.

On-Chain Flows Reflect Ongoing Weakness But Less Panic

Coinglass data shows $13.7 million in net outflows from exchanges on October 13, highlighting that selling pressure remains but has moderated compared to the prior day’s capitulation.

Persistent outflows suggest that investors are still cautious, preferring to withdraw holdings rather than deploy new capital. However, the drop in outflow magnitude indicates that extreme fear may be easing. Analysts typically view smaller outflows after a crash as a sign that markets are transitioning from panic to accumulation.

TRUMP:

– DON’T WORRY ABOUT CHINA, IT WILL ALL BE FINE

– PRESIDENT XI JUST HAD A BAD MOMENT

– THE USA WANTS TO HELP CHINA NOT HURT IT

omg the most hated V shape 2.0 coming up 😂 pic.twitter.com/qaWdmaCTeT

— amit (@amitisinvesting) October 12, 2025

Dogecoin’s partial recovery coincides with a broader risk rebound after President Trump softened his stance toward China. His statement that the “U.S. wants to help China, not hurt it” calmed investors following last week’s tariff shock.

Traders on social media described the move as the beginning of a “V-shape 2.0” recovery, referencing the swift reversals seen earlier in the year. This shift in sentiment is key because DOGE, historically tied to broader speculative cycles, often reacts sharply to improvements in global risk appetite.

Related: XRP Price Prediction: ETF Countdown Sparks Renewed Optimism

As geopolitical anxiety eases, traders appear willing to re-engage with high-beta assets like Dogecoin. The market will now watch whether renewed optimism translates into sustained capital inflows across the crypto complex.

Technical Outlook For Dogecoin Price

- Upside targets: $0.222–$0.233 (initial test), $0.245 (secondary resistance), and $0.26 (breakout extension).

- Downside levels: $0.20 (key defense), $0.18 (liquidity base), and $0.15 (structural low).

- Trend indicators: The 50-day EMA sits at $0.229, while the 200-day EMA near $0.222 remains pivotal for trend confirmation.

Outlook: Will Dogecoin Go Up?

The path forward for Dogecoin hinges on whether market sentiment can stay positive following the easing in U.S.–China tensions. Technicals suggest that the token is stabilizing, but momentum remains weak until buyers reclaim the EMA cluster above $0.23.

If DOGE can sustain closes above that zone, the probability of a short-term recovery toward $0.245–$0.26 increases significantly. A failure to hold $0.20, however, could erase the rebound and reintroduce pressure toward $0.18.

Related: BNB Price Prediction: Analysts Bullish as $96M Inflows Signal Accumulation

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.