- Chainlink eyes rebound as $20.84 resistance tests bullish momentum strength

- Rising open interest signals trader optimism but adds short-term volatility risk

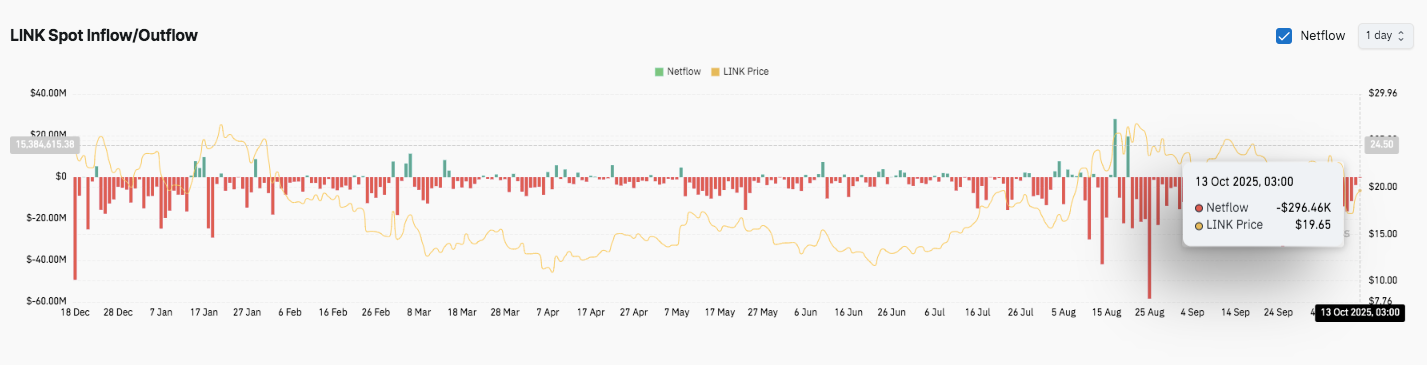

- Sustained outflows highlight fading spot demand despite improving price structure

Chainlink (LINK) showed signs of a cautious rebound after recent volatility, as its price climbed to $19.61 following a strong bounce from the $16.98 level. The asset’s short-term momentum improved as it moved above the 0.618 Fibonacci retracement level near $18.57, suggesting that buying interest is gradually returning. However, the broader outlook remains uncertain as technical indicators and market data signal mixed conditions in both spot and futures markets.

Short-Term Trend and Key Levels

The recent rebound represents a partial recovery from LINK’s steep decline off the $23.72 swing high. Price action now faces a critical test near the $20.84 zone, where the 0.786 Fibonacci retracement aligns with the descending 50-period EMA. A break above this resistance could trigger a short-term shift toward $23.7, marking the upper boundary of the ongoing correction.

On the down, there is also the strength of the near-term support of $18.57, and then there is the level of $16.98 that had been the primary point of reversal in the past. The 0.382 and 0.236 retracement levels are supported by deeper price at $15.39 and $13.42, which suggests potential price targets in the case of a regained control of sellers.

Related: XRP Price Prediction: ETF Countdown Sparks Renewed Optimism

Market Indicators and Structure

The RSI sits around 50, reflecting balanced momentum after recovering from oversold territory. Sustained movement above 55 could confirm the start of a stronger bullish wave. Meanwhile, the 20-period EMA is flattening, while the 50-, 100-, and 200-period EMAs hover between $19.14 and $21.71, forming a resistance cluster that may limit upside potential.

Besides, open interest in Chainlink futures has surged sharply since August 2025, rising from under $400 million to about $674 million. This increase shows renewed trader participation and heightened speculative exposure. Historically, such growth often precedes continued price expansion, though it also amplifies short-term liquidation risk during volatile swings.

On-Chain Flows and Sentiment

Throughout 2025, Chainlink’s on-chain data shows persistent outflows, reflecting ongoing selling pressure. The latest figure on October 13 revealed a $296,460 outflow while LINK traded at $19.65. Earlier inflow surges near $25 coincided with price recoveries, but continued outflows since mid-July indicate reduced spot demand and profit-taking behavior.

Technical Outlook for Chainlink Price

Key levels remain tightly defined as Chainlink consolidates within a mid-cycle recovery phase.

- Upside levels: $20.84 (0.786 Fib and 50-EMA confluence) stands as the first hurdle. A breakout could extend toward $23.72 and $25.40, which mark the upper range of the corrective channel. Sustained momentum above $23.72 would confirm a short-term bullish reversal and open the path toward $27.80.

- Downside levels: $18.57 (0.618 Fib) acts as near-term support, followed by $16.98 (0.5 Fib) and $15.39 as secondary defense zones. A breakdown below $16.98 could expose LINK to $13.42, the 0.236 Fib area, representing a deeper retracement level.

- Resistance ceiling: $21.70 (EMA cluster region) remains the key level to flip for medium-term bullish momentum. The convergence of 50, 100, and 200-EMAs suggests compressed volatility, often a precursor to sharp directional moves.

Will Chainlink Continue Its Recovery?

Chainlink’s October performance hinges on whether bulls can maintain control above the $18.5–$19.0 support area. Holding this zone could trigger an upside retest toward $20.84 and $23.7. Historical price behavior during similar compression periods has led to strong volatility breakouts once liquidity builds around EMA clusters.

Related: BNB Price Prediction: Analysts Bullish as $96M Inflows Signal Accumulation

However, sustained outflows and profit-taking across the network continue to cap aggressive rallies. If LINK fails to reclaim the $21–$22 resistance band, renewed selling could send it back toward $17.

Therefore, the following few sessions will help decide whether the recovery of LINK will become a trend reversal or it will plateau in the consolidation. At this stage, LINK will be in a pivotal construction with conviction volume and the wider market sentiment determining the next leg.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/chainlink-price-prediction-link-recovery-faces-key-resistance/