- XRP trades around $2.57 after rebounding from $2.30, with support anchored by the 200-day EMA.

- On-chain flows show easing outflows, signaling stabilization after last week’s panic-driven selloff.

- ETF approval dates between Oct. 18–25 could be the catalyst for a breakout above $2.80 resistance.

XRP price today is trading around $2.57, climbing 1.6% in the past 24 hours as buyers defend the $2.50 zone after last week’s heavy selloff. The rebound from the $2.30 region aligns with the 200-day EMA and rising trendline support, suggesting early signs of recovery as traders turn their focus to upcoming spot ETF approval dates.

XRP Price Reclaims Key Support Zone

The daily chart shows XRP stabilizing after the flash crash, which briefly sent the token under its long-term ascending trendline. The bounce from $2.30 has lifted price back above the $2.55 mark, supported by the 100-day EMA at $2.63 and the 50-day EMA near $2.82.

Immediate resistance sits near $2.77–$2.82, where the 20-day EMA and a descending trendline converge. A clear breakout above this zone could set up a run toward $2.94 and $3.10. On the downside, the $2.45–$2.30 band remains critical support, protecting XRP from deeper losses.

Related: BNB Price Prediction: Analysts Bullish as $96M Inflows Signal Accumulation

The Parabolic SAR has flipped below price for the first time since early October, signaling a short-term bullish shift, while RSI has recovered from oversold territory to neutral levels, suggesting growing buyer strength.

On-Chain Flows Reflect Stabilization After Panic Outflows

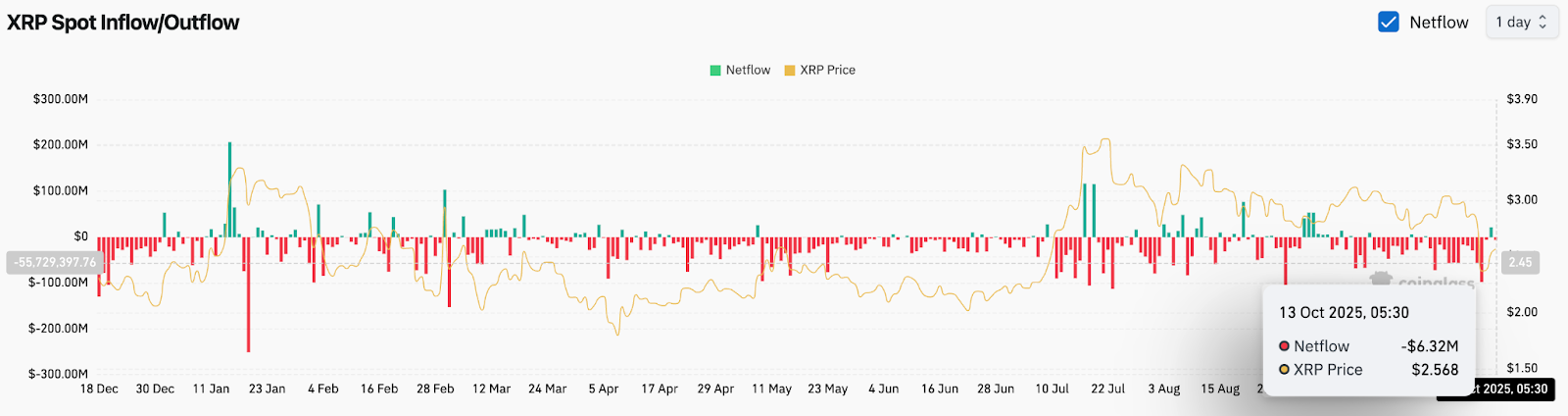

Exchange data from Coinglass shows $6.32 million in net outflows on October 13, a notable improvement following last week’s extreme selling pressure. Despite the modest withdrawal, the broader flow structure suggests stabilization, with fewer large spikes compared to the liquidation-driven dumps seen earlier in the month.

Analysts view this as a healthy sign of market normalization. A sustained return to inflows above $25 million daily could validate renewed accumulation ahead of key ETF decisions, while continued low-volume outflows imply that participants are waiting for confirmation before re-entering aggressively.

ETF Anticipation Drives Market Excitement

Investor attention has turned sharply to the October 18–25 window, when final decisions are expected for eight proposed XRP spot ETFs, including filings from Grayscale, Bitwise, Franklin Templeton, and WisdomTree.

Crypto influencer JackTheRippler emphasized that approval “will be massive news,” fueling speculation that XRP could mirror Bitcoin’s ETF-driven momentum earlier this year. While the SEC has not issued any formal indication, the clustering of decision dates has intensified market optimism, drawing speculative bids back into XRP after weeks of weakness.

Broader Market Recovery Supports Sentiment

The broader crypto market is stabilizing following the $20 billion liquidation event triggered by U.S. tariff news last week. Bitcoin and Ethereum have both recovered sharply, with major analysts calling it a “buy zone” rather than a collapse. This rebound has helped improve sentiment across large-cap altcoins, including XRP, which had been among the hardest hit during the flash crash.

Related: Cardano Price Prediction: Outflows Ease And Buyers Defend Support

Improving macro sentiment and risk appetite could further support XRP’s short-term recovery if ETF headlines arrive as anticipated.

Technical Outlook For XRP Price

XRP’s structure remains cautiously bullish as long as price holds above the $2.45 pivot.

- Upside levels: $2.77, $2.94, and $3.10 if breakout strength continues.

- Downside levels: $2.45, $2.30, and $2.10 if sellers regain control.

- Trend anchors: 100-day EMA at $2.63 and 200-day EMA at $2.63 remain crucial for maintaining the medium-term uptrend.

Outlook: Will XRP Go Up?

The short-term direction for XRP depends on whether ETF optimism can translate into actual inflows and technical follow-through above $2.77. The gradual easing of outflows and the Parabolic SAR flip indicate momentum is turning in favor of buyers.

If XRP can close above $2.82 in the next few sessions, analysts expect a potential move toward $2.94–$3.10, aligning with the descending trendline break. Losing $2.45, however, would reopen risks toward $2.30 and delay the recovery phase.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-price-prediction-etf-countdown-sparks-renewed-optimism/