- Trump indirectly holds a significant Bitcoin position through media group equity.

- Trump Media aligns with corporate trends by investing in Bitcoin.

- Bitcoin price surge linked to institutional purchases, reflecting Trump’s influence in the market.

Former US President Donald Trump indirectly holds $870 million in Bitcoin through Trump Media & Technology Group, which recently acquired $2 billion worth of the cryptocurrency, as reported by specialized outlets.

This acquisition highlights the growing institutional interest in cryptocurrencies, influencing Bitcoin’s price and raising questions about the strategic direction of Trump-related enterprises.

Trump Holds $870M in Bitcoin Amid Media Group Equity Changes

Former President Donald Trump indirectly holds an estimated $870 million in Bitcoin. This position is maintained through his reduced 41% equity stake in Trump Media & Technology Group, which manages the influential platform Truth Social.

Trump Media’s large-scale Bitcoin purchase follows a nearly $2.3 billion capital raise. The move highlights the company’s strategic pivot to cryptocurrency investments, which are aligned with similar strategies by other major firms. Such purchases have a history of bolstering Bitcoin prices and institutional interest in digital assets.

“Bitcoin is hope for corporations seeking better treasury assets.” — Michael Saylor, CEO, MicroStrategy.

Historical Context, Price Data, and Expert Analysis

Did you know? Michael Saylor’s MicroStrategy pioneered similar large Bitcoin purchases in public company treasuries, significantly influencing market perception and price trends.

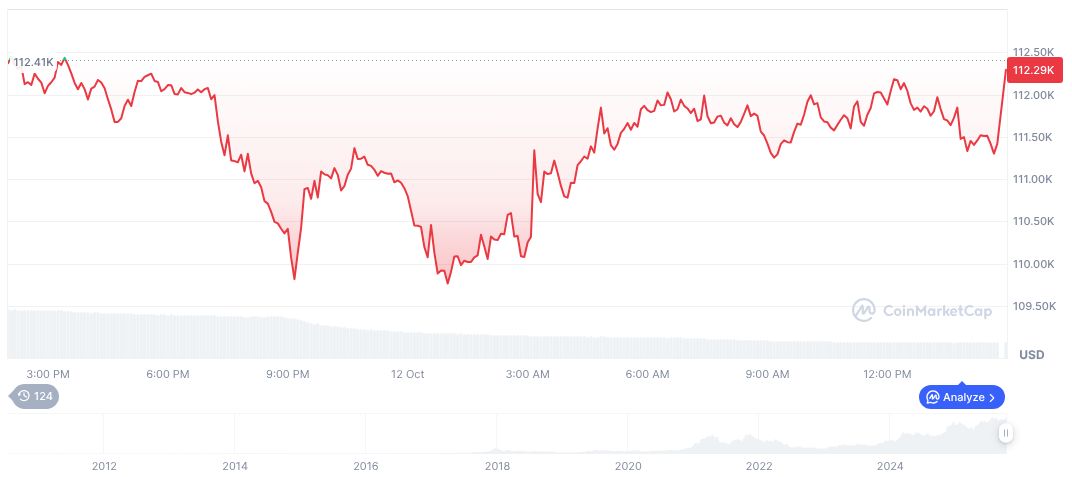

Bitcoin (BTC) currently stands at a price of $115,197.61, with a market cap of $2.30 trillion, as per CoinMarketCap’s recent update. Market dominance is 58.87%, reflecting the sustained preference for BTC over other cryptocurrencies. The asset’s price has increased by 3.89% in the past 24 hours while showing a decrease in value over longer periods, including 7-day and 90-day time frames.

According to Coincu research insights, regulatory scrutiny and strategic corporate treasury shifts may significantly influence the next phase of Bitcoin’s market trajectory. Future trends could be shaped by how similar transactions from high-profile entities are perceived in both market and regulatory environments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/trump-870m-bitcoin-media-group/