- Cardano price today trades near $0.64 after slipping 20% this week, with buyers defending the $0.60–$0.62 zone.

- Futures open interest fell 12% as traders reduced leverage, while exchange outflows eased after heavy selling.

- Analysts see potential rebound toward $0.77 if ADA reclaims $0.68 and $0.72 resistance levels.

Cardano price today is consolidating near $0.64, attempting to stabilize after falling over 20% this week. The move follows heavy liquidations that drove ADA below its rising trendline and 20/50/100/200 EMAs clustered between $0.77 and $0.82. Buyers are now defending the $0.60–$0.62 area, which marks the last structural support before the $0.50 base seen in April.

Cardano Price Finds Support After Breakdown

ADA Technical Price Analysis (Source: TradingView)

The daily chart shows ADA has sharply broken below its ascending trendline that connected July and September lows. The breakdown triggered a wave of selling pressure as price slipped through all major EMAs, flipping the short-term trend bearish.

Momentum readings remain weak. RSI is hovering around 30, indicating near-oversold conditions but not yet signaling a confirmed reversal. If the $0.60 zone holds, a rebound toward $0.68 and $0.72 could follow. However, continued rejection near $0.70 would keep ADA vulnerable to retesting the $0.55–$0.50 range.

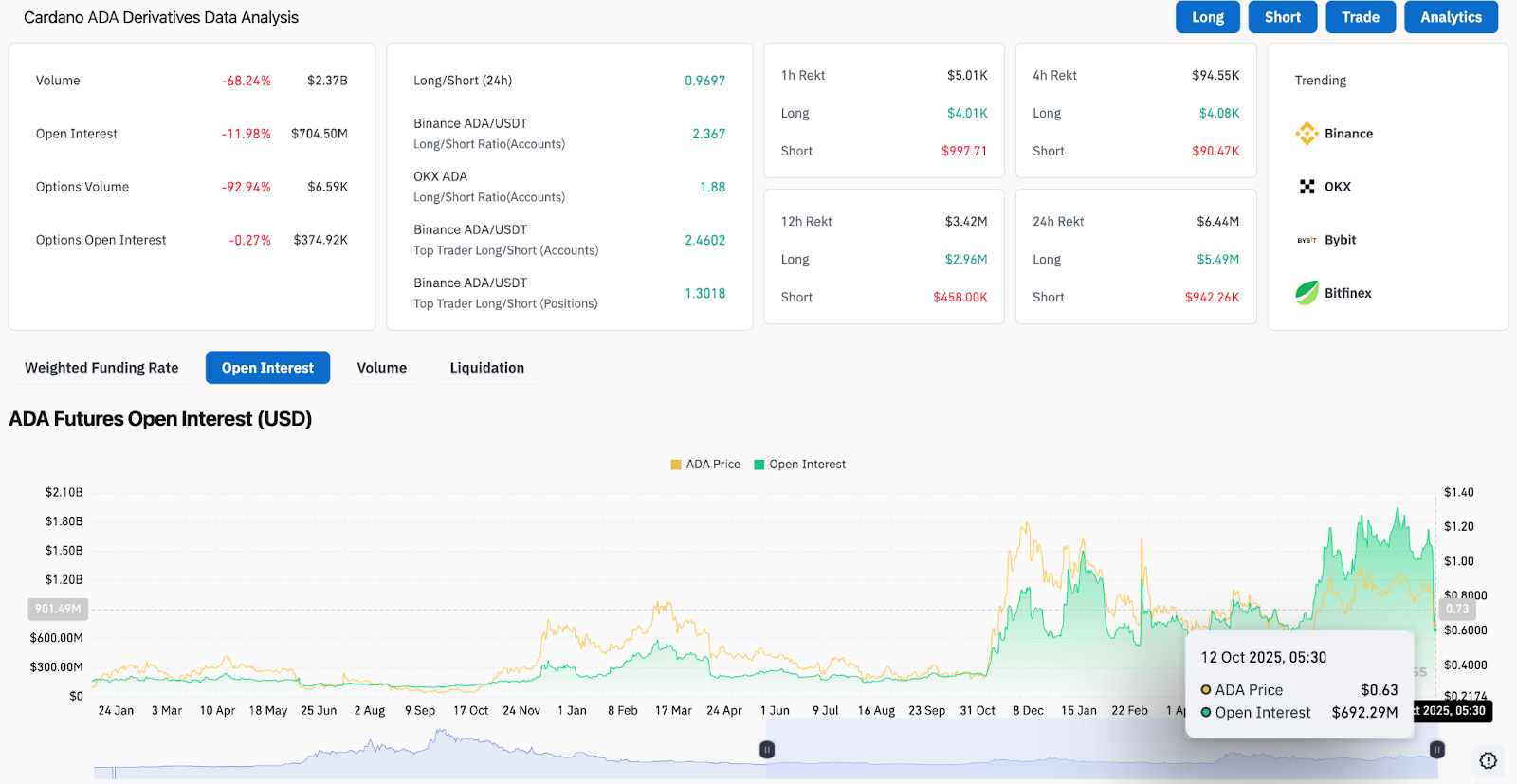

Futures Data Shows Derivative Traders Turning Cautious

ADA Derivative Analysis (Source: Coinglass)

According to Coinglass data, Cardano’s open interest has fallen nearly 12% to about $704 million as traders unwind leveraged positions. Volume collapsed over 68% to $2.37 billion, while options volume plunged more than 90%.

The long/short ratio on Binance stands near 2.36, suggesting that despite declining activity, top traders remain net long. Funding rates remain neutral, and liquidation data shows $94,000 wiped out in the past 4 hours, mostly from short positions. This indicates that the sharp drop may have flushed weaker shorts while stronger hands begin reaccumulating.

On-Chain Flows Indicate Stabilizing Sentiment

ADA Netflows (Source: Coinglass)

Spot flow data highlights $48 million in net outflows over the past two days, followed by a notable slowdown today, with minimal outflows reported. Historically, declining outflows after a major dip have preceded short-term stabilization periods for ADA.

Exchange netflow on October 12 recorded only a $276,000 outflow compared with tens of millions earlier in the week, implying sellers may be exhausting. While this does not yet confirm accumulation, the easing pressure provides a foundation for price to hold above the $0.60 level in the near term.

Technical Setup Points To Relief Potential

ADA’s next resistance lies near $0.68, aligning with the 20-day EMA and former support trendline. Above that, the $0.72 and $0.77 levels mark successive resistance clusters.

On the downside, $0.60 remains the immediate defense level. Losing this threshold could expose the $0.53–$0.50 demand block, where historical accumulation took place in April. The broader trend remains under pressure until price reclaims the 50-day EMA near $0.79, which has capped upside since early September.

Outlook. Will Cardano Go Up?

The near-term path for Cardano depends on whether buyers can defend $0.60 long enough to trigger a momentum reversal. On-chain flows suggest that panic selling has cooled, and RSI oversold readings may attract dip buyers.

A close above $0.68 would indicate short-term recovery potential toward $0.72–$0.77. Conversely, a daily close below $0.60 would invalidate this rebound scenario, opening a path to $0.50.

At current levels, Cardano remains at a technical inflection point. With outflows slowing and leverage reset, the market may be setting up for a relief bounce — but only a sustained move above $0.70 will confirm that sellers have finally stepped aside.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.