In Brief

- Bitcoin demand turns negative (-13.7K BTC) for the first time since July 2025.

- BTC volume drops 67% as market sentiment slips into Fear zone at index level 24.

- Analysts eye $110K support and $113.5K–$124K resistance as key breakout levels.

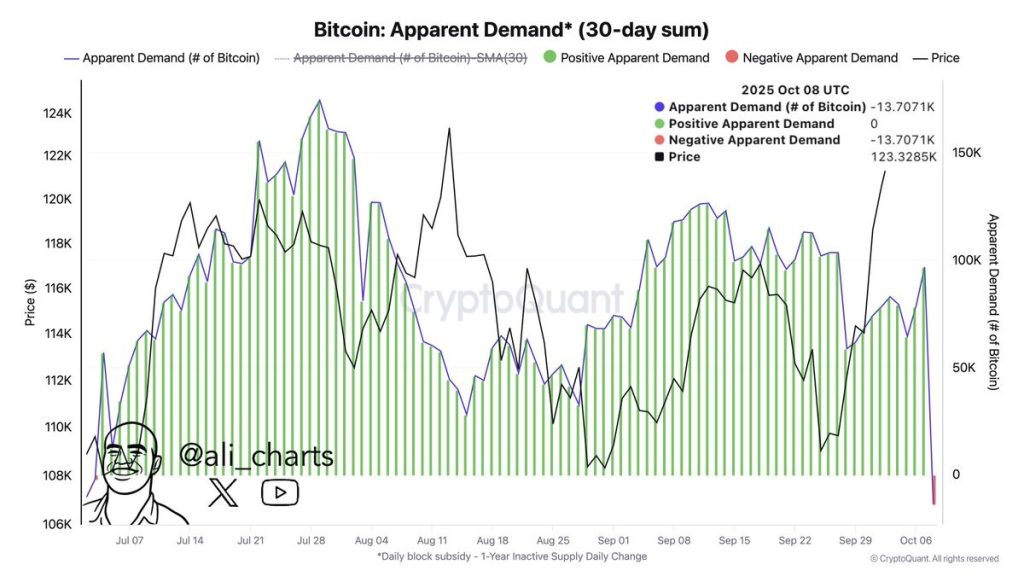

Bitcoin’s 30-day apparent demand has turned negative for the first time since July, signalling a notable shift in market behaviour. According to CryptoQuant data, demand fell by -13.7K BTC after previously holding above 120K BTC.

Despite this drop in demand, Bitcoin still trades around $112k, showing price stability but weakening accumulation. Historically, negative demand often signals declining buying pressure or increased distribution, typically leading to short-term pullbacks.

Trading volume also declined sharply, with Coin Bureau reporting a 67% drop in Bitcoin volume to $87.52 billion. Ethereum followed with a 61.53% decrease, while Solana recorded the largest price decline, falling 6.42% to $175.48.

Altcoins like XRP dropped 3.22% to $2.3387, while BNB gained 0.55% to $1,121.46 despite a 55.57% fall in volume. The broad-based volume slump reflects fading liquidity and suggests growing caution among traders amid ongoing market uncertainty.

The Bitcoin Fear & Greed Index has dropped to 24, placing sentiment deep in the Fear zone. This reading follows the largest crypto liquidation event in history, adding further pressure to short-term market outlooks.

Analysts Point to Crucial Support Zones and Potential Recovery Triggers

Ted reports Bitcoin has reclaimed the $110,000 support, though market structure remains uncertain. He highlights resistance at $113,500 and notes a failure to hold above $110,000 could trigger a move toward $101,000.

Price must close above $113,500 to confirm recovery, with further resistance at $117,933–$124,475 likely to challenge upward momentum. A strong breakout could revive short-term bullish sentiment if confirmed in the coming week.

Meanwhile, Merlijn The Trader views current conditions as a typical accumulation phase, with Bitcoin holding around $110,539. He notes that extreme fear historically creates long-term buying opportunities, especially when sentiment drops into the 0–25 zone.

His analysis shows consistent rebounds from similar dips earlier this year, reinforcing patience over panic. As prices hover near key supports, Bitcoin may be preparing for a reset rather than signalling the end of its trend.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/bitcoin-demand-turns-negative-for-first-time-since-july/