Key Takeaways

What does recent whale activity suggest about Pepe’s market sentiment?

Whales sold 9.04 trillion PEPE while buying only 6.62 trillion, signaling bearish sentiment and potential downward pressure.

Could Pepe rebound from its 21.66% drop?

If buying pushes RSI above 31, Pepe could reclaim $0.000009 and aim for $0.0000106, but continued selling may drag it to $0.00000614.

After the crypto market crashed, Pepe [PEPE] plunged to March 2024 levels before rebounding. At press time, PEPE was trading at $0.00000724, marking a 21.66% slip over the past 24 hours.

Amid this market slip, investors, especially whales, jumped into the market to take strategic positions.

Pepe whale activity intensifies

Interestingly, amid market turmoil, Pepe whale activity intensified on both the demand and supply sides.

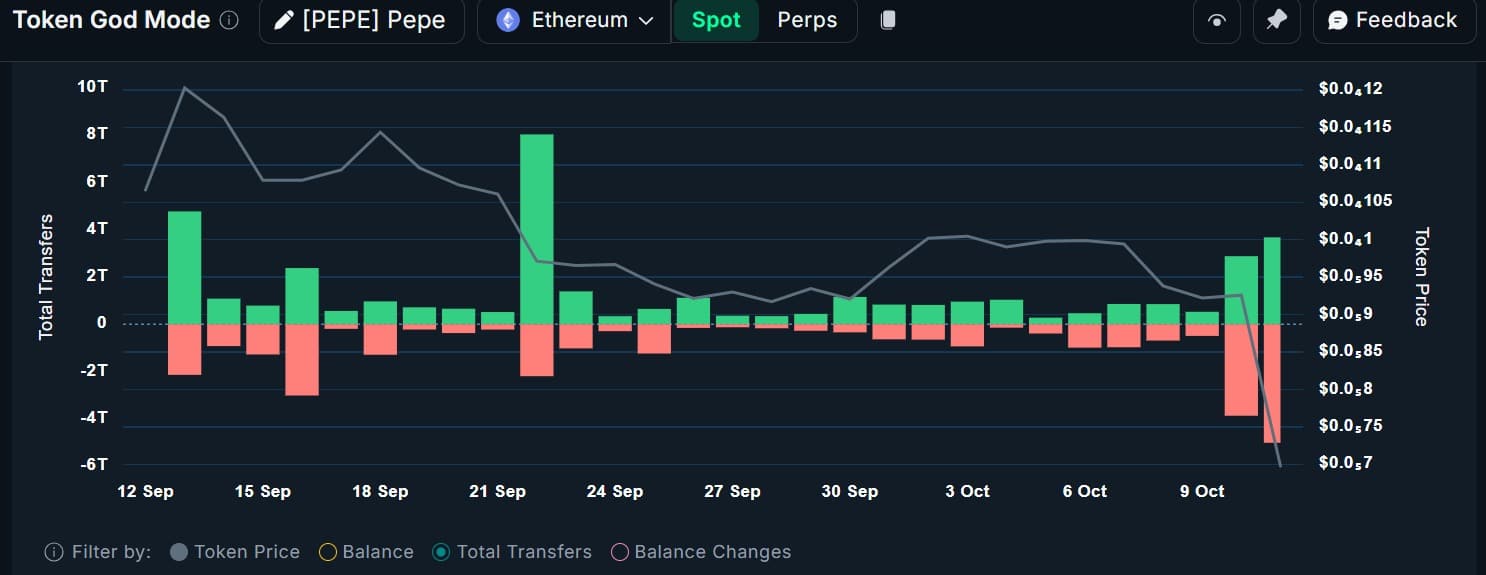

According to Nansen, Pepe whales offloaded 9.04 trillion between the 10th and the 11th of October. Over the same period, the memecoin’s top holders acquired 6.62 trillion tokens.

Source: Nansen

Among the buying whales, Onchain Lens identified one who spent $4.97 million to purchase 600.88 billion Pepe tokens. The wallet still holds $1 million, which may be used to buy more in the near future.

Despite this large purchase, Pepe recorded a negative Balance Change of $2.42 million, indicating that whales sold more than they bought overall.

This trend typically reflects declining market confidence, a bearish signal. Historically, heavy selling by large holders has often led to further price drops due to increased downward pressure.

Retail traders are selling

Unsurprisingly, as Pepe’s downward spiral persisted, small-scale investors rushed to close their positions to avoid more losses.

According to Coinalyze, Pepe recorded 25.19 trillion in Sell Volume, compared to 24.84 trillion in Buy Volume over the past 24 hours.

Source: Coinalyze

As a result, the memecoin saw a negative buy-sell delta of -350 billion tokens, at press time, a clear sign of aggressive spot selling.

Furthermore, exchange activity further validates this market condition.

According to Coinglass, Pepe’s Spot Netflow surged to positive after being negative the previous day. PEPE’s Netflow was $10.42 million, reflecting higher inflows.

Source: CoinGlass

When inflows spike, it suggests investors are aggressively depositing into exchanges, raising the potential for further downward pressure.

What’s next for PEPE?

According to AMBCrypto, PEPE plummeted as investors, both whales and retail, increased their selling activity.

For that reason, the memecoin’s Relative Strength Index (RSI) dropped to 25, hitting oversold territory before slightly rising to 31, as of writing.

Such volatility on RSI indicates an increased battle between bulls and bears for market control.

Source: Tradingview

If buying activity, particularly from whales, drives the RSI up to 31, the memecoin could rebound and reclaim the EMA20 level at $0.000009, with a potential move toward EMA200 at $0.0000106.

However, if selling pressure continues to dominate, the memecoin is likely to find support near $0.00000614.

Source: https://ambcrypto.com/pepe-plunges-21-amid-whale-frenzy-watch-this-support-next/