- XRP trades near $2.49 after a 42% drop to $1.64, marking one of its steepest one-day declines.

- Exchange inflows of $10.4M suggest early stabilization, though open interest remains weak.

- Analysts say a breakout above $2.90 is needed to confirm recovery, with support at $2.35 and $2.22.

XRP price today is hovering near $2.49 after one of the sharpest one-day collapses in recent history. The token fell 42% on Friday, reaching $1.64 before buyers staged a partial recovery above $2.35. Volumes surged 164% over the 30-day average, signaling capitulation and forced liquidations across major exchanges.

Despite the rebound, sentiment remains fragile as institutional open interest dropped by $150 million, underscoring the extent of long unwinding that triggered the flash crash.

XRP Price Recovers But Faces Heavy Resistance

The daily chart shows XRP bouncing from its intraday lows but still struggling below key exponential moving averages. The 20-day EMA sits at $2.83, the 50-day EMA at $2.83, and the 100-day EMA at $2.84, forming a strong resistance band near $2.88–$2.90.

Below, the 200-day EMA lies at $2.63 — a critical line that XRP must defend to maintain short-term structure. A daily close under this level could expose deeper downside toward the $2.20–$2.10 zone.

The RSI currently reads near 47 after recovering from a deeply oversold 34 reading, indicating that bearish momentum has slowed but not reversed. Price remains trapped under a descending trendline stretching from the mid-year highs near $3.60, keeping the overall setup tilted slightly bearish until a clean breakout occurs.

On-Chain Flows Show Mild Accumulation After Capitulation

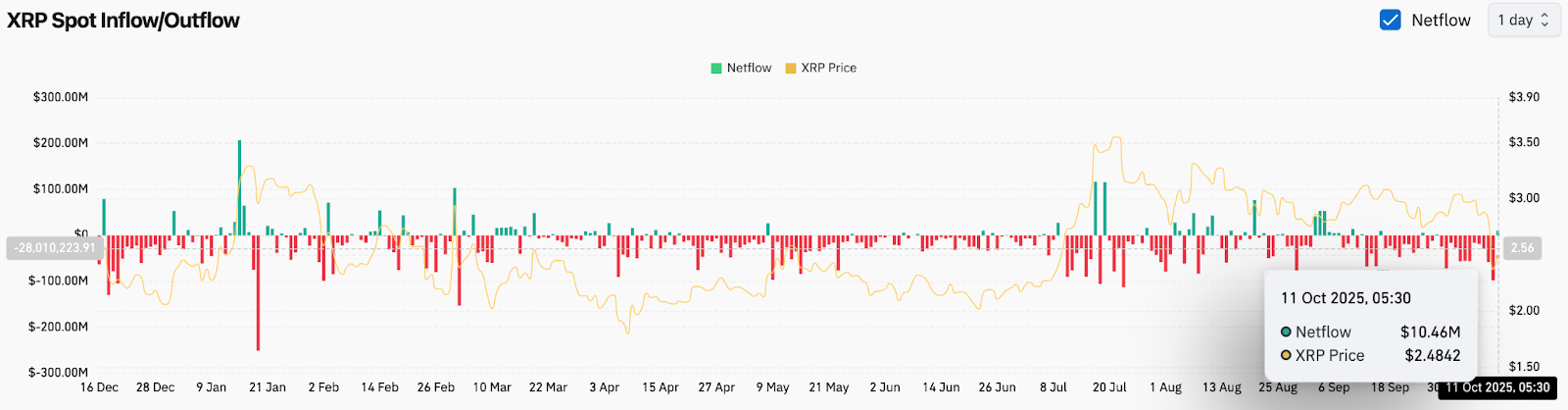

Exchange flow data shows a $10.46 million net inflow on October 11, following days of heavy outflows. This shift hints that short-term traders are beginning to re-enter after the selloff. However, the scale remains modest compared with the $28 million outflows seen in late September.

Analysts note that the recovery in netflows must be sustained to confirm real accumulation. Futures open interest has yet to rebuild meaningfully after the $150 million contraction, showing that leveraged players remain cautious. Still, the shift from aggressive outflows to small inflows provides early signs of stabilization.

Capitulation Triggers Massive Volume Spike

Friday’s liquidation event saw hourly volumes peak at 817 million XRP, marking one of the largest turnover spikes this year. The $1.64 low is being interpreted as a possible capitulation wick, particularly as buyers absorbed supply rapidly back toward $2.35.

Market watchers highlight that the bounce coincided with Bitcoin’s partial recovery from its own flash crash near $108,000, suggesting cross-asset spillover. A rebound in BTC or ETH could further support XRP’s attempt to rebuild above the $2.50 handle.

Technical Structure Still Fragile Below $2.90

The broader trend remains under pressure, with XRP having broken below its 75-day symmetrical triangle earlier in the week. The immediate resistance zone is layered between $2.84 and $2.90, aligning with the descending trendline and EMA cluster. A breakout above this area is essential for restoring bullish momentum.

If buyers fail to clear $2.90, the price could drift back toward $2.35 and $2.22. Sustained weakness in volume or another drop in open interest could invite retests of $2.00 or even the $1.80 support band seen during the wick lows.

Outlook. Will XRP Go Up

For XRP to extend its recovery, it must hold above $2.35 and close decisively over $2.90 in the coming sessions. A confirmed breakout there could open the path to $3.05 and later $3.30, reversing the recent damage.

However, losing the 200-day EMA at $2.63 would signal renewed selling pressure and risk another slide toward $2.20. On-chain flows and derivative participation remain key — if net inflows strengthen next week, traders may view the $1.64 capitulation as a base for the next rebound phase.

For now, XRP trades in recovery mode but remains at a pivotal crossroads between relief rally and deeper correction.

Short-Term Technical Outlook For XRP Price

- Resistance: $2.84–$2.90, then $3.05

- Support: $2.35, $2.22, and $1.80

- Bias: Neutral to cautiously bullish while above $2.35

- Breakout trigger: Daily close above $2.90

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-price-prediction-analysts-see-2-90-retest-as-panic-selling-cools/